High levels of uncertainty are somehow coexisting with stability in the U.S. economy. Negative feedback loops inherently present in a capitalist economy tend to be equilibrium reinforcing, but they often work on a delay. In other words, deviation from the norm is what triggers the return to the norm.

The current environment seems to have an even tighter feedback mechanism, which triggers the mere thought of deviating from the norm. So rather than getting too hot or too cold and then bouncing back, the economy is somewhat prevented from getting hot or cold in the first place. In my opinion, this new mechanism is the Fed’s current approach to policy.

Fed Put becomes a Put and a Call

Financial media often talks about the “Fed Put” which is the idea that if the economy were to go south, the Fed would step in and stimulate by cutting rates. Today, there seems to also be a “Fed Call” in the sense that they have indicated a willingness to remain restrictive indefinitely as long as employment holds up.

How did we get here?

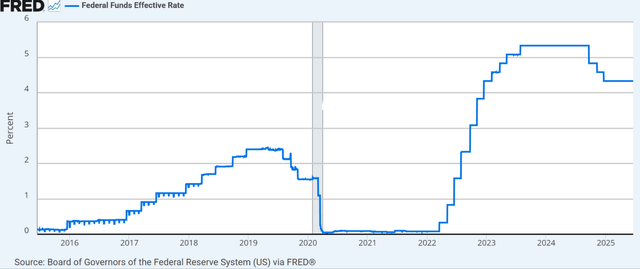

The Fed Funds rate is at what would historically be considered a significantly restrictive level.

FRED

Yet, it seems to not really be holding back the economy.

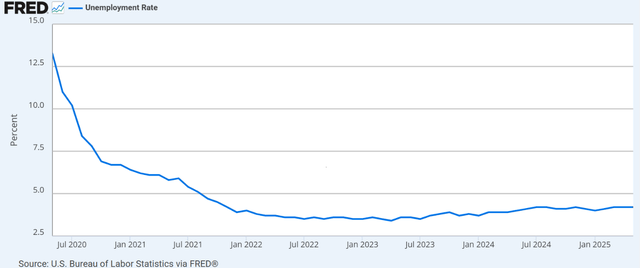

Unemployment has been rangebound between 4.1% and 4.2% for an entire year.

FRED

There is some weakness in job openings as evinced by JOLTS data as well as 7% unemployment in college graduates.

However, that weakness is being counterbalanced by low firings and layoffs, such that employment overall has remained in a range the Fed considers to be healthy.

Stable employment is essentially giving the Fed the green light to remain at its highly restrictive stance for an extended period of time.

GDP and inflation expectations are also offsetting each other to keep the Fed Funds rate where it is.

In its June meeting, the Fed lowered GDP expectations to 1.4% from 1.7%.

Inflation expectations were raised to 3% from 2.7%.

The lowered GDP forecast would encourage the Fed to cut, but they are holding off on doing so for fear of reigniting inflation.

Thus, the Fed, like the economy, is in a period of high stability concurrent with high uncertainty. I believe the holding pattern will remain until the uncertainty breaks one way or the other.

Godot’s arrival

Unlike the eponymous Godot, who never arrived, uncertainty in the economy has a finite life. Within the next few months, we will likely get clarity on inflation.

Inflation

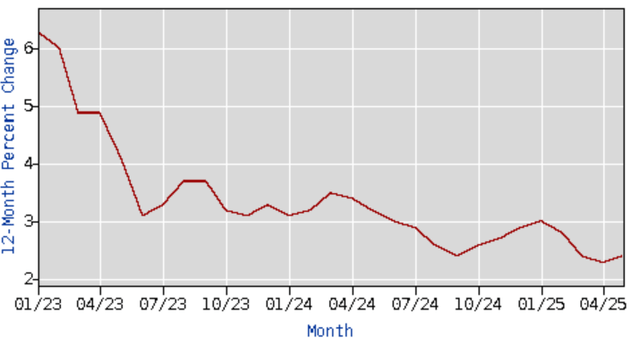

Recent inflation data has been excellent, with CPI trending nicely toward the 2% target.

