Rent control is often mischaracterized as landlords versus tenants in a sort of Marxian proletariat versus bourgeoisie.

On the surface, this characterization makes sense, as landlords would generally want higher rent while tenants would generally want lower rent. It gets far more complex as we pull back the layers of the onion.

Rent control has been thrust into the spotlight as Zohran Mamdani, a democratic socialist, bested former governor Andrew Cuomo in the NYC Mayoral primary. A cornerstone of Mamdani’s campaign has been a pledge to freeze apartment rents in the city, with rents bordering on unaffordable.

This potentially has massive implications for apartment REITs so we shall dig in. As always, we will remain non-political in our discussion.

Key topics analyzed in this article:

- Mamdani rent freeze policy

- Potential for rent freezes to become widespread

- Rent control mechanics

- REITs with significant exposure to potentially rent controlled apartments

- Impact on apartment REITs

Let us begin with the specific policy proposed by Mamdani and then move on to rent control more broadly. Per Mamdani’s platform webpage, he intends to freeze rent on rent-stabilized apartments.

Specifically, there is a board that governs rental rates for rent-stabilized apartments. In recent years, this board has approved rent increases each year that roughly match inflation. Mamdani intends to elect board members that favor rent freezes, such that year over year rent change would be 0%.

This policy would have little direct impact on apartment REITs because publicly traded REITs own almost exclusively market rate apartments as opposed to affordable housing or rent-stabilized apartments.

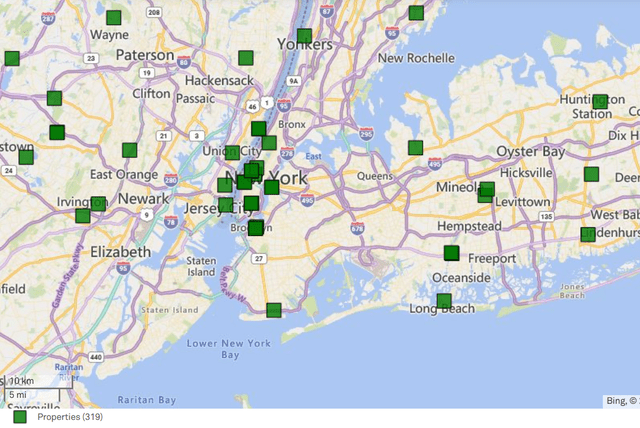

AvalonBay (AVB), for example, has substantial exposure to NYC with its properties mapped below.

S&P Global Market Intelligence

However, AVB’s average monthly rent is well over $3,000 while rent-controlled apartments in NYC are closer to $1,500. Thus, a freeze on rent increases on rent-controlled units would have minimal impact on AVB because it is such a different segment.

However, there is potential for rent control to become significantly more widespread, both geographically and by market segment.

Potential For Rent Freezes Or Similar Policies To Become More Widespread

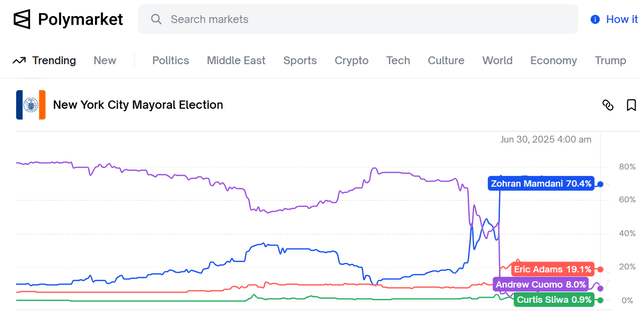

Mamdani has tapped into a broad frustration about the high cost of living. His rent freeze policy is arguably what launched him into popularity and despite the Mayoral election still being 4 months away, he is already at 70.4% on Polymarket betting odds.

Polymarket

Polymarket odds are to be taken with a grain of salt as the bidders which inform the odds tend to skew into certain demographics (likely younger) and those demographics may be more favorable to Mamdani.

So the real chances of a Mamdani victory might not actually be 70%, but they are certainly high and likely above 50%.

