Key Points

-

Form 13Fs are filed quarterly and provide investors with a way to track which stocks Wall Street’s most-successful money managers are buying and selling.

-

Five prominent billionaires purchased shares of Nvidia during the June-ended quarter, including two that had been persistent sellers for more than a year.

-

However, two billionaire fund managers have taken a different approach with Nvidia.

- 10 stocks we like better than Nvidia ›

Form 13Fs are filed quarterly and provide investors with a way to track which stocks Wall Street’s most-successful money managers are buying and selling.

Five prominent billionaires purchased shares of Nvidia during the June-ended quarter, including two that had been persistent sellers for more than a year.

However, two billionaire fund managers have taken a different approach with Nvidia.

A solid argument can be made that August contains the two most important data releases of the entire third quarter:

- Nvidia‘s (NASDAQ: NVDA) fiscal second-quarter operating results, which were released after the closing bell yesterday (Aug. 27).

- The Aug. 14 deadline to file Form 13Fs with the Securities and Exchange Commission.

A 13F is a required quarterly filing for institutional investors with at least $100 million in assets under management that tells investors which stocks Wall Street’s smartest money managers have been buying and selling. Consider it an inside look at the companies and trends piquing the interest of the stock market’s top-tier investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

What’s particularly noteworthy about the latest round of 13Fs, which covers trading activity during the second quarter, is that billionaires, which had been decisive sellers of Nvidia stock, have returned en masse to this artificial intelligence (AI) leader… with two notable exceptions.

Five prominent billionaire investors loaded up on shares of Nvidia in the June-ended quarter

Excluding passive funds, market makers, and quant funds that hold thousands of positions and often hedge their common stock holdings with call and put options, five premier hedge funds with billionaire investors at the helm were buyers of Nvidia stock during the second quarter:

- Philippe Laffont of Coatue Management: 2,942,694 shares purchased.

- Karthik Sarma of SRS Investment Management: 2,653,210 shares purchased.

- David Tepper of Appaloosa: 1,450,000 shares purchased.

- Dan Loeb of Third Point: 1,350,000 shares purchased.

- Chase Coleman of Tiger Global Management: 742,202 shares purchased.

It’s worth pointing out that Laffont’s purchase ended an eight-quarter streak of paring down his fund’s Nvidia position. Likewise, Tepper’s buy nearly 6X’d his stake following a 97% reduction in Nvidia since Sept. 30, 2023.

Perhaps the leading catalyst behind this buying activity was the early April swoon that stocks endured. President Donald Trump’s tariff and trade policy reveal on April 2 kicked off a mini-crash in the benchmark S&P 500, Nasdaq Composite, and Dow Jones Industrial Average. On a peak-to-trough basis between early January and April 8, shares of Nvidia fell by approximately 40% and acted as an insatiable lure for opportunistic investors betting big on the AI revolution.

Beyond a sizable pullback in Nvidia stock, these five billionaire fund managers are likely also enticed by its sustainable competitive advantages. Nvidia’s Hopper (H100) and Blackwell graphics processing units (GPUs) have faced minimal competition, in terms of compute ability. No external AI-GPU producers have come particularly close to matching what Nvidia’s hardware can do in AI-accelerated data centers, which in turn has helped the world’s largest publicly traded company command a premium price for its chips.

Furthermore, trade restrictions have lifted for the face of the AI space. Following nearly three years of AI-GPU and related equipment export restrictions to China, Nvidia is now free to ship the H20 chip to the world’s No. 2 economy. With export restrictions a thing of the past, billionaires appear more willing to pay a heftier profit multiple for Nvidia.

Lastly, most billionaire money managers are optimistic given Nvidia’s accelerated innovation timeline. CEO Jensen Huang is targeting the release of a new advanced AI chip every year. This means ramping up the rollout of Blackwell Ultra in the second-half of 2025, debuting Vera Rubin next year, and following it up with Vera Rubin Ultra in the second-half of 2027. Maintaining its compute advantage may help Nvidia sustain its premium pricing power.

Image source: Getty Images.

Two billionaire asset managers are Nvidia outliers

Whereas a number of well-known fund managers added to their respective position in Nvidia during the second quarter, two billionaire investors had the opposite reaction:

- Ole Andreas Halvorsen of Viking Global Investors: 2,861,172 shares sold.

- Paul Singer of Elliott Investment Management: 2,580,000 put contracts purchased.

Halvorsen reduced his fund’s stake in Nvidia by 44% during the June-ended quarter, while Singer’s put contracts point to the expectation of future downside in Nvidia stock.

Simple profit-taking might be all the explanation needed in the case of Viking Global. The average top-20 position in Viking’s portfolio has been held for less than six months, which suggests Halvorsen is a very active trader who isn’t afraid to lock in gains when presented with the opportunity to do so. But there’s probably more to this pessimistic trading activity than just profit-taking.

For example, next-big-thing technology trends don’t exactly have the best track record. For more than three decades, every game-changing technology has endured an early stage bubble that eventually burst. This is a reflection of investors overestimating how quickly a new technology would become mainstream and/or gain utility. It results in lofty investor expectations not being met and trend-leading companies, like Nvidia, eventually taking it on the chin.

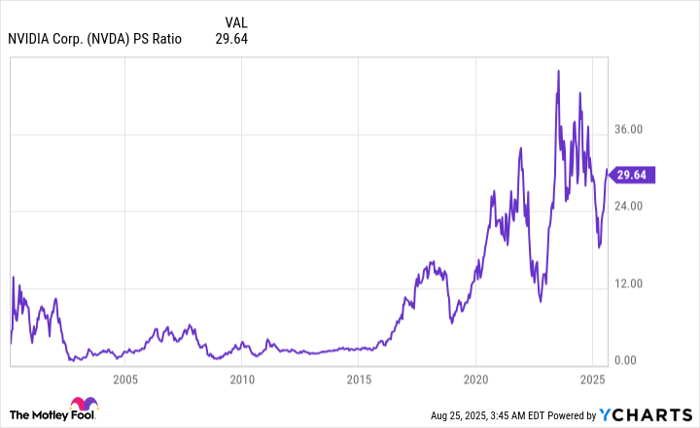

NVDA PS Ratio data by YCharts. PS ratio = price-to-sales ratio.

While an argument can be made that Nvidia’s valuation inspired billionaires to dive in during the second quarter, its valuation might also be encouraging other prominent billionaires to head for the sideline or to wager on downside in the company’s stock.

As of the closing bell on Aug. 22, Nvidia was valued at a price-to-sales (P/S) ratio of nearly 30. Historically, P/S ratios of 30 to 40 have served as a valuation ceiling for companies on the cutting edge of a next-big-thing technology trend. While Nvidia’s rapid sales growth will help reduce its P/S ratio, history tells us that maintaining this aggressive of a valuation premium is virtually impossible.

Halvorsen and Singer might also be expecting Nvidia’s biggest competitive edge — AI-GPU scarcity — to wane in the coming quarters. An increase in competitors producing AI-accelerating chips, coupled with many of Nvidia’s top clients by net sales internally developing their own AI-GPUs, paves the way for AI-GPU scarcity to diminish over time. As this scarcity fades, so should Nvidia’s triple-digit percentage pricing premium for its AI hardware, as well its exceptionally high gross margin.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $661,220!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,114,162!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 25, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Billionaire #Money #Managers #Piling #Nvidia #Stock #Notable #Exceptions