BLS

Whichever way one slices the data, whether it is PCE or ex-food/energy or whatever, the data that has come in has shown low inflation. Yet, the Fed remains concerned that inflation could be just around the corner due to tariffs.

Tariffs, which were largely implemented in early April, were initially speculated to cause inflation almost immediately. The April and May data have thoroughly dispelled that notion, so now the concern is that they will cause inflation in a delayed fashion.

The idea here is that importers may have pulled forward purchases to stock up on inventory prior to tariff implementation and that in April and May, they were simply running off the inventory of their pre-tariff purchases. Having bought the inventory at pre-tariff prices, they have been able to keep their prices low, which is what caused the tame inflation in April and May. Eventually, the inventory will run out, and they will have to buy with tariffs, which could theoretically cause delayed inflation.

Fed Governor Waller wants to cut in July. He is of the belief that even if tariffs do cause inflation, it is a one-time adjustment, which he believes the Fed should look through.

Fed Governor Bowman also is looking for a cut in July, provided inflation remains low.

Other Fed officials remain concerned about one-time inflation transitioning to rolling inflation through the wage expectations cycle.

Jerome Powell tends to be quite level-headed and presents the macroeconomic outlook fairly. The Fed consists of some of the best economic minds, and they collectively believe the outcome of tariffs on inflation could be any of the following:

- No impact on inflation

- Delayed one-time inflation

- Persistent inflation.

The good news is that we will find out very soon. Whatever pull-forward happened in March is almost certainly depleted now, so the June and July data will be fairly definitive.

If inflation remains tame in June and July it is likely the first option, but if it ticks up materially, we may have to wait longer to see if it is one-time or sustaining.

Scenario analysis

The 3 main scenarios concerning the market right now are:

- Employment weakening

- Continuing to chug along at moderate growth and modest inflation

- Inflation reigniting.

While it is possible to have the double whammy outcome of inflation AND weak jobs, it is considerably less likely because the weak jobs would inherently reduce demand for goods and services, which would in turn quell inflation. It doesn’t mean it can’t happen, it is just substantially less likely.

The too-cold scenario of weak employment and perhaps a recession is one that has played out many times before. The Fed is well-prepared, and the standard Fed put is likely to apply. Of course, cutting rates takes a while to actually stimulate jobs and GDP, so some observers, who believe the labor market is already showing signs of weakening, believe the Fed could be too late to prevent a potential downturn.

A newer addition that seems to be in the Fed’s playbook based on rhetoric is that in addition to the put, there is also a Fed call.

More specifically, the Fed seems prepared to keep rates at a highly restrictive level so as to prevent inflation from heating up. The side effect is that it also hinders the economy from heating up.

These external mechanisms, which come into play when the economy moves in either direction, have a volatility-dampening effect. So despite uncertainty in the economy being high right now, I think the path of least resistance is continued tepid growth.

How to play it

If one believes GDP growth is going to be somewhere in the 1%-2.5% range, high cashflow yield stocks should outperform.

Value infrastructure, utilities, and REITs offer strong cashflows which are positioned to grow even in a tepid economy. The stability of revenues and cashflows is particularly valuable when overall economic growth is slow to moderate.

Companies that have their cashflows somewhat locked in by rental contracts or the regulatory framework of utilities tend to not like the extremes of the economy. A really bad economy can potentially disrupt the cashflows by tenant default. Similarly, the contractually locked-in cashflows may not get to participate in rapid economic growth. As such, they can be overshadowed as growth plays leave them in the dust.

A tepid economy is where contractual cashflows thrive. In particular, we like 3 areas at current market pricing:

- Value REITs with 8%-10% AFFO yields and 1%-5% AFFO/share growth protected by annual rent escalators.

- Discounted preferreds with 8%-11% current dividend yields

- Utilities with ~4% dividend yields and 6%-8% annual growth through rate base growth.

#Fed #Put #Call #Scenario #Analysis #Uncertainty #Breaks