ElenVD/iStock via Getty Images

By Scott Kennedy, Produced with Colorado Wealth Management Fund

Introduction

Two Harbors Investment (NYSE:TWO) had a tough quarter on book value, with a larger-than-expected decline. Some of this can be attributed to their legal loss and hedging choice. We still see TWO as weaker than top peers. At current pricing, we view shares as a hold.

Commentary

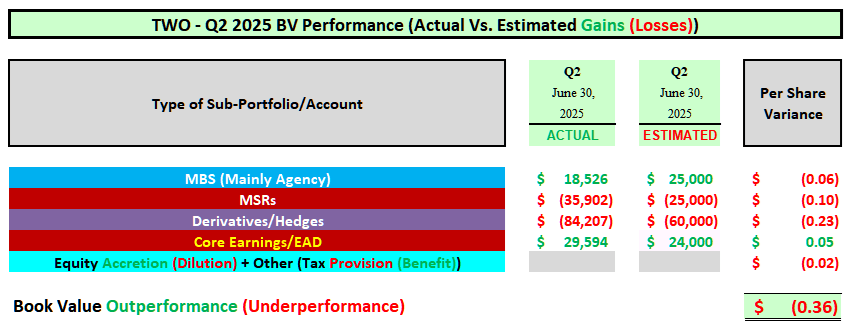

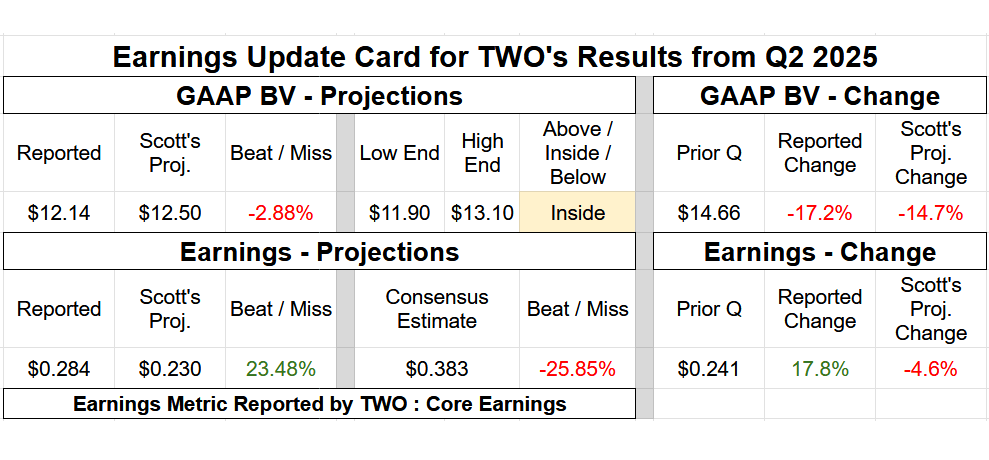

- Quarterly BV Fluctuation: Minor – Modest Underperformance (2.4% Variance).

- Core Earnings/EAD: Modest Outperformance ($0.054 Variance).

A bit of an underperforming quarter regarding Two Harbors Investment’s BV, in my opinion. I projected TWO would report a severe (14.8%) quarterly BV decrease. In comparison, TWO reported a severe–very severe (17.2%) quarterly BV increase. Remember, Q2 2025 was a very volatile quarter for agency mREIT stocks regarding BV fluctuations.

There was a “unique” event that notably negatively impacted TWO’s BV during Q2 2025. This has to do with an ongoing legal dispute with their prior external manager.

In addition, TWO made some hedging decisions that negatively impacted the company’s BV but positively impacted core earnings/EAD during Q2 2025. As such, let us first review TWO’s performance versus my expectations.

First, similar to a couple other agency mREIT sub-sector peers, TWO largely maintained the size of the company’s on-balance sheet fixed-rate agency MBS/investment portfolio by the end of the quarter. In comparison, after TWO’s negative legal ruling and appeal denial in May 2025, I ultimately assumed management would begin to “shed” assets to raise cash during Q2 2025. At first, I didn’t believe management needed to do this. However, my assumption changed after management’s 6/18/2025 commentary in conjunction with the Q2 2025 common stock dividend reduction. In particular, the following quote from TWO’s CEO and President, Mr. Greenberg:

“…The reduced dividend reflects our projected static returns in future quarters as we adjust our portfolio in light of this accrual…”

Looking back, perhaps this was a bit of a “pre-mature” assumption on my end. That said, asset sales during parts of Q2 2025 would have been slightly more beneficial than most of June 2025. However, during late June 2025, MBS pricing quickly moved higher, which largely offset this assumption. In the end, even with my general assumption of a modest portfolio reduction not coming to fruition, TWO’s net valuation gain within the company’s on-balance sheet fixed-rate agency MBS/investment portfolio largely matched my expectations during Q2 2025 (see BV table below; 1st row of accounts). If anything, a very minor underperformance.

