Structured equity products are packages of synthetic investment instruments specifically designed to appeal to needs that investors perceive are not met by available securities. They are often packaged as asset allocation tools that can be used to reduce portfolio risk. Structured equity products usually consist of an equity index and a derivative (typically a put to protect downside risk, though call options can also be used to capture the upside of returns.

These strategies have proved popular with investors as Morningstar’s options trading-related fund categories had amassed $234 billion of assets by the end of February 2025. Their popularity flies in the face of economic theory—the sellers of the options that protect the downside risk demand a risk premium; thus, the buyers are paying an insurance premium, which should be expected to reduce returns. Thus, even before trading costs and the higher expense ratios of these funds, investors should expect to be disappointed in the returns of such strategies.

AQR’s Dan Villalon examined the performance of the 99 funds Morningstar’s options-trading related categories that had histories going back to January 2020. For these 99 funds, he asked two questions:

-

Did their cumulative returns exceed that of passive U.S. equities (proxied by the S&P 500 Index)?

-

Were their worst drawdowns less severe than that of passive U.S. equities?

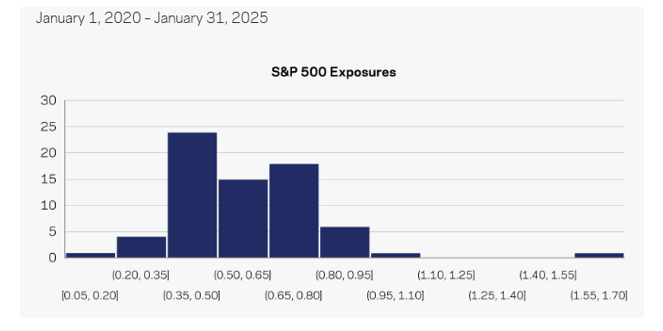

Villalon found that while all these funds delivered lower returns than the equity market, 86% did experience smaller drawdowns than the market. However, as Villalon explained, “There are simpler ways to get returns lower than equities with less risk. For example, instead of putting $100 in the market, an investor could invest only $70 and put the other $30 in Treasury Bills.” The following chart shows the distribution of the average equity exposure of the 99 funds in his sample.

Adjusting for each fund’s average exposure to the equity market (the fund’s beta), he found that more than two-thirds of all funds delivered lower returns with more risk than a simple combination of passive equities and T-Bills. In addition, 81% of all the funds had worse drawdowns than the simple “passive equity plus cash” combination. And, even compared to this simple benchmark, only 14% outperformed.

His findings led Villalon to conclude: “By and large, options-based strategies have not been effective tools to achieve better risk/return outcomes. And this is unlikely to be some fluke of the past five years. Economic theory would argue investors should have expected this result, and that they should going forward, too.“ He asked: “if you’re concerned with equity risk, are you better off a) using options or b) simply reducing your exposure to equities? Obviously, we believe, based on both theory and realized fact, that option b) is likely to be the better choice.” In other words, these products are marketing successes and investment failures.

Structured equity investments are not the only products that have been developed to exploit naïve retail investors.

Structured Debt Products

Because of the derivative component, structured products have long been promoted to investors as debt securities. Full protection of the principal invested is sometimes offered, depending on the structured product. In other cases, only limited protection may be provided, or even no protection. We’ll review the empirical evidence.

The Evidence

Petra Vokata, author of the October 2020 study “Engineering Lemons” covering January 2006-September 2015 and more than 21,000 products, found that investors paid 7% on average in annual fees and lost 7% per year relative to risk-adjusted benchmark returns.

Brian Henderson and Neil Pearson, authors of the study “The Dark Side of Financial Innovation: A Case Study of the Pricing of a Retail Financial Product” published in the May 2011 issue of the Journal of Financial Economics, found that the offering prices of 64 issues of a popular retail structured equity product were almost 8% greater on average than estimates of the products’ fair market values obtained using option pricing methods, and the mean expected return estimate on the structured products was slightly below zero. The authors concluded that the issuing firms either shrouded some aspects of their innovative securities or introduced complexity to exploit uninformed investors.

Geng Deng, Ilan Guedj, Joshua Mallett, and Craig McCann, authors of the August 2011 study “The Anatomy of Principal Protected Absolute Return Barrier Notes,” examined the evidence on ARBNs (absolute return barrier notes)—structured products that guarantee to return the face value of the note at maturity and pay interest if the underlying security’s price doesn’t vary excessively. The principal protection feature guarantees the full payback of the note’s face value at maturity if the investor holds the note to maturity and the issuer does not default. The study covered 214 ARBNs issued by six different investment banks. Most products were linked to indexes such as the S&P 500 and the Russell 2000. They found that the ARBNs’ fair price was approximately 4.5% below the actual issue prices. The authors also found that the yields on ARBNs were lower than the corresponding corporate yields. Many were even lower than the risk-free rate!

Carole Bernard, Phelim Boyle, and William Gornall, authors of the study “Locally-Capped Investment Products and the Retail Investor” published in the Summer 2011 issue of the Journal of Derivatives, found that the contracts were overpriced relative to their fair values by about 6.5% on average.

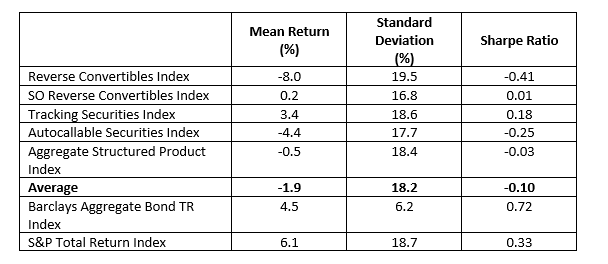

Geng Deng of Wells Fargo, Tim Dulaney, Tim Husson, Craig McCann, and Mike Yan, authors of the study “Ex Post Structured Product Returns: Index Methodology and Analysis” published in the Summer 2015 edition of the Journal of Investing, analyzed the ex-post returns of more than 20,000 individual structured products issued by 13 leading investment firms from 2007 through 2014. They constructed a structured product index and subindexes for reverse convertibles, single observation (SO) reverse convertibles, tracking securities, and autocallable securities by valuing each structured product in their database daily. The table below presents the mean returns, standard deviations, and Sharpe ratios for the five structured product indexes as well as the comparable figures for the S&P 500 Index and the Barclay Aggregate Bond Index.

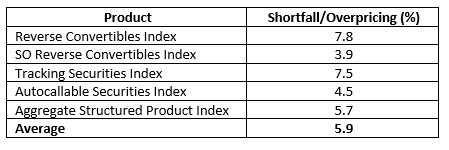

To isolate the performance results from the issue of overpricing on the date of issuance, the authors also calculated the initial “shortfall” in pricing:

The results clearly show that structured products have dramatically underperformed alternative allocations to stocks and bonds because they are overvalued. The authors concluded: “The results of our index analysis should cause investors and their advisers to avoid structured products.”

Investor Takeaways

Wall Street’s product machine is continuously pumping out fairy tales. Their product innovations can also be called “fanciful tales of legendary deeds.” The only difference is that they are intended for adults. Like the apple the Evil Queen offered Snow White, they have shiny features designed to entice naive investors. And despite the many fanciful tales available, they have one thing in common: Despite their seeming appeal, they have attributes that make them more attractive to the fund sponsor or note issuer than the buyer. Thus, the main takeaway is that structured products should be avoided.

#Structured #Equity #Products #Marketing #Success #Investment #Failure