North American Data Center Market Hits Historic Supply Crunch

North America’s data center colocation market is straining under unprecedented demand, with vacancy rates plunging to just 2.3%, according to JLL’s North America Data Center Report – Midyear 2025. Total inventory has reached a record 15.5 gigawatts (GW), but capacity constraints and energy shortages are intensifying, even as the sector continues its rapid expansion.

Northern Virginia remains the continent’s largest hub with 5.6 GW–more than triple Dallas-Fort Worth’s 1.5 GW. Cloud giants and major tech firms account for roughly 65% of leasing activity, cementing hyperscalers’ dominance in the market.

“The colocation market is under unprecedented demand pressure,” said Andy Cvengros, Executive Managing Director at JLL. “Despite early-year disruptions, including the DeepSeek event and tariff concerns, the sector posted another record-shattering performance.”

Absorption Outpaces Supply

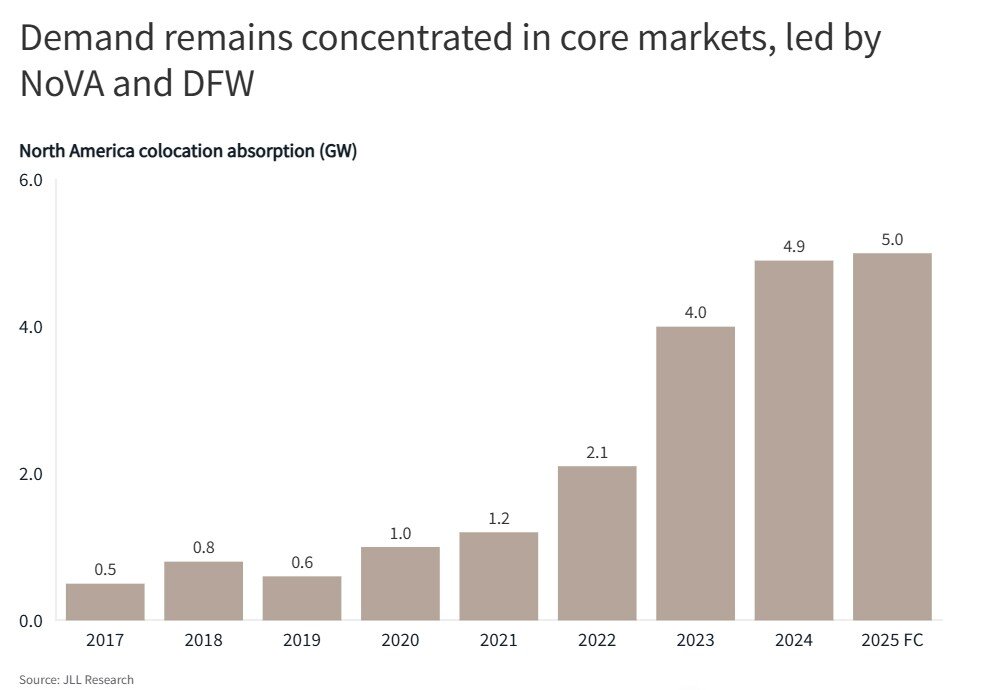

The first half of 2025 saw 2.2 GW of net absorption, led by Northern Virginia (647 MW) and Dallas-Fort Worth (575 MW), with Chicago (368 MW) and Austin/San Antonio (291 MW) also registering strong activity. The pace is on track to surpass 2024’s record levels.

Curt Holcomb, Managing Director of JLL’s Global Data Center Solutions, noted, “In Dallas-Fort Worth, competition for limited capacity is fierce. Major cloud providers are locking in power years in advance. Austin has emerged as a Tier 1 market with nearly 921 MW of inventory and 341 MW under construction–a 500% increase since 2020.”

The broader construction pipeline has ballooned to 7.8 GW–10 times the volume of five years ago–but 73% of this capacity is already preleased.

“Build-it-and-they-will-come is over,” said Matt Landek, Division President at JLL. “Companies are now securing capacity 18-24 months ahead of deployment, fundamentally changing data center strategy.”

