Key Points

-

Nvidia is primed to benefit from further artificial intelligence (AI) computing capacity build-out.

-

Alphabet’s cheap stock price is a result of old ideas.

-

Meta is still a top company in the AI realm.

- 10 stocks we like better than Nvidia ›

Nvidia is primed to benefit from further artificial intelligence (AI) computing capacity build-out.

Alphabet’s cheap stock price is a result of old ideas.

Meta is still a top company in the AI realm.

Artificial intelligence (AI) investing is still a dominant market theme right now. There is a ton of money flowing into this space, and many companies stand to benefit as they deploy AI solutions.

Three stocks that have my attention right now are Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META). This trio has a ton going for them, and will likely be among the major winners in the AI arms race.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

1. Nvidia

Nvidia has been the gold standard in AI investing since the arms race kicked off in 2023. Its graphics processing units (GPUs) have been the primary computing devices used for AI, and any further capacity build-out will benefit Nvidia.

Both Alphabet and Meta Platforms have informed investors that data center capital expenditures will increase in 2026 to expand their AI computing capacity. This bodes well for Nvidia, as does the return of its China export business.

In April, the Trump administration revoked Nvidia’s export license for H20 chips. This was a big deal, and caused Nvidia’s revenue guidance for Q2 to fall from 77% growth to 50% growth, as the H20 chips were expected to generate about $8 billion in sales during Q2 alone. Nvidia has reapplied for its license with assurances from the government that it will be approved, although it will likely need to pay a 15% export tax. Still, if Nvidia can export to China again, it will be a massive win for the company.

Although Nvidia has had a successful few years, 2026 still looks bright for Nvidia, making it a smart stock to scoop up now.

2. Alphabet

Alphabet was the laughingstock of the AI world when it was beaten to the punch to launch several AI products. However, that is no longer the case. Alphabet’s generative AI model, Gemini, ranks among the best available and has been integrated into the Google Search engine, making it one of the most often used models, too.

There’s a widespread fear in the investing community that AI will replace Google searches someday, but that hasn’t come to fruition, as Google Search’s revenue rose 12% year over year in Q2. Despite this success, the market is undervaluing Alphabet’s stock compared to the broader market.

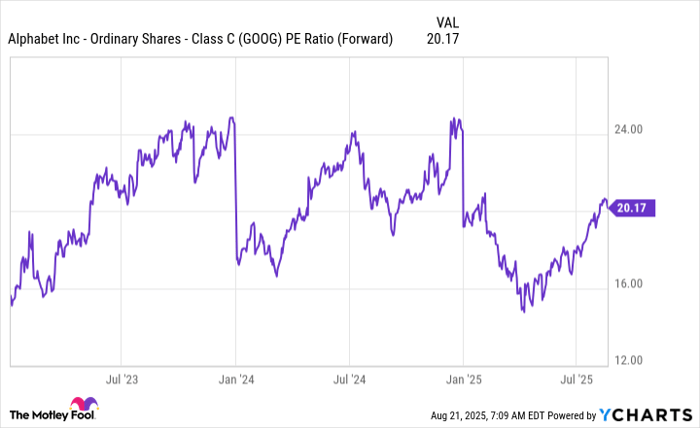

GOOG PE Ratio (Forward) data by YCharts

At 20.2 times forward earnings, Alphabet’s stock trades at a sizable discount to the S&P 500 (SNPINDEX: ^GSPC), which trades for 24.1 times forward earnings.

Alphabet is still an AI leader, despite its slow start. The cheap price tag is an artifact of dated analysis with Alphabet, making today’s price a bargain for long-term investors.

3. Meta Platforms

Meta is the parent company of social media sites like Facebook and Instagram, and is heavily investing in AI technologies to improve ad experiences on these platforms. They’ve already seen a ton of success, with improved ad conversion as well as an increase in time on the platform, thanks to AI-powered recommendations.

Meta made headlines recently when it announced it may downsize its AI division. While there isn’t a ton of information available, this could be a prudent business practice. Meta may have found a dead end in some of its AI research, and instead of endlessly pursuing it, it decided to reorganize its AI research to benefit the company over the long term. This change of course is a warm welcome to investors who saw Meta sink billions of dollars into its metaverse ambitions, so this move should be viewed positively.

The reality is that Meta is a dominant business that’s still growing rapidly and has substantial cash flows to research and expand its AI capabilities. Meta has acquired some of the top AI talent available, and this move should lead to a successful AI approach over the long run. Because of that, I think Meta is an excellent stock to scoop up right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 18, 2025

Keithen Drury has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Phenomenal #Artificial #Intelligence #Stocks #Buy