Key Points

-

Realty Income is the largest net lease REIT and has a reliable dividend history.

-

Realty Income is a great business, but there’s a competitor that might be a better choice right now.

-

With a similar yield and more growth opportunity, this 5.5%-yielding net lease REIT gives you almost everything Realty Income offers, but also a little more.

- 10 stocks we like better than Realty Income ›

Realty Income is the largest net lease REIT and has a reliable dividend history.

Realty Income is a great business, but there’s a competitor that might be a better choice right now.

With a similar yield and more growth opportunity, this 5.5%-yielding net lease REIT gives you almost everything Realty Income offers, but also a little more.

Realty Income (NYSE: O) is a smart dividend stock to buy today. It has a high yield, an attractive business model, and a history of rewarding income investors well. But there could be a smarter option in the net lease real estate investment trust (REIT) niche. Here’s what you need to know about why Realty Income is attractive, and why its smaller peer could be even more attractive.

What does a net lease REIT do?

Realty Income is the largest net lease REIT by a wide margin. It is more than three times the size of the next runner-up, W.P. Carey (NYSE: WPC), based on market cap. Looking at size in a different way, Realty Income owns over 16,600 properties, compared to W.P. Carey’s roughly 1,600 properties.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Being large gives a net lease REIT an advantage, because it allows easier access to capital markets. That’s notable because net leases are, for the most part, financing transactions for the seller. Essentially, a company sells property it owns and then leases it back, with a long-term lease that includes regular rent escalators. But the seller agrees to pay for most property-level operating costs, which gives it effective control of the property. A net lease REIT like Realty Income or W.P. Carey gets a reliable tenant, a low-maintenance property, and a long lease. It’s pretty close to a win/win arrangement.

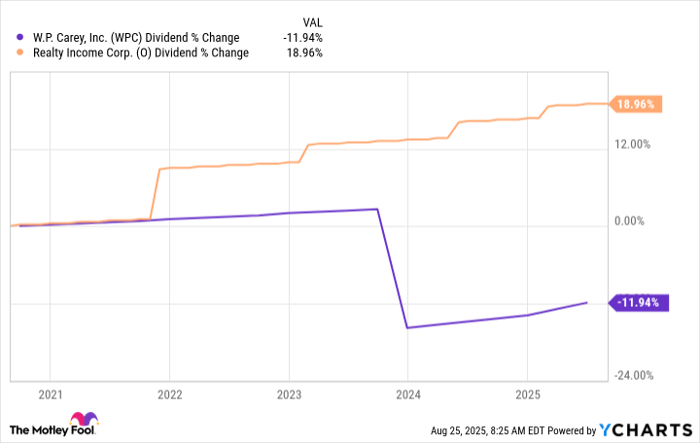

If you like owning the biggest and best, Realty Income is a smart net lease REIT to buy. Notably, it has hiked its dividend annually for three decades while W.P. Carey reset its dividend lower in 2023. And yet, smaller W.P. Carey could actually be the smarter buy right now.

WPC Dividend data by YCharts

Why W.P. Carey could be the smarter choice

The first thing to address with W.P. Carey is the dividend reset. In 2023, it exited the office property niche, which necessitated a reset because of the size of the office portfolio it owned. The move was strategic, given the occupancy troubles office properties are facing. It is using the cash it raised from the exit to buy more industrial, warehouse, and retail properties. This is where the opportunity with W.P. Carey starts to shine through.

Realty Income is heavily focused on retail assets, with nearly 75% of its rents coming from that sector. W.P. Carey’s portfolio is tilted toward industrial and warehouse assets, which make up around two-thirds of the REIT’s rents. There’s nothing wrong with retail properties, which are easy to buy, sell, and release. But industrial properties and warehouses, which tend to be larger assets, are likely to see more benefit from reshoring activity in the years ahead. And both properties have generally benefited from higher rent bumps in recent years than have been seen in retail assets.

To put a number on that, Realty Income’s adjusted funds from operations (FFO) per share rose roughly 1% year over year in the first half of 2025. W.P. Carey’s adjusted FFO went up 6%. The faster growth is also helped along by W.P. Carey’s more modest size, since it takes less investment to move the needle on the top and bottom lines on the income statement.

So Realty Income is big and slow. W.P. Carey is smaller and more nimble. But they have similar dividend yields, roughly 5.5%. Sure, Realty Income’s dividend has been more reliable. But W.P. Carey has already gone back to increasing its dividend each quarter, just as it did prior to the reset, when the dividend had grown annually for 24 years. The office exit was a hard decision, but one that is likely to benefit shareholders for years to come in the form of higher growth. Which is why it could be the smarter choice compared to Realty Income.

Take your pick…or don’t

Realty Income is a leading dividend investment option in the net lease sector given its size and the reliability of its dividend. It wouldn’t be a mistake to buy it, even though it may not be the fastest-growing company right now. But if you have looked at Realty Income, you should also consider the runner-up in the attractive net lease REIT niche, W.P. Carey. W.P. Carey has the dividend reset issue to grapple with, but it also seems likely to offer more growth opportunities than Realty Income. For many it will be the smarter dividend option.

That said, the smartest decision of all could be to buy both, given that their portfolios complement each other, with one focused on retail and the other on industrial assets. That’s what I’ve chosen to do, so I have both a reliable foundation (Realty Income) and a bit of growth (W.P. Carey) in the reliable net lease REIT niche.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $661,220!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,114,162!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 25, 2025

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Smartest #Dividend #Stock #Buy #Today