Why do we invest in preferred shares?

Investors are constantly balancing between risk and reward. We cover some preferred shares that are offering a 9.5% yield. These relatively low-risk securities offer consistent income at rates well above traditional bonds. For income-focused investors, or really any investor looking to stabilize returns, that kind of yield provides a nice mix of income and steadiness. Further, the consistency of some relatively low-risk preferred shares makes a reliable investment for those who want solid returns without consistently having to watch the market.

Preferred shares sit above common equity in the capital structure. They don’t carry the same guarantees as debt, but they would get paid before the common equity. While they are not risk free, the risk profile is significantly lower than common stock, especially within the mortgage REIT sector.

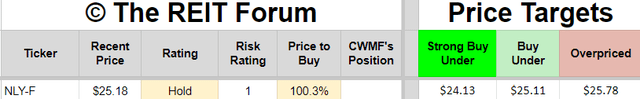

A couple of the preferred shares from Annaly Capital Management (NYSE:NLY) are offering a 9.5% yield and come with our lowest preferred share risk rating (on a scale from 1 to 5 with 1 being the least amount of risk). These preferred shares offer relatively safe income, which is a nice thing to have in today’s market. It also helps that they’re coming from a company as large as Annaly.

Annaly Preferred Shares

We will be going over three of Annaly’s preferred shares:

However, we will be focusing on NLY-F for this article.

All the images used here come from the Google Sheets provided to members of The REIT Forum.

The REIT Forum

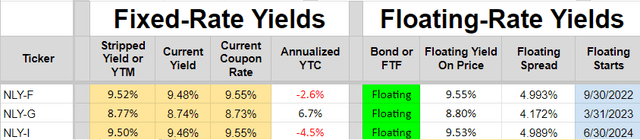

Currently, NLY-F and NLY-I are a more attractive investment opportunity than NLY-G despite having worse yield-to-call values.

The REIT Forum

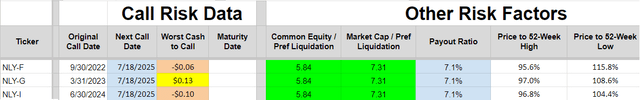

We would be interested in buying both at a slightly lower price to mitigate some of the call risk. At any time, the company can call shares with a 30-day notice. That adds a layer of uncertainty, but it’s something we manage by selecting our entry price.

NLY-G can’t keep up because of the lower floating spread of 4.172%. The higher spreads on NLY-F and NLY-I which you can see in the chart above result in bigger dividends that would make up for the higher price.

Here are the current annualized dividends for each share are about:

- NLY-F: $2.3881

- NLY-G: $2.1828

- NLY-I: $2.3871

NLY-F and NLY-I are paying about $.20 in extra dividends per year than NLY-G but only cost $0.20 to $0.24 more. In well under two years, both preferred shares would have paid off the difference in price relative to having NLY-G. It’s possible that NLY-F and/or NLY-I could get called within that time, but it doesn’t really hurt investors unless the call is very quick. If shares remain outstanding even one month without a call, the negative yield-to-call scenario would’ve been mitigated. In short, the downside is minor unless the call comes almost immediately after purchasing shares.

The REIT Forum

We doubt NLY-G will be called at any point because the spread is fairly thin. We would be interested in any of the shares at the right price, but would generally find NLY-I and NLY-F more appealing because they usually have higher yields. We would simply want to see modestly lower prices. That’s happened a few times within the last several months, so it’s entirely plausible.

We think it’s a coin flip for whether NLY-I or NLY-F gets called during the next year or two. Further, when there are periods of market stress, I believe NLY-F and NLY-I typically hold up a bit better than NLY-G. So when the market gets pretty optimistic, we might see G outperform the others by a bit, but if we see any stress, we would expect NLY-F and NLY-I to decline less than NLY-G.

Final Thoughts

It’s worth considering preferred shares with relatively low risk that pay around a 9.5% dividend. The market doesn’t often provide this kind of opportunity without significantly more risk. NLY-F and NLY-I provide steady income and are backed by the biggest name in the mREIT sector. At recent prices, we would definitely pick those two preferred shares over the NLY-G option even if it means taking on a tiny bit of call risk. For long-term investors who are looking for steady returns and income, NLY-I and NLY-F deserve a spot on your radar.

NLY-F is only pennies outside our target range presently.

#Annaly #Preferred #Shares #Face #NYSENLY.PR.F