Key Points

-

Pfizer is a well-run pharmaceutical company with a long and rich history.

-

Like all drug makers, Pfizer has to deal with patent expirations.

-

Pfizer is also facing headwinds from a shifting view of the medical industry today.

- 10 stocks we like better than Pfizer ›

Pfizer is a well-run pharmaceutical company with a long and rich history.

Like all drug makers, Pfizer has to deal with patent expirations.

Pfizer is also facing headwinds from a shifting view of the medical industry today.

The S&P 500 is offering a skinny yield of 1.2%. The average healthcare stock has a yield of 1.7%. Healthcare giant Pfizer (NYSE: PFE) is yielding a relatively huge 7.2%. Before you jump at that dividend, step back and consider these three facts. You might decide that other dividend stocks are more to your liking.

1. Pfizer is a well-run drug company, but…

Pfizer is one of the world’s leading pharmaceutical companies. Finding, developing, testing, and getting new drugs approved is a very difficult process. It requires a lot of money and time, not to mention skill and knowledge. With a market cap of $135 billion, Pfizer has plenty of scale to support its research efforts. And still, no matter how much money the company throws at research, finding new drugs is time-consuming, and the results are uncertain.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

The best way to think about research and development in the drug space is probably the word lumpy. A promising new drug can take years to actually come to market. And it can flame out at any step along the way, laying to waste all of the money that was spent. This is why drug companies are granted a limited time period where they have the exclusive right to sell a drug they have developed. That’s great, but it is also a problem. Because drug development is so uncertain, companies like Pfizer often face what are called patent cliffs.

Those occur when a blockbuster drug loses patent protections, and the revenue the drugs generate falls sharply as competitors sell generic versions of the drug. It is a normal part of the drug industry, but it is one that has to be considered when buying a drug maker’s stock. Specifically, Pfizer has three important drugs set to lose patent protections in 2027 and 2028 (Ibrance in oncology and Eliquis and Vyndaqel in the cardiovascular space). It has a pipeline of potential new drugs, but until they hit the market, there is a looming risk to Pfizer’s top line that will keep investors on edge.

2. Pfizer has a less-than-stellar dividend history

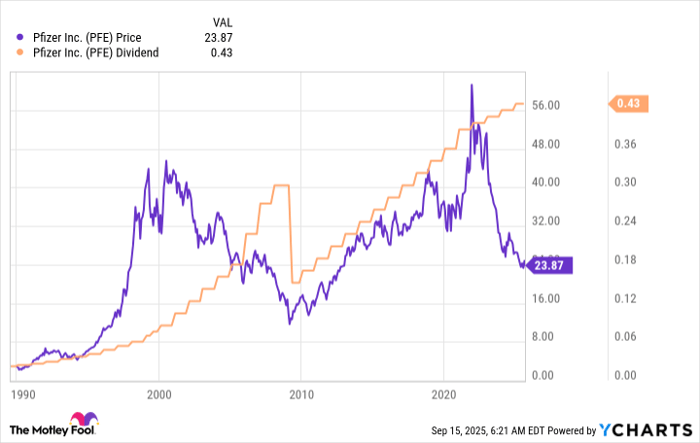

Pfizer has the scale to develop drugs internally, but it is also big enough to buy companies that have attractive drugs or drug candidates. That’s not a bad thing, but buying companies is costly. And that’s an issue for dividend investors to consider here. Pfizer has increased its dividend each year for 15 consecutive years, but that streak follows a dividend cut.

Data by YCharts.

The dividend was cut following Pfizer’s 2009 acquisition of Wyeth for roughly $68 billion. It wasn’t a bad deal, but it clearly came at a financial cost for dividend investors. If you are buying Pfizer hoping for a reliable dividend, the board of directors’ dividend decision around the Wyeth deal should probably cause you a little concern. Sometimes, what’s best for the company and what’s best for shareholders aren’t the same.

3. Pfizer has an extra headwind right now

So far, the concerns highlighted have been fairly typical ones for the healthcare sector. But right now, following a regime change in Washington, D.C., there’s a new issue to consider. The healthcare sector, and specifically drug companies like Pfizer that make vaccines, are under the microscope. There has also been a shift socially on this front, too. Although there’s no way to predict the political future or social trends, right now, Pfizer is in the hot seat, so to speak.

If government support for drug and vaccine development is slashed, Pfizer will probably feel some hurt financially. And if consumers opt not to use the vaccines that Pfizer develops, its products may not be as successful as hoped when they were developed. This situation could all blow over, but right now, there is a lot of uncertainty hanging over Pfizer’s stock.

Pfizer could be an opportunistic buy

Despite all of the negative implications here, Pfizer is highly likely to survive as a company and thrive over the long term. So if you have a long-term investment horizon, now could actually be a good time to buy the stock. But you need to go in understanding the risks you face, from the basic ones faced by drug makers, to the dividend risk highlighted by the Wyeth deal, to the vaccine-related risks specific to both Pfizer and the current political and social environment. To buy Pfizer and its lofty yield, you will need to have the fortitude to sit through what could be at least a few more years of uncertainty.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 15, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Buy #Pfizer #Today