Key Points

-

After an antitrust ruling, Alphabet will retain Chrome, a victory for the company and the artificial intelligence (AI) part of its business.

-

ChatGPT appeared to undermine confidence in Google’s AI.

-

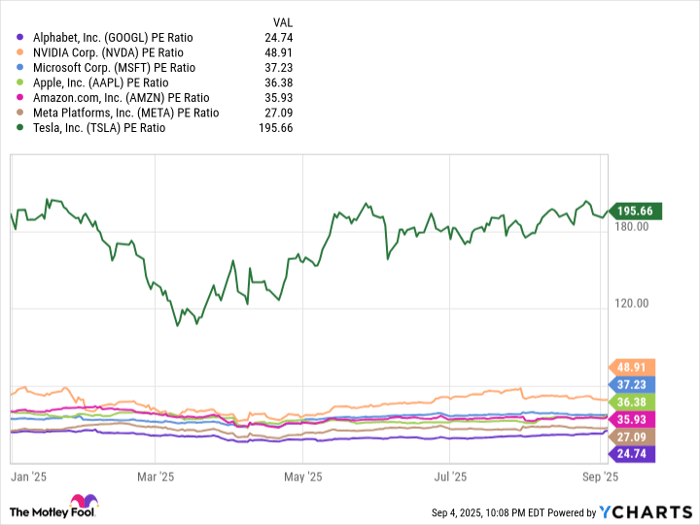

Alphabet has the lowest P/E ratio among “Magnificent Seven” stocks.

- 10 stocks we like better than Alphabet ›

After an antitrust ruling, Alphabet will retain Chrome, a victory for the company and the artificial intelligence (AI) part of its business.

ChatGPT appeared to undermine confidence in Google’s AI.

Alphabet has the lowest P/E ratio among “Magnificent Seven” stocks.

Google parent Alphabet‘s (NASDAQ: GOOGL) (NASDAQ: GOOG) stock received a boost from an unexpected source: the courts. The stock rose 8% on Sept. 3 after a federal district judge ruled it would not have to sell its Chrome browser.

Although it will have to share data with its rivals, investors saw this ruling as a win. Additionally, with the rising share price, the artificial intelligence (AI) stock seems to have gained momentum in earnest, possibly igniting a long-awaited bull market in Alphabet.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Alphabet.

The state of Alphabet

Perhaps one of the more surprising investment stories over the last two years is Alphabet’s perceived lack of AI success. It has utilized the technology since 2001 and was widely seen as an industry leader. However, the release of GPT-4 in early 2023 seemed to catch the Google parent off guard, and the release of Gemini did little to win back investor confidence.

The ruling ensures Chrome will remain a platform for Google’s AI. Still, with or without Chrome, Alphabet was still set to move away from digital ad revenue in favor of driving its growth from other technologies. While Google Cloud is the only major source of non-ad revenue right now, its other businesses, such as autonomous driving platform Waymo, could become significant AI-driven revenue sources.

Judging by its valuation, investors may have only begun to appreciate Alphabet’s potential recently. It trades at a 25 P/E ratio, up from a 16 earnings multiple on “Liberation Day” in early April. Although that is a significant gain, it still has the lowest valuation among “Magnificent Seven” stocks, indicating the stock is still a bargain.

GOOGL PE Ratio data by YCharts

Alphabet’s financials

That P/E ratio is arguably low when looking at Alphabet’s financial situation. Alphabet retains $95 billion in liquidity. Amid such optionality, it pledged $75 billion in capital expenditures (capex) for 2025, authorized a $70 billion share repurchase program, and raised its dividend.

It can afford to do all that because its digital ad business and Google Cloud have become major cash generators. In the first half of 2025, its $96 billion in revenue grew 14% from year-ago levels. Approximately 74% of revenue came from digital ads, down from 76% the previous year. Also, Google Cloud now makes up 14% of revenue for the year.

Additionally, costs and expenses increased by 11% during that time, lagging the revenue growth rate. Thus, its $63 billion in net income for the first two quarters of 2025 increased by 33% compared to the same period a year ago.

That is not much less than the $67 billion in free cash flow over the last 12 months. However, the difference is due to Alphabet’s heavy capex spending, which it subtracts out of the free cash flow calculation, and the fact that it can afford such levels of spending is a testament to the company’s financial strength.

Furthermore, despite negative perceptions, Alphabet stock has generally trended higher since the beginning of 2023. The latest surge of momentum came after the sell-off that culminated in Liberation Day.

Since the low in early April, Alphabet stock is up nearly 60%. When one also considers its massive cash reserves, rapidly rising profits, and low valuation, the momentum could easily continue.

Consider Alphabet stock

Amid a favorable antitrust ruling, Alphabet stock is gaining momentum.

Despite worries that it was behind in generative AI weighing on the stock, it has produced increasingly positive returns while retaining the lowest P/E ratio among the Magnificent Seven stocks.

The news that its browser will remain part of its AI strategy is a significant boost for this stock. Moreover, its cash reserves and ability to invest heavily in capex should keep it competitive in AI. Now that the antitrust ruling has added some certainty to its strategy, it is likely time to capitalize on the discounted valuation and consider buying Alphabet stock.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $670,781!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,023,752!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 25, 2025

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Artificial #Intelligence #Stock #Gaining #Momentum #Fast