Key Points

-

Investors are feeling increasingly pessimistic about the stock market.

-

If a recession is looming, history has good news for investors.

-

The right strategy can help protect your portfolio no matter what happens.

- 10 stocks we like better than S&P 500 Index ›

Investors are feeling increasingly pessimistic about the stock market.

If a recession is looming, history has good news for investors.

The right strategy can help protect your portfolio no matter what happens.

While we’re not in a recession yet, some investors are beginning to worry that it’s coming.

Around 43% of investors feel “bearish” about the next six months, according to the most recent weekly survey from the American Association of Individual Investors, while only 33% feel “bullish.” Those figures have shifted from around 39% and 35%, respectively, the week prior.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

In his speech last month, Federal Reserve Chair Jerome Powell noted that although inflation has remained stubbornly high, a weakening labor market could call for a series of interest rate cuts.

Now, this doesn’t mean a recession in 2025 is inevitable. A lot can happen in the coming months, and even the experts can’t say for certain when the next downturn will begin. But if the market does take a turn for the worse, there’s one critical rule to remember: You won’t lose money in the market until you sell.

Image source: Getty Images.

The easiest way to protect your portfolio

During a stock market downturn, your portfolio will likely lose value. Stock prices can fall significantly during a recession or bear market, and your investments may be worth less than they were when you initially bought them.

However, you don’t technically lose any money until you sell your investments. No matter how far stock prices fall, holding your investments makes it far less likely you’ll lose anything.

For example, say you buy one share of stock for $100. If that stock’s price drops to $70 per share, it’s now lost $30 worth of value. Selling it at that point would lock in that $30 loss, but if you simply hold onto it until the market recovers and its price bounces back to $100 per share, you won’t lose anything.

It’s normal for even the strongest stocks to lose value during a downturn, and it can be daunting to watch your account balance plunge. But the most important thing to remember is that the only way to lock in those losses is to sell your stocks for less than you paid for them.

History has promising news for investors

Past performance doesn’t predict future returns. But if you’re feeling nervous about how a potential recession might impact your savings, it can be helpful to see what history says about times like these.

Some recessions and bear markets last for years, and it can take even longer for stocks to begin reaching new all-time highs. But the good news is that there’s never been a downturn the market hasn’t managed to recover from, and by keeping a long-term outlook, you’re all but guaranteed to see positive long-term returns.

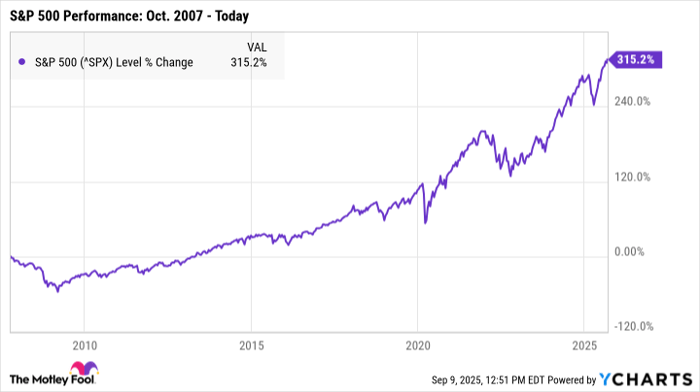

Take the Great Recession, for example. This recession lasted from late 2007 to mid-2009, and it was the longest and most severe economic downturn in America since WWII. Those years were rough for most investors, as the S&P 500 (SNPINDEX: ^GSPC) fell by more than 50%.

^SPX data by YCharts

However, between October 2007 and October 2017, the S&P 500 surged by nearly 63%. By today, the index is up by a staggering 315%.

^SPX data by YCharts

If you had been investing in 2007 and sold your stocks after the market crashed, you’d likely have locked in serious losses. But if you’d stayed in the market for at least a decade, you’d have generated substantial wealth despite all of the short-term volatility.

How to ensure your stocks recover from a recession

Market downturns and recessions can be a major test for stocks. Even shaky businesses can appear to thrive when the market is surging, as rising stock prices can help conceal flaws such as poor management or a lack of a competitive advantage. But those stocks will often struggle to bounce back from tough economic times.

However, if you have a well-diversified portfolio full of healthy companies, it’s far more likely your investments will survive even the worst market slump.

Investing in at least 25 to 30 stocks from a variety of industries can limit your risk, because even if one or two stocks don’t recover, the rest of your portfolio should be strong enough that it won’t have a devastating impact on your total earnings.

Nobody knows when the next downturn will begin or how severe it might be, but the market has a flawless track record of recovering from recessions. By investing in the right places and holding those investments through the rough patches, your portfolio will be far more protected against volatility.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $681,260!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,046,676!*

Now, it’s worth noting Stock Advisor’s total average return is 1,066% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Crucial #Rule #Investors #Stock #Market #Recession #Coming