Welcome to another great article about the mortgage REITs and BDCs. We’re going to touch on a handful of shares in the sector and provide some quick thoughts on each.

Annaly Capital Management Preferred Shares

We will start with the Annaly Capital Management (NLY) preferred shares. There are four of them.

I’m not thrilled with the valuation. NLY-F and NLY-I both have a materially negative yield to call. NLY-G has a positive yield to call, but the floating yield is only 8.73%. That’s lower than the yield on most baby bonds in the sector. While NLY preferred shares are easily among the safest in the sector, I would hesitate to call them safer than any of the baby bonds.

NLY also has a new preferred share that will be called NLY-J. It’s a fixed-rate share with an 8.875% coupon rate. It’s not bad, but it doesn’t excite me at all either. Since the share is callable after about five years, the upside if rates fall is limited. But if rates go up, there’s no requirement for NLY to redeem the share. That makes the interest rate risk situation a bit less favorable. I think NLY had a good decision in issuing these shares. They could’ve got a lower rate if they issued baby bonds instead, but it would probably have only saved them around 100 basis points. Consequently, I think management made a good decision by going with preferred shares instead.

NLY-J was initially trading as NNLYV, but it is now NNLYP. It should be NLY-J soon enough. However, we’ve seen share prices rise from $24.80, to $24.90 when I first wrote about it on Aug. 4, to $25.10 today. That seems about right. I wouldn’t be surprised if it still goes up a bit more, but the easiest upside was over the last two weeks. It’s pretty common to see preferred shares climb in the first few weeks (faster than dividend accrual).

MFA Preferred Shares

MFA Financial (MFA) has two preferred shares and two baby bonds.

I find the valuation on MFA-C about right. Perhaps slightly favorable. The shares carry a reasonable floating spread of 5.79% over 3-month LIBOR, which means a bit over 6% over 3-month SOFR. That’s not bad. It comes out to a stripped yield of about 10.3% to 10.4% given today’s price of $24.23. That’s about 130 to 140 basis points over the two baby bonds, MFAN (at $25.09) and MFAO (at $25.20). The yield to maturity for those baby bonds is extremely close to 9.00%.

I’m a bit more hesitant regarding MFA-B.

MFA-B is a fixed-rate share. The value proposition is a mix of yield (8.84% stripped yield at $21.58) and upside potential if rates fall. Back when rates were in the 0% to 2% range, we saw MFA-B trading around $25.00. Investors in the shares have to be valuing that potential upside as a way to benefit if interest rates decline. Otherwise, there’s no way they would be picking MFA-B. I’m not going to hammer shares with a sell rating, but I’m really not excited about it because the upside isn’t large enough for me to overlook the difference in yield and relatively lower risk provided by baby bonds.

So overall, I suppose I’m leaning slightly toward MFA-C? But it’s pretty close (between MFA-C and the baby bonds). I would really like the baby bonds if the price dipped modestly because even a modest dip in the price (for baby bonds) can have a material impact on yield to call and yield to maturity.

Note: Preferred shares don’t have a yield to maturity since they typically lack a maturity.

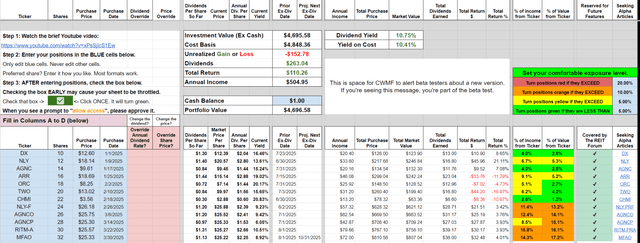

Tracking Your Investments

I built a tool for all my readers on Seeking Alpha. I posted a YouTube Video for the Best Dividend Portfolio Tracker yesterday (8/11/2025). I put together this example in a few seconds:

The REIT Forum

Yes, this tool even has links on the right-hand side that will take you to the latest Seeking Alpha articles about that stock. The users only need to enter the information in the blue cells, shown here in the bottom left.

ARMOUR Residential REIT

ARMOUR Residential REIT (ARR) was the worst-performing mortgage REIT last week. We’re just going to discuss ARR’s common shares this time.

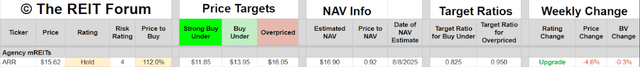

I edited the image from our weekly subscriber update for members of The REIT Forum to just show ARR:

The REIT Forum

You’ll notice shares dropped 4.6%. That’s much worse than peers. Their agency peers were mostly positive. The only dips among peers were shares falling by less than 1%.

ARR dropped into our neutral range as the price-to-NAV (net asset value) dropped to a projected 0.92x. Price to NAV is interchangeable with price-to-BV (book value) for these mortgage REITs. We use NAV in this image to make it align with the image for BDCs (where using NAV is more common). What happened?

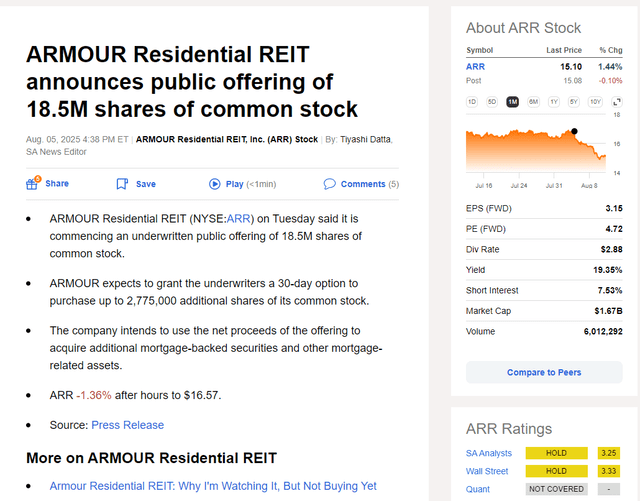

As you can see in this image from Seeking Alpha, shares began falling after the board of directors announced a public offering of shares:

Seeking Alpha

That box on the right-hand side is one of my favorite things about the presentation because you can see how well it lines up with shares starting to decline.

Issuing at about 98% of book value the end of the world? No. But it sure didn’t leave shareholders excited.

Charts

You can see all the charts here.

It’s just one extra click, and it saves me a ton of time on uploading the article.

Note: GAIN reports earnings today. So starting in the next article, we will be able to do price-to-book using the Q2 2025 values. I didn’t want to start using the new values until we had all of them reported. Using Q1 and Q2 book values within the same chart just isn’t great. I’ll try to have another piece out relatively soon so investors can contrast the charts.

All The Stocks

The charts compare the following companies and their preferred shares or baby bonds:

- BDCs: (CSWC), (BXSL), (TSLX), (OCSL), (GAIN), (TPVG), (FSK), (MAIN), (ARCC), (GBDC), (OBDC), (SLRC)

- Commercial mREITs: (GPMT), (FBRT), (BXMT)

- Residential Hybrid mREITs: (MITT), (CIM), (RC), (MFA), (EFC), (NYMT)

- Residential Agency mREITs: (NLY), (AGNC), (CHMI), (DX), (TWO), (ARR), (ORC)

- Residential Originator and Servicer mREITs: (RITM), (PMT)

#HighYield #Shares #Compared #Seeking #Alpha