Key Points

-

The company’s dividend makes Realty Income live up to its name for shareholders.

-

The valuation is much lower than it appears.

-

Realty Income will likely receive significant help with interest rates.

- 10 stocks we like better than Realty Income ›

The company’s dividend makes Realty Income live up to its name for shareholders.

The valuation is much lower than it appears.

Realty Income will likely receive significant help with interest rates.

Realty Income (NYSE: O) has stood out for its business model. The real estate investment trust (REIT) specializes in single-tenant, net-leased properties. This means the tenant assumes responsibility for maintenance, insurance, and property taxes, providing the company with steady revenue streams.

It leases such properties to some of the country’s best-known companies, helping to bolster its nearly 99% occupancy rate on approximately 15,600 properties. Despite that strength, investors have three compelling reasons to buy the stock, and now is a good time to consider Realty Income before more investors take notice of these attributes.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

1. Dividend income

As a REIT, it must pay at least 90% of its net income in the form of dividends to avoid taxes on its operations. Thus, investors may not find its payout noteworthy at first glance.

However, Realty Income bills itself as “The Monthly Dividend Company,” and this is worthwhile for reasons beyond monthly payouts. It went public in 1994 and has increased its payout at least once per year since then.

Moreover, the current annual payout stands at almost $3.23 per share. That amounts to a dividend yield of 5.3%, far above the S&P 500 average of 1.2%. Also, it generated $4.11 in funds from operations (FFO) income, a measure of a REIT’s free cash flow. That means it generates more than enough FFO income to cover the dividend, making it likely the payout hikes will continue.

2. Realty Income’s valuation

Additionally, high dividend yields often accompany low valuations. Nonetheless, investors have to approach this issue carefully. REITs tend to pay high amounts of interest, which they can deduct from the net income figure.

Its P/E ratio of 58 may appear expensive because the interest rate deduction tends to keep net income low. Also, considering that the five-year average earnings multiple for the company is 54, it’s easy for investors to write off Realty Income as an expensive stock.

Such a conclusion is likely a mistake. As previously mentioned, the FFO income is a more representative measure of the cash it generates. When measured against that metric, its price-to-FFO ratio is just 15. Hence, what may appear to be an expensive stock at first glance is likely valued attractively, which should draw in investors once they take notice of a key catalyst.

3. Falling interest rates

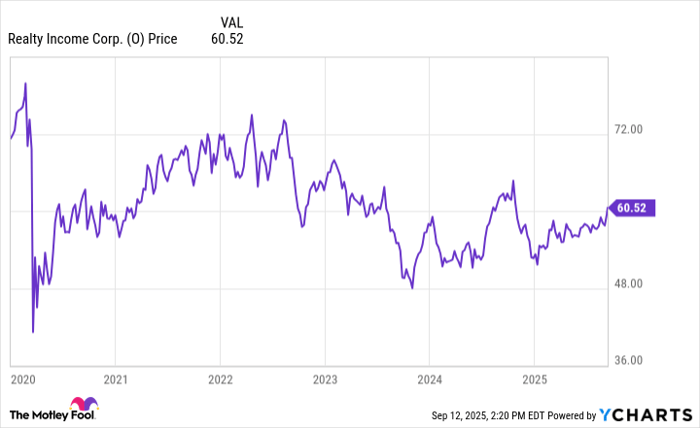

That catalyst will likely be an improving interest rate environment. Indeed, interest expenses tend to rise in high-rate environments, and the income statement shows that this expense has reduced profits and, by extension, FFO income. That may be why Realty Income stock still trades more than 25% below its 2020 high.

O data by YCharts

Fortunately, interest rates appear set to fall for the first time since Trump’s second term began. The Federal Reserve has three meetings scheduled before the end of 2025, with the earliest taking place on Sept. 16 and Sept. 17. These meetings will likely bring steadily lower rates in the coming months.

The effect is twofold. For one, the company could have the opportunity to refinance some of its debt, which would reduce interest expenses. Furthermore, Realty Income can now afford more acquisitions and developments. Given the aforementioned 99% occupancy rate, this should lead to higher revenue, resulting in increased FFO income over time.

Investing in Realty Income stock

Ultimately, Realty Income operates a stable real estate business with numerous properties and a consistently high occupancy rate. For now, investors can benefit from a high-yielding, rising dividend and a low valuation that is not obvious to casual observers.

However, investors may want to act quickly, as interest rates appear on track to fall thanks to a high likelihood of interest rate cuts from the Fed. That will likely lead to lower interest expenses and additional property purchases and development projects. Both are likely to increase the company’s FFO income, which should lead to higher dividend income and a rising stock price.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 15, 2025

Will Healy has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Reasons #Buy #HighYield #Realty #Income #Stock #Tomorrow