The REITweek 2025 conference on 6/2/25-6/5/25 served as a massive information update for much of the REIT sector:

- Fresh operating data as recent as through the end of May.

- Management commentary on today’s operating environment.

This article will discuss some key takeaways from the conference as well as themes that resonate across a large portion of the REIT universe.

A focal point of the REITweek conference was the massive disconnect between public and private real estate pricing. Real estate values have been increasing in tandem with net operating income, so Net Asset Value (NAV) of REITs has increased. At the same time, market prices of REITs have remained weak.

The disparate directions of real estate value and market prices has led to an extraordinary rift between asset value in the private market and public stock market caps. Discounts to NAV for each REIT sector are shown below:

S&P Global Market Intelligence

Healthcare is a bit of an anomaly with companies like Welltower (WELL) trading at 190% of NAV. Premiums in the sector seem to be in names with at least some exposure to senior housing. Fundamentals in senior housing are decent, still rebounding from the former crash, but I’m not convinced the entirety of that premium is warranted.

Data centers trading at 110% of NAV is the result of AI excitement. That’s rather straightforward. The market is anticipating continued growth in data center demand as AI rolls out and is pricing in some of that growth.

Everything else is discounted to asset value. Some sectors are lightly discounted while others are massively discounted. We all know the difference between top-down and bottom-up calculations, but given how large these discounts are, one needs to keep that in mind when looking at the NAV discount table above.

A 20% discount means 25% upside to NAV. A REIT trading at a 33% discount to NAV would need to have its market price increase fully 50% just to get to NAV. That is the magnitude of disconnect between public and private real estate valuation.

This was the major point of discussion at the REITweek conference. Many of the REIT executives were directly asked about their thoughts on the disconnect and how they might take advantage of it.

The answer was overwhelmingly share buybacks:

Crown Castle (CCI) intends to funnel a significant portion of its free cashflow into share buybacks.

Weyerhaeuser (WY) said they completed a $1B buyback and teed up another $1B buyback.

Potlatch (PCH) discussed engaging in significant share buybacks.

Kimco (KIM) has bought back 3 million shares since 3/31/25 at a weighted average price of $19.61.

Farmland Partners (FPI) per its 1Q25 earnings “repurchased 63,023 shares of its common stock at a weighted average price of $11.74 per share.” This followed on from other buybacks in which they have bought back more than 20% of outstanding shares

I could go on with myriad REITs buying back their stock.

A 180-degree turn in REIT growth patterns

The historical operating pattern of REITs is that they issue shares and use the fresh capital to buy more properties. They used to grow by growing larger.

Now, they are growing by shrinking. They are actively selling assets and using the proceeds to buyback stock.

Why?

It all comes back to the massive disconnect between stock prices and the value of real estate.

NAV is the more accurate number. It represents the prices at which properties are actually transacting. Consensus NAVs are occasionally delayed because it takes analysts a while to collectively adjust their estimates, but it’s not hard to find transaction data in real time. For many of the REIT sectors, real time NAV is even higher than the consensus NAV because property values are still rising.

In retail, for example, private capital is clamoring over itself to get open air shopping centers. There’s a lot of capital chasing not all that many properties for sale. Analysts are continually raising their NAV estimates, as seen below with Kimco, but prices are still rising beyond their latest figures.

S&P Global Market Intelligence

The massive disconnect in price between public and private provides REITs with a new way to grow. They can sell assets at their true value and buy back stock at 60%-80% of fair value.

These buybacks are immediately accretive to NAV and AFFO/share.

Buying back their stock is the equivalent of buying a $500,000 house for $300,000. It is such an obvious win and based on the commentary from management teams at REITweek, it seems the executives are diving into the opportunity. They know what their assets are worth and if the stock market isn’t going to give them credit, they will just buy it themselves. In so doing, it’s going to drive further NAV growth and a share concentration that will accelerate AFFO/share growth.

REITs have historically traded primarily in a range of 90%-105% of NAV. It is a recent phenomenon that the index as a whole is trading 20% discount to NAV and many companies are trading 30% or even 40% discounted to NAV.

Buying assets so far below where they are observably and measurably valued is a great opportunity, but an investor still needs to know what they are doing.

