Daniel Grizelj/DigitalVision via Getty Images

By Ivan Castano

At a Glance

- The dollar is facing headwinds from trade policy decisions, a budget deficit and interest rate uncertainty

- The dollar’s decline primarily occurred during the first six months of the year, and it has traded mostly flat since July

Policy uncertainty. A ballooning deficit. Weakening economic growth. These are some of the key factors that could pressure the U.S. dollar in the next 12 months, extending the greenback’s downtrend that has dominated much of 2025.

“One day you have tariffs, the other you don’t,” said Zain Vawda, an analyst at forex consultancy Oanda. “These constant policy changes are hurting the dollar.”

Unprecedented volatility has encouraged traders to move away from the U.S. and buy the euro, the British pound and Swiss franc, he said.

And as Washington eyes two to three rate cuts this year, the de-dollarization trend is expected to stick around for some time, potentially boosting top G10 pairs such as the EUR/USD, CHF/USD and CAD/USD, Vawda said.

The euro, the most heavily traded currency against the dollar, could see gains amid a strengthening European economy, a large stimulus package and expectations that interest rate cuts will be more moderate than in the U.S.

On July 27, the U.S. and the EU signed a long-awaited trade deal that will see the EU pay a 15% tariff to sell its goods to the U.S., down from the much higher 30% that was initially proposed. The announcement saw the dollar gain about 1.2% on the day, though it’s still down roughly 13% this year.

Mark Connors of financial consultancy Riskdynamics doesn’t expect the deal, alongside a Japan trade accord struck on July 23, to significantly boost the dollar until more acute risks are addressed.

“These agreements remove tariff uncertainty,” said Connors. “But we still have a massive budget deficit and debt crisis.”

Amid ongoing uncertainty, the dollar’s performance could become a headwind or tailwind for other top currencies:

- British pound: While the pound nearly hit 1.4 against the dollar in late June, the weak greenback fueled most of the gains, not investor faith in the UK’s economy, analysts said. Vawda sees GBP trading relatively flat for the next year.

- Canadian dollar: Hovering around 1.38 per U.S. dollar as of mid-September, Canada’s currency could gain if Ottawa and Washington reach a favorable tariff deal, beyond overhauling the U.S.-Mexico-Canada Agreement next summer, Vawda said. This is because oil prices would likely gain, boosting Canada’s key export and potentially its currency as a result.

- Swiss franc: While it could continue to benefit from its safe-haven status, a significant rise means the central bank could sell CHF to lift exports.

- Japanese yen: The Japan trade deal included a 15% levy on the nation’s U.S. shipments and a $550 billion Japanese investment commitment. While this removed tariff uncertainty, Connors doesn’t expect the sluggish yen to tick up until the Asian country tackles a string of macroeconomic challenges.

“Japan still faces fiscal challenges, high inflation with low growth and a wide trade differential with the U.S.,” said Connors. Its overnight lending rates stand at 50 basis points (bp) compared to over 400bp for the U.S. “Unless they bring up rates soon, at least 25bp, I don’t see the yen moving significantly higher.”

A Booming, Yet Fragmented Market

As the dollar fluctuates and global FX markets experience heightened volatility, investors have been turning to futures and options to hedge their portfolios. CME Group has seen a 19% rise in unique FX futures and options users year-over-year, and open interest reached a record 3.78 million contracts – representing ~$358 billion in notional value – in March of this year.

Despite growing participation, the market as a whole still has its challenges. There’s high fragmentation, with an ever-rising number of platforms offering FX trading, hindering investors’ ability to obtain reliable pricing and access liquidity. Additionally, many firms and smaller investors may lack futures market relationships or clearing privileges. This has created a “two tier” market between those who can access that liquidity and those who can’t.

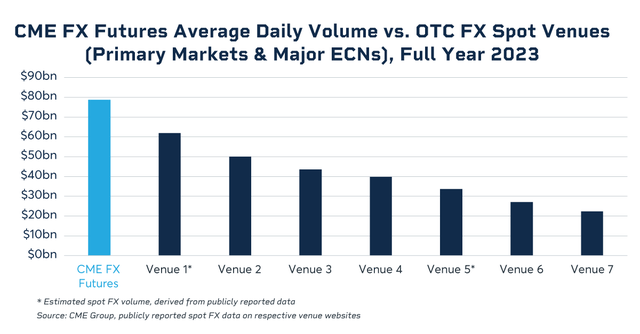

To help address these hurdles, CME Group launched FX Spot+ in April, a product that connects OTC traders with its expanding FX futures liquidity pool, which moves roughly $90 billion a day on average and over $300 billion on the busiest days. The all-to-all marketplace reached a record $5 billion in trading activity on September 10, with more than 70 clients now active and trading on the platform, including 25 banks new to FX futures.

“FX Spot+ provides spot trading desks with simple access to the FX futures market,” said Michael Driscoll, Head of eFX Spot Trading Europe, Commerzbank. “Through implied pricing in the futures market, FX Spot+ enables our spot orders to reach a wider audience offering opportunities for additional business.”

Renminbi’s Gains

China’s currency is also on investors’ watch, not only because of the country’s ongoing trade tensions with the U.S., but also because it’s growing as a global reserve currency.

The world’s second-largest economy has gradually liberalized its financial markets, boosting the renminbi’s uptake in Asia-Pacific, Europe and emerging markets, according to Deutsche Bank. A growing number of institutions are increasingly using it to fund cross-border trade and investment.

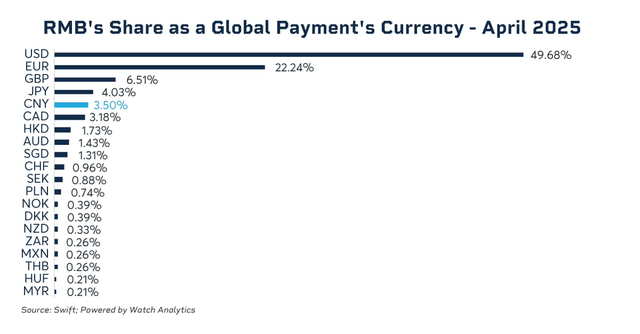

This has lifted China’s global SWIFT payments’ market share to 3.5% as of April 2025, up from 2% in 2023, the bank said. In trade, 6% of global commerce was financed in renminbi last year, up from under 2% in 2023.

This marks “a clear shift in preference, particularly across emerging markets and major global trade corridors,” Deutsche Bank added.

Katy Kaminski, chief research strategist at AlphaSimplex, agreed the renminbi could see additional strength, especially if the anti-dollar narrative continues.

“While many have shorted the yuan recently, the possibility of new stimulus policies could boