mathieukor/E+ via Getty Images

By Bob Iaccino

At a Glance

- Silver is seeing a surge in demand due to its use in electronics, solar panels and data centers

- Chinese jewelry demand for platinum is on the rise as high gold prices push consumers and jewelers to seek alternatives

Gold has historically been the most popular precious metal for investors seeking a perceived safe haven and a hedge against economic uncertainty. But the first half of 2025 has seen a shift in the market, with silver and platinum taking the spotlight. A combination of structural and cyclical factors has led investors to increasingly favor these metals.

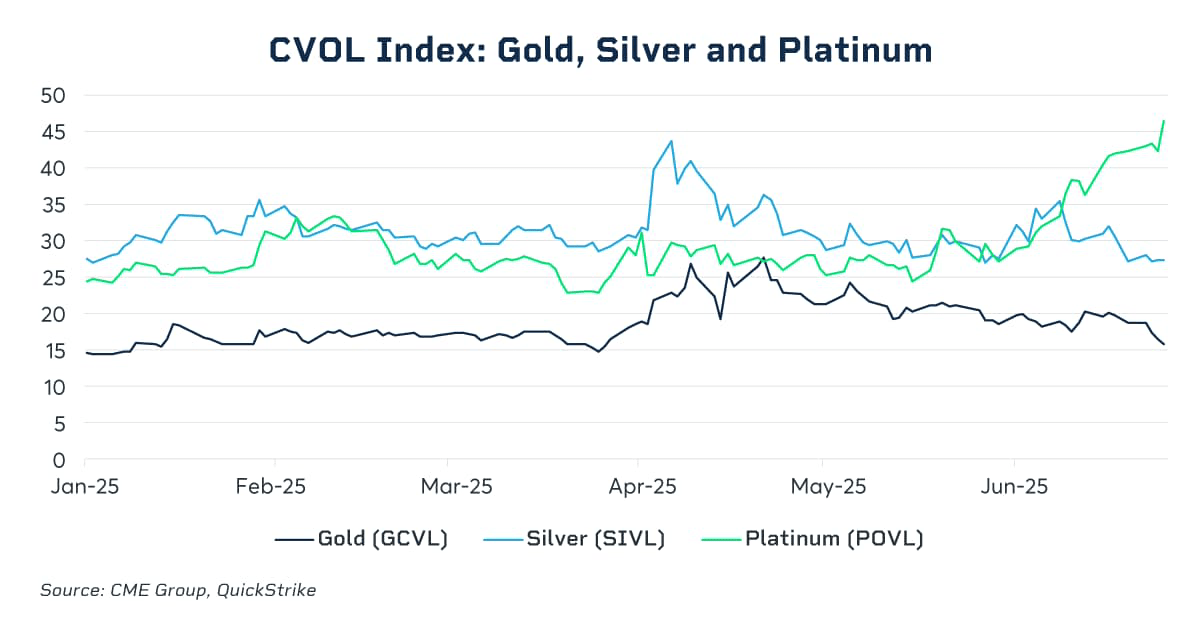

As of late June 2025, the momentum behind silver and platinum is unmistakable, with prices climbing steadily amid a backdrop of global economic uncertainty, supply constraints and robust industrial demand. According to CME Group futures data, silver and platinum prices have surged by 9.5% and 28.2%, respectively, since the start of June, far outpacing gold’s 1.1% gain over the same period. Year-to-date, through mid-June 2025, CME-traded silver futures prices have climbed approximately 27%, while platinum futures have seen a robust 30% growth. Gold, by comparison, has gained about 25% year-to-date.

What Makes Silver and Platinum Attractive Diversifiers to Gold?

For starters, both metals benefit from strong industrial applications, which sets them apart from gold’s primarily monetary and safe-haven role. Silver, in particular, is a critical component in electronics, solar panels and data centers – all sectors experiencing rapid growth. The ongoing push for renewable energy and digital infrastructure has kept silver demand robust, while supply deficits have persisted with global inventories hitting multi-year lows. This tightness in the market has helped propel silver prices to levels unseen in over a decade.

Platinum’s resurgence is driven by its essential role in catalytic converters for internal combustion engine vehicles, with demand remaining strong due to stricter emissions standards and a rebound in auto production. Chinese jewelry demand for platinum has also increased as high gold prices push consumers and jewelers to seek more affordable alternatives. The World Platinum Investment Council has projected a third consecutive annual market deficit, further depleting above-ground inventories and supporting higher prices.

Beyond industrial demand, both silver and platinum are increasingly seen as attractive safe-haven assets. While gold remains the traditional go-to for many in times of uncertainty, silver and platinum’s relative affordability and momentum have drawn in a broader range of investors. The weakening U.S. dollar and volatile bond markets have only added to their appeal, encouraging more investors to diversify beyond conventional financial assets.

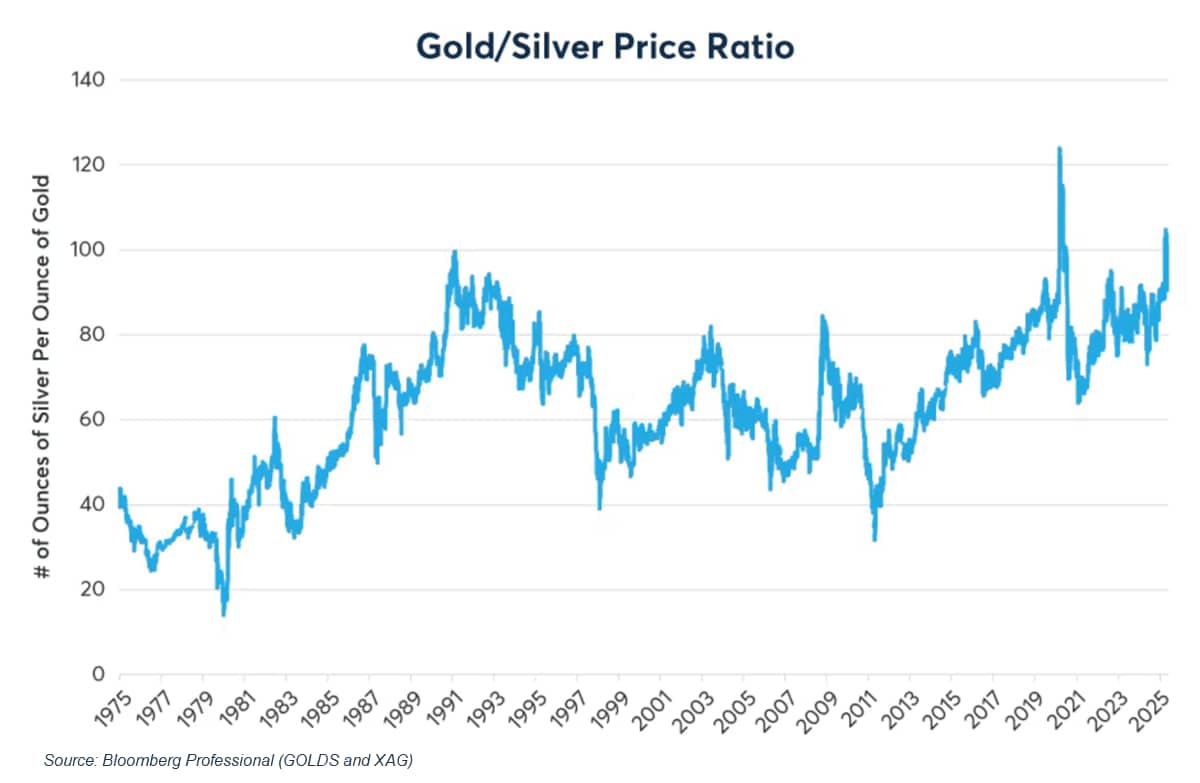

Silver and platinum are trading at significant discounts to gold, making them an attractive option for those seeking upside potential. The gold-to-silver ratio recently hit an 11-year high, underscoring silver’s relative undervaluation and the opportunity it could present for investors.

Can the momentum last? In the short term, volatility is likely to persist. Market sentiment, geopolitical developments and macroeconomic data will continue to influence prices. However, the fundamental backdrop for both metals remains strong. Central banks are cutting interest rates globally, reducing the opportunity cost of holding non-yielding assets like silver and platinum. Continued steady growth in alternative energy technologies and electronics should sustain demand for silver, while platinum could benefit from both industrial and investment demand, especially if gold remains expensive.

That said, there are risks. Any significant increase in mine production could alleviate supply constraints and cap potential price gains, though analysts remain cautious about the ability of miners to ramp up production quickly. A stronger-than-expected economic recovery or easing geopolitical tensions could reduce safe-haven demand. For platinum, the long-term risk from electric vehicles – which do not require catalytic converters – remains a concern, though current demand dynamics appear positive.

What’s Ahead For Precious Metals?

Looking ahead to the second half of 2025, the outlook for precious metals is broadly positive. Gold is expected to remain well-supported, with central bank buying, geopolitical risks and lower interest rates as key drivers. Supply deficits, robust industrial demand and investment inflows will likely keep silver prices elevated. If current trends continue, silver could challenge its all-time highs in the coming years.

Platinum is also likely to maintain its strong performance. The price of platinum, with CME futures recently topping $1,340 per ounce, is supported by a structural deficit and renewed demand from both industrial and investment sectors. Despite potential short-term volatility, the ongoing supply-demand imbalance and platinum’s diversification benefits suggest continued strength.

While short-term volatility is likely, the structural fundamentals suggest that silver and platinum could remain strong performers through the second half of 2025. Gold, meanwhile, is expected to maintain its perceived safe-haven status. For investors, a diversified precious metals portfolio offers both defensive and growth opportunities in the current environment.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#Silver #Platinum #Outperforming #Portfolio #Diversifiers #Gold