How to discern when a discount to NAV is truly an opportunity

We recently discussed the concept of discounts to NAV not necessarily being opportunities with Hudson Pacific (HPP). You can read the full analysis here, but the key ideas were:

- Leverage can make discount to NAV larger than the true enterprise value discount.

- Declining asset value can make discount to NAV disappear the wrong way, where NAV drops to market price rather than market price moving up to NAV.

The office sector is trading at a 33% discount to NAV. Consider the skyscrapers that make up the New York City skyline. Those towers are clearly worth a ton of money and would be wildly expensive to build today, but they’re not easily transactable. So even if a given office tower is worth $1.2B in the theoretical sense, it may be difficult to actually sell it for that much. It gets further complicated when noting that rental rates and occupancy are potentially declining, which could erode that theoretical $1.2B value.

If the discount to NAV is large enough, it can still work, but it’s messy and risky. As such fundamentally difficult sectors like office, hotel and self-storage remain risky even with the discounts at which they are trading.

Buying REITs at a discount to NAV is a much cleaner proposition in sectors where there are fundamental tailwinds. To really take advantage of the dislocation between real estate values and the market price of REITs I think it’s best to stick to areas with the following criteria:

- Properties are transactable.

- Property values are continuing to rise.

- Net operating income of underlying properties is growing.

In my opinion, the four sectors with the greatest disconnects between public and private valuations that also meet the above 3 fundamental criteria are:

- Shopping centers – 20.1% discount to NAV

- Industrial – 22.1% discount to NAV

- Farmland – 26.9% discount to NAV

- Timberland – 30.8% discount to NAV

We already believed these sectors were strong, but the fresh data from REITweek further demonstrated strength.

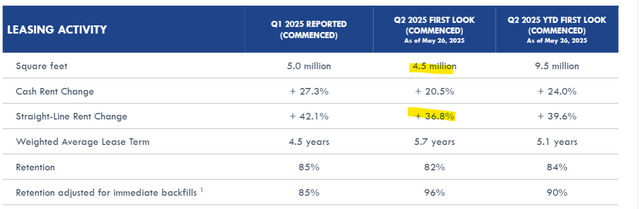

STAG Industrial (STAG) announced its operating results all the way through May 26.

STAG

In just April and May, STAG signed 4.5 million square feet of space at a 36.8% GAAP increase to rent. That represents both an acceleration in leasing volume and impressive rent spreads.

East Group Properties discussed at their REITweek meeting some visibility into a positive inflection point in industrial leasing as early as June 2025 (this month). If you know the track record of EGP or its management, they are not the kind of people to make empty promises. I’m willing to bet that they have good reason to believe leasing is about to get even stronger.

Kimco (KIM) began its REITweek meeting discussing 4.4 million square feet of leasing with +49% cash spreads. The rest of the meeting was about strong tenant demand and scarcity of supply of high-quality open-air shopping centers.

I listened in on the meetings of both Weyerhaeuser (WY) and Potlatch (PCH) and the common refrain was that the upcoming increase in duties on Canadian lumber from 14% to 34% is going to significantly increase margins for American lumber producers. There may be additional tariffs beyond the duty, but the duty alone is sufficient to revitalize mill margins. The companies also discussed the strength of timberland in the private market with even mediocre land trading north of $2,000 per acre. The timber REITs, which have much better overall land quality, are trading far below $2K per acre when adjusting for the value of mills and inventories.

Farmland is one of the most liquid hard assets. The value of farmland is continuously measurable by the daily auctions that take place. It has an extraordinary track record of appreciation, and that trend has not changed.

Wrapping it up

It’s not just my opinion that shopping centers, industrial, timberland and farmland are high value assets. It’s the consensus of industry participants and verifiable by actual transactions, essentially in real-time.

The private value of these assets is cleanly determinable with reasonably small error bars. Current market pricing of REITs is the true phenomenon. It is not sustainable for high quality and growing assets to trade so far below NAV.

Either the market price will rise to approach NAV, or the companies will just capture accretion through buybacks. Either way, I think it’s a great opportunity, and we’re very long the fundamentally strong yet highly discounted sectors.

#REITweek #Conference #Fresh #Data #REIT