Cost of living frustration is not unique to NYC, and seeing Mamdani’s popularity could embolden politicians throughout the country to foster similar stances. Thus, while Mamdani’s currently proposed policy has minimal impact on apartment REITs, it behooves us to consider the potential for broader rent control.

Rent control can extend beyond apartments classified as affordable housing. For example, belonghome notes that:

The Tenant Protection Act caps rent increases for most residential tenants in California. Landlords can’t raise rent more than 10% total or 5% + CPI increase (whichever is lower) over a 12-month period.

10% is a big year-over-year change that is unlikely to come into play in the next few years, although it is worth noting that 20% rental rate growth was common circa 2021-2022.

With enough political willpower, that 10% could be amended to 2% or even 0%. That would have major implications, so we want to have a deeper understanding about what that means for apartment owners as well as tenants.

Rent Control Mechanics

Rent control directly affects the price landlords are allowed to charge, and in this first order impact it does keep rent lower. However, there are 2 ripple effects which make the overall impact much less clear.

- Disincentivized maintenance capex

- Disincentivized new development

Landlords are constantly in competition with other landlords of similar price points. They are incentivized to maintain their buildings because tenants are more likely to go with the nicer/cleaner/safer place to live.

In other words, capex can actually increase NOI by driving revenue more than the incremental cost. Many REITs, such as NexPoint Residential (NXRT) base their business model around this concept. They buy poorly maintained apartments, and make some smart renovations that increase rent a couple hundred dollars a month for an overall IRR in the 15%-28% range.

With rent control in place, this sort of capex is discouraged. No landlord is going to want to put in thousands of dollars of capex into each unit if they cannot raise rent for doing so.

Similarly, development cap rates in apartments are generally quite low. In 2022, developers underwrote to 4% cap rates. Today, development cap rates are closer to 5.0%-6.5%, but that is still a fairly low return for the risk of development. However, development is made worth it by new properties often experiencing significant rent growth over time.

Thus, the going in cap rate of say 6% can become an 8% or 10% return on invested capital over time. If you take away the rent growth or cap it at 2% through rent control, it disincentivizes development.

Overall Impact Of Rent Control Policy

With the ripple impacts in mind, it is much less clear what the actual outcome of rent control is.

Some believe it actually benefits landlords as they can keep cash flowing while significantly reducing capex spend. New York City and major cities in California are the areas which have most embraced rent control historically, and each of these areas feature extremely high rent and housing shortage.