Power Constraints Drive Development Shift

Rising electricity costs–up nearly 30% since 2020 to an average 9.7 cents/kWh–are steering growth toward emerging markets. Columbus has seen 1,800% growth since 2020, while Austin/San Antonio has grown 500%. Lower-cost power markets such as Salt Lake City (5.7 cents/kWh) and Denver (6.4 cents/kWh) are attracting new development.

“Power has become the new real estate,” said Andrew Batson, Head of U.S. Data Center Research at JLL. “With vacancy near zero, absorption relies almost entirely on preleasing, with delivery times exceeding 12 months. The market has grown at a 20% CAGR since 2017, and our data suggests this pace will continue through 2030, potentially expanding capacity to 42 GW.”

Investor Appetite Surges

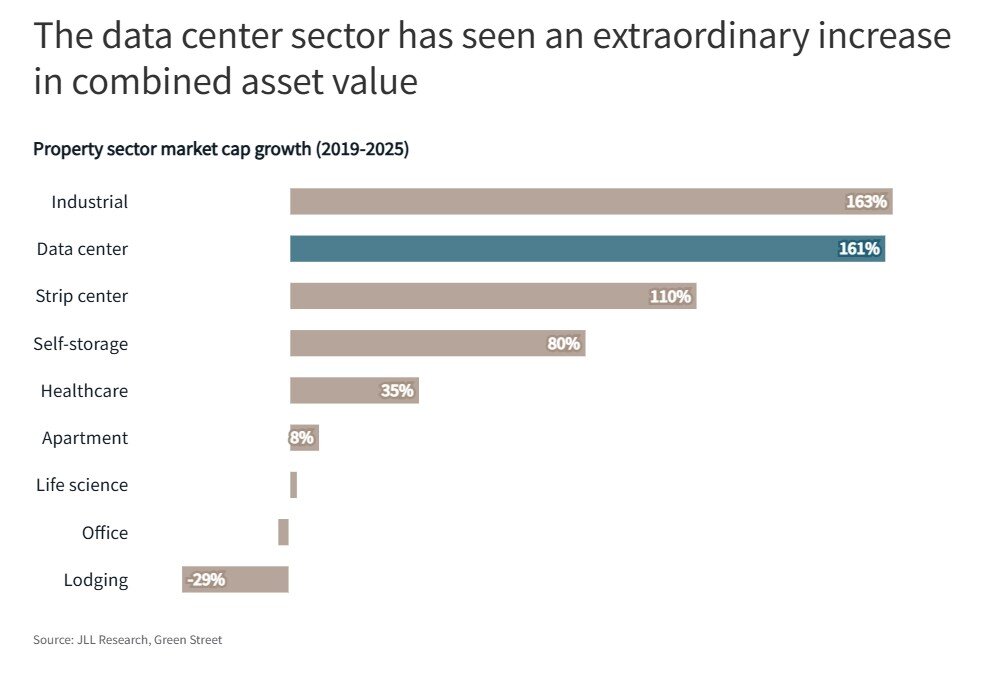

Data centers remain one of the hottest real estate asset classes, with market capitalization up 161% since 2019, second only to industrial properties. Capital deployment surged in H1 2025, with long-term leased developments securing up to 85% loan-to-cost financing, while debt markets expand through ABS and SASB loans.

JLL projects the supply-demand imbalance will persist. Projects under construction are largely preleased, while 31.6 GW of additional capacity is planned over the next five years. Northern Virginia leads with 5.9 GW, followed by Phoenix (4.2 GW), Dallas-Fort Worth (3.9 GW), and Las Vegas/Reno (3.5 GW).

“North America could see $1 trillion in data center development through 2030,” Batson said. “More than 100 GW of colocation and hyperscale capacity could break ground or deliver, not including potential accelerators like quantum computing. AI adoption, cloud migration, and digital transformation have created a perfect storm–demand far outstripping supply.”

Real Estate Listings Showcase

#Trillion #Data #Center #Development #Underway