Guido Mieth

| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | 19.3% | 10.5% | 28.3% |

| S&P 500 | 10.8% | 6.0% | 14.7% |

| Russell 2000 | 8.5% | -1.8% | 7.1% |

| DJ Industrial Average | 5.4% | 4.4% | 12.1% |

*The ”Pernas Portfolio” is a private account managed by Pernas Research LLC. Performance inception date is 01/01/2017. Periods longer than a year are annualized.

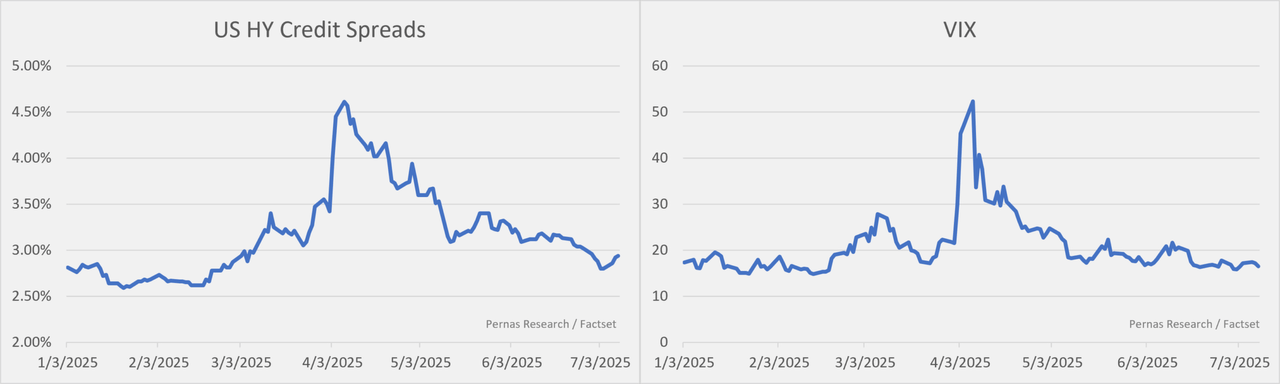

The second quarter delivered a dramatic and historic reversal in market sentiment and equity prices. Our portfolio outperformed the S&P 500 by more than 800bps in Q2, bringing our YTD performance to +10.5%. The overall recovery from the S&P 500’s intra-year drawdown of -19% was not only swift—it was the fastest in modern market history. Nearly half the rebound occurred in a single trading session, signaling the existence of the ‘Trump Put.’ Whether one debates the details of the strike price or if this put is more tied to the bond market or stock market, participants are right to assume some level of intervention when policy risk or tariff headlines begin to spiral. Q2 saw a broad-based compression in risk premiums: the VIX fell from 52 to 16, high-yield credit spreads tightened by ~180bps, and market-based recession probabilities dropped to their lowest levels in over a year. From tariff resolutions to easing tensions in the Middle East, the second quarter was defined by substantial de-risking.

OBBB

The One Big, Beautiful Bill (OBBB), passed beginning Q3, included a $5 trillion increase to the debt ceiling and a wide array of spending and tax changes. Salient spending increases include $75 billion to ICE for enforcement and deportation operations, $45 billion for expanded detention infrastructure, and $70 billion over ten years for border barriers, surveillance systems, and hardened ports of entry. The bill also delivers a 13% increase to the Department of Defense budget, pushing annual military spending above $1 trillion, with significant allocations for missile defense, drones, and naval modernization.

While most press coverage has focused on politically driven tax provisions that favor certain classes of workers over others, we believe two elements of the bill are meaningfully pro-growth:

- 100% expensing for R&D, permanently restored and reversing the amortization rules introduced in 2022

- 100% bonus depreciation for capital equipment and, starting in 2025, factory construction

These pro-growth components aside, from a fiscal perspective, the bill adds roughly $2.8 trillion to the deficit over the next decade, raising long-term debt levels significantly. The CBO now projects the deficit will rise to ~7% of GDP by 2025, and then average just under 9% over the coming decades. Meanwhile, debt held by the public is projected to reach ~176% of GDP by 2054. It’s worth noting that historically, the CBO has underestimated future debt-to-GDP ratios. Any views that the CBO is being conservative on the denominator growth is misguided. The reality of our political system is that both parties will continue to invent ways to grow spending faster than the economy is expanding.

