Key Points

-

Broadcom’s artificial intelligence (AI) chips for the data center are a popular alternative to those supplied by Nvidia.

-

Broadcom stock is leaving Nvidia stock in the dust this year, as sales explode for its AI chips and networking equipment.

-

Broadcom stock is trading at a sky-high valuation, which could be a barrier to further upside in the short term.

- 10 stocks we like better than Broadcom ›

Broadcom’s artificial intelligence (AI) chips for the data center are a popular alternative to those supplied by Nvidia.

Broadcom stock is leaving Nvidia stock in the dust this year, as sales explode for its AI chips and networking equipment.

Broadcom stock is trading at a sky-high valuation, which could be a barrier to further upside in the short term.

Most artificial intelligence (AI) development happens with the help of data centers filled with purpose-designed chips and networking equipment. Nvidia (NASDAQ: NVDA) CEO Jensen Huang predicts tech giants will spend an eye-popping $4 trillion on AI data center infrastructure by 2030 to help further this AI development. That suggests a gargantuan financial opportunity for the semiconductor industry.

Broadcom (NASDAQ: AVGO) wants to capture a chunk of this rapidly growing market. Tech giants are already lining up to buy the company’s customizable AI accelerators (a type of data center chip) and networking equipment, and the chip designer revealed a new $10 billion deal last Thursday that sent Wall Street into a frenzy. Broadcom stock has soared by 44% in 2025, outpacing Nvidia stock, which is up by just 25%. That has led to Broadcom having a sky-high valuation, which could hamper further upside.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

So is Broadcom stock a buy, sell, or hold from here? The answer might depend on your time horizon.

Image source: Getty Images.

The world’s leading AI start-up could be buying Broadcom’s chips

Broadcom has been a top supplier of computing hardware since the 1960s. It merged with semiconductor powerhouse Avago Technologies in 2016 to fortify its market position, and since then, the new-look Broadcom has spent almost $100 billion acquiring other companies like CA Technologies, Symantec, and VMware.

The spotlight is firmly on Broadcom’s hardware business right now because of its role in the AI boom. Hyperscalers like Alphabet are buying the company’s AI accelerators because they can be customized to suit specific workloads. That means they offer more flexibility than ready-made graphics processing units (GPUs) from suppliers like Nvidia.

Broadcom previously told investors that at least three hyperscale customers plan to deploy 1 million AI accelerators each in 2027, creating a market opportunity worth up to $90 billion. But during a conference call for the company’s fiscal 2025 third quarter (ended Aug. 3) last Thursday, CEO Hock Tan said a new customer had just placed a $10 billion order for custom accelerators. He didn’t disclose a name, but several Wall Street analysts speculate it could be the world’s top AI start-up (and ChatGPT creator), OpenAI.

But chips are only one piece of the AI data center puzzle. Broadcom is also a top supplier of networking equipment, including its Ethernet switches, which regulate how fast data travels between chips and devices. Its latest Tomahawk Ultra switch delivers industry-leading low latency and high throughput, paving the way for faster processing speeds with less data loss. This is a winning combination in data-intensive AI workloads.

Broadcom’s AI revenue continues to soar

Broadcom generated $15.9 billion in total revenue during its fiscal 2025 third quarter, edging out management’s guidance of $15.8 billion. It represented a 22% increase compared to the year-ago period, which was an acceleration from the 20% growth the company delivered in the second quarter three months earlier.

The strong Q3 result was partly attributable to Broadcom’s AI semiconductor revenue, which soared by 63% year over year to a record $5.2 billion. That also marked an acceleration from the second quarter, when growth was 46%, highlighting the company’s incredible momentum in the fast-paced AI market.

But it gets better. Management’s guidance for the fourth quarter (which ends in early November) points to $17.4 billion in total revenue, with $6.2 billion in AI semiconductor revenue. Those figures would represent even faster year-over-year growth of 24% and 66%, respectively.

Broadcom also delivered a very strong result at the bottom line during Q3. Its generally accepted accounting principles (GAAP) net income came in at $4.1 billion, which was a massive swing from its $1.9 billion net loss from the year-ago period.

The company’s adjusted (non-GAAP) earnings before interest, taxes, depreciation, and amortization (EBITDA) climbed by 30% to $10.7 billion. This is management’s preferred measure of profitability because it excludes one-off and noncash expenses, like those related to acquisitions, so it’s a better reflection of how much actual money the business is generating.

Broadcom’s growing profits are a welcome payoff for investors who have owned the stock since the merger and subsequent acquisition spree kicked off in 2016.

Broadcom’s valuation leaves little room for upside in the short term

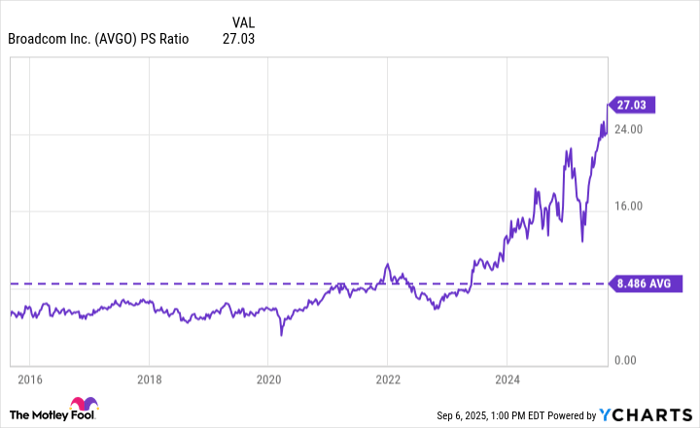

There is no denying that Broadcom’s business is performing spectacularly right now, but whether or not its stock is a buy might depend on investors’ time horizon. It’s trading at a price-to-sales (P/S) ratio of 27, which is not only a record high, but also a whopping 221% premium to its 10-year average of 8.4:

Data by YCharts.

Further, based on Broadcom’s trailing-12-month earnings of $3.92 per share, its stock is trading at a price-to-earnings (P/E) ratio of 85.4. That is nearly 3 times higher than the P/E ratio of the Nasdaq-100 index, which is currently 31.6, meaning Broadcom is significantly more expensive than its tech-sector peers.

Broadcom will grow into its valuation if its revenue and profits continue to increase at the current pace, but unless its stock suffers a steep correction, it could take years before it’s trading at a market multiple.

Therefore, investors who are looking for a quick gain over the next 12 months should probably steer clear of Broadcom. Longer-term investors who are willing to hold the stock for at least the next five years could still earn a positive return despite its sky-high valuation, as long as the company’s AI-fueled momentum continues.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $681,260!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,046,676!*

Now, it’s worth noting Stock Advisor’s total average return is 1,066% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Meet #Super #Semiconductor #Stock #Crushing #Nvidia #Buy #Hold #Sell