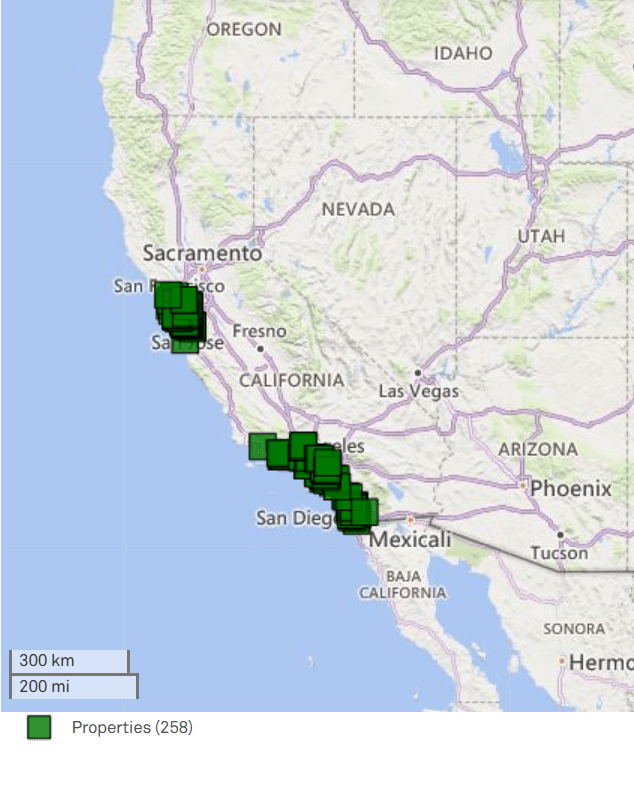

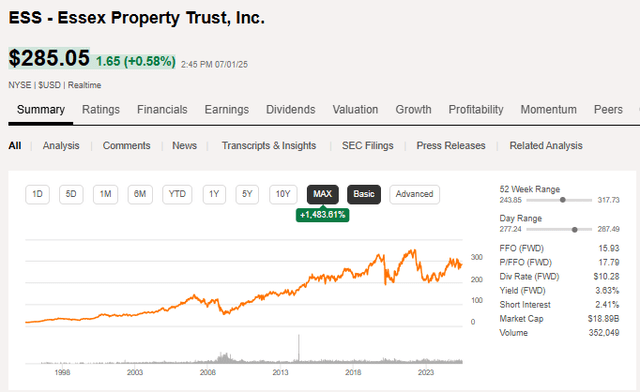

Essex Property Trust (ESS) is an apartment REIT that has been concentrated in California for decades and has had to battle rent control in various forms.

S&P Global Market Intelligence

It has also been quite successful, racking up a strong long-term shareholder return.

SA

Rent control, like most economic policies, involves a complex web of interactions. It is very difficult to disaggregate the various forces that lead to events. We cannot determine if the housing shortage in historically rent controlled areas is related to rent control or if it is simply a matter of the high population density of these areas which results in land scarcity.

As such, I have no opinion on the merits of rent control in terms of whether it is good or bad as a policy. We can merely consider the potential impacts on apartment REITs listed below:

- Lower rent growth in the near term

- Lower capex

- Lower competing development

- Mixed impact on NOI

On the flip side, we can also look at areas that have gone the opposite direction. Texas has intentionally low regulations, and ample land, which has encouraged development. Rents are allowed to go sky-high but are also tamped down by competing supply.

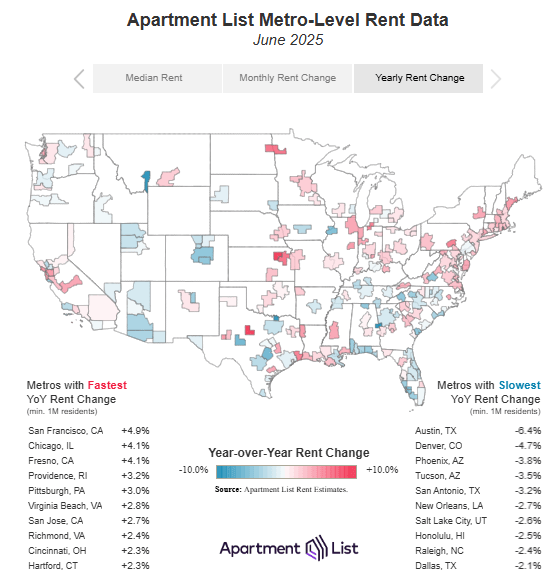

Per the June data from ApartmentList, rental rates are down 6.4% in Austin and down 3.2% in San Antonio.

ApartmentList

This happened despite both cities having healthy population and job growth. Texas exposed apartment REITs BSR REIT (OTCPK:BSRTF) and Camden (CPT) are currently feeling the negative impacts of high supply.

On the positive side, these Texas markets have also experienced incredible boom times when construction activity is naturally in a low period.

Wrapping It Up

The financial media is often overly focused on the first order impacts of policy, but economics always involves feedback mechanisms and ripple effects. In giving proper weight to the full web of mechanisms, it is entirely unclear whether apartment REITs perform better in the laissez-faire of Texas, or the more controlling policies such as those proposed by Mamdani.

So rather than trying to buy or avoid apartment REITs exposed to certain political ideologies, I think forward performance will be much more determined by individual company operations, fundamentals and valuation.

We are still somewhat light on apartment REIT exposure presently as we await further data on how well the wave of deliveries gets absorbed. The sector is well positioned for strong NOI growth going forward, it is just hard to tell if that will start in late 2025, early 2026, or late 2026.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

#Landlords #Survive #Mamdanis #Rent #Freeze