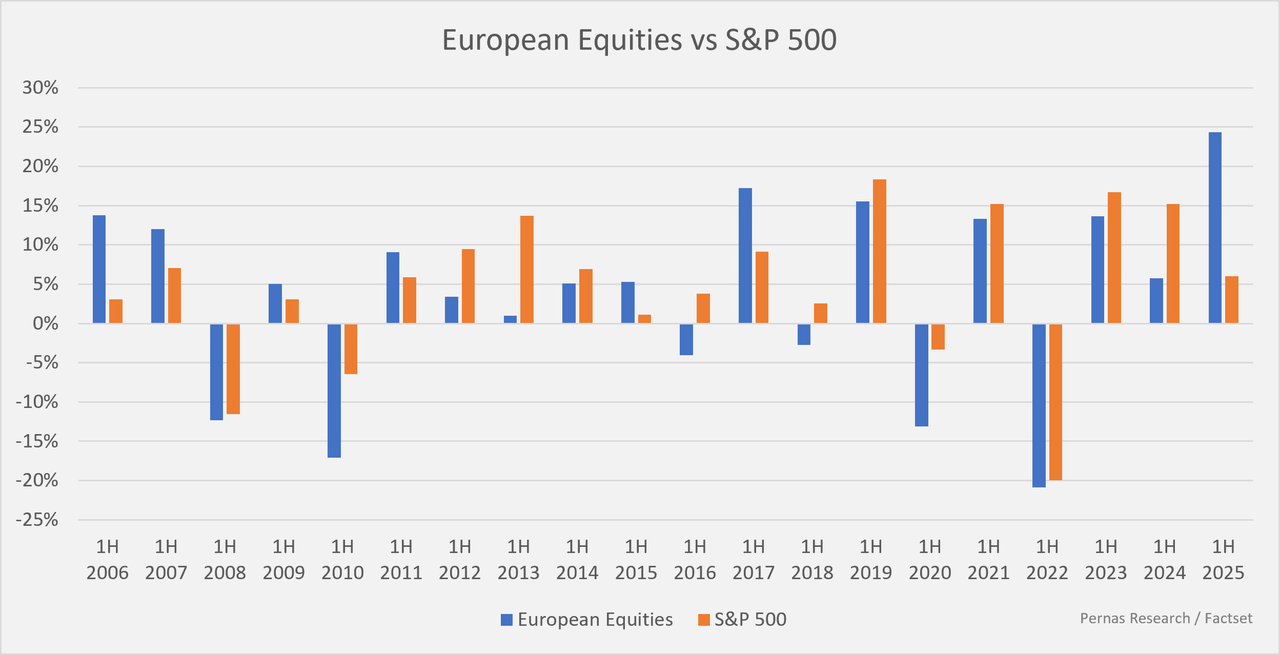

Europe Ascendant: A Break from U.S. Market Dominance

YTD outperformance of ~18% by European large-cap equities (Vanguard’s VGK) relative to the S&P 500 marks the strongest six-month stretch since the ETF’s inception. The move has been supported by robust European corporate earnings growth, easier central bank policy, and improving sentiment. More importantly, it reflects a rotation out of U.S. and dollar-denominated assets, as investors reacted to rising policy unpredictability and headline risk. Roughly half of VGK’s 1H returns are due currency contribution from US dollar depreciation. It’s a good reminder that owning foreign developed-market equities in local currency and intentionally not hedging the FX risk is a free diversifier.

Tear sheet

|

INVESTMENT DISCLAIMERS & INVESTMENT RISKS Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#Pernas #Research #Investment #Letter