Second, TWO’s MSR sub-portfolio slightly underperformed my expectations during Q2 2025. This was mainly due to the fact that TWO’s UPB slightly increased during Q2 2025 (sub-portfolio size). Unlike the prior quarter, TWO made new bulk purchases of $6.4 billion (along with very minor flow acquisitions and recaptures of $0.2 billion) during Q2 2025. After quarterly roll-off and prepayments, this resulted in a quarterly UPB increase of $2.0 billion, which versus my projection of a quarterly UPB decrease of $3.0 billion. Since MSR valuations decreased in late June 2025 as rates/yields quickly decreased, this factor, along with a fractionally larger-than-anticipated quarterly CPR increase that led to higher amortization, directly resulted in a slightly more severe MSR valuation loss when compared to my expectations (see BV table below; 2nd row of accounts).

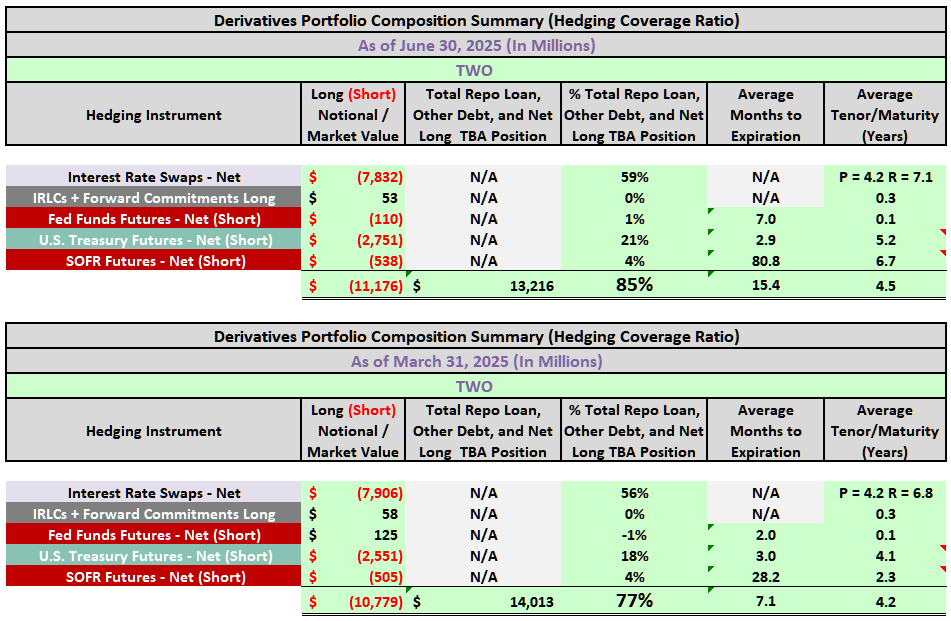

Third, TWO’s derivatives sub-portfolio modestly underperformed my expectations during Q2 2025. This was the biggest BV disappointment/surprise, in my opinion. This was mainly due to 2 related factors. First, as noted earlier, I assumed TWO would begin to sell assets (and terminate underlying derivatives) to accumulate cash/capital for the upcoming notable contingent liability that was booked during the quarter. As noted earlier, this, for the most part, did not occur within TWO’s MBS/investment portfolio during Q2 2025. As such, it is logical that a reduction also did not occur within TWO’s derivative instruments sub-portfolio. Since mortgage interest rates/U.S. Treasury yields quickly net decreased in late June 2025, this directly resulted in a larger derivatives net valuation loss when compared to my expectations (larger derivative portfolio size). Second, on top of this, TWO wound up actually increasing the company’s hedging coverage ratio from 77% as of 3/31/2025 to 85% as of 6/30/2025. Simply put, even if my 1st assumption did not occur (reduction of both MBS/investments and derivatives), I did not assume management would actually increase hedges during Q2 2025 (at worst they would be maintained). New interest rate payer swaps (though largely offset by new receiver swaps) and a larger net (short) futures position simply increased the severity of TWO’s total derivatives net valuation loss versus my expectations (see BV table below; 3rd row of accounts). However, as will be discussed next, this strategy positively impacted TWO’s core earnings/EAD when compared to my expectations.

Moving on, TWO’s core earnings/EAD modestly outperformed my expectations during Q2 2025. This was a “bright spot” to the quarter in my opinion and basically saved TWO from another percentage recommendation range downgrade. TWO’s quarterly core earnings/EAD outperformance was mainly due to the following when compared to my expectations: 1) slightly smaller net interest expense due to maintaining a larger on-balance sheet fixed-rate agency MBS/investment portfolio size; 2) slightly higher net servicing income due to a slightly larger MSR sub-portfolio size; 3) very similar TBA NDR income (due to a correctly anticipated relatively unchanged off-balance sheet net long TBA MBS position); and 4) modestly more net periodic interest income on interest rate swaps and U.S. Treasury futures income (current period hedging income; mainly due to the aforementioned addition of some lower-cost interest rate payer swaps, Treasury futures, and SOFR futures). For the 6th straight quarter, operational expenses came in largely as expected.

So, a mixed quarter for TWO regarding the company’s overall performance. TWO will certainly underperform the company’s agency mREIT sub-sector peers regarding a severe—very severe quarterly BV decrease. However, most of this decrease was already anticipated. In addition, TWO reported a decent quarterly increase in core earnings/EAD.

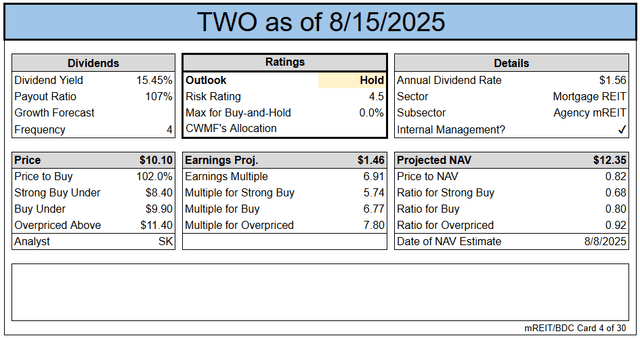

Since I already downgraded TWO back in late May 2025 due to the company’s $200 million contingent liability accrual, I do not believe another downgrade is warranted from today’s earnings results.

That said, I continue to believe TWO is still not in the same “class” as AGNC Investment Corp. (AGNC), Dynex Capital, Inc. (DX), or Annaly Capital Management Inc. (NLY) regarding long-term operational performance. As noted last quarter, 1 quarter of TWO BV outperformance versus these peers is simply “1 chapter in a book.” TWO’s recent negative legal ruling has taken a good “chunk” out of the company’s available capital over the foreseeable future and BV during Q2 2025.

As such, a risk/performance rating of 4.5 for TWO remains appropriate in the current environment/over the foreseeable future.

Remember, even though most agency mREITs have very little credit risk, these companies still have to navigate the following risks: 1) spread/basis; 2) leverage; 3) prepayment/extension; and 4) interest rate (regarding derivatives). As a reminder, my/our models continue to project 1 – 2 (25) basis point (“bp”) Federal (“Fed”) Funds Rate cuts at some point during the 2nd half of 2025. This is already “baked” into current sector recommendation ranges/price targets.

BV Performance (Actual Vs. Estimated)

The REIT Forum

Change or Maintain

- BV/NAV Adjustment (BV/NAV Used Interchangeably): Our projection for current BV/NAV per share was adjusted: Down ($0.35) (To account for the Actual 6/30/2025 BV/NAV Vs. Prior Projection). Price targets have already been adjusted to reflect the change in BV/NAV. The update is included in the card below and the subscriber spreadsheets.

- Percentage Recommendation Range (Relative to CURRENT BV/NAV): No Change.

- Risk/Performance Rating: No Change. Remains at 4.5.

Hedging

- Hedging Coverage Ratio: Increase from 77% to 85%.

The REIT forum

Earnings Results

The REIT Forum

Note: BV at the end of the quarter. Subscriber spreadsheets and targets use current estimates, not trailing values.

Valuation

The REIT Forum

Ending Notes/Commentary

TWO did not provide the company’s IXM figure this quarter in its earnings press release (6th quarter in a row). As stated in prior quarters, this metric is not an accurate comparison to core earnings/EAD and positively “skewed” TWO’s performance when compared to both sub-sector and broader sector peers. TWO’s IXM metric had/has some “interesting” methodologies versus both GAAP accounting and core earnings/EAD, so I am glad it was omitted once again this quarter by the company.

TWO is currently deemed appropriately valued (hence our HOLD recommendation). TWO has some insulation in a “higher-for-longer” interest rate/yield environment via the company’s MSR sub-portfolio. Still, I would like to see spread stabilization over a period longer than simply 1 quarter, along with TWO’s stock price trading at a slightly to modestly more attractive valuation before considering an investment.

Subscribers also have to consider the ongoing legal matters regarding TWO’s formal external manager. There is the possibility for even further legal damages awarded to Pine River Capital Management, aside from what TWO has already accrued.

#Assessing #Harbors #Performance #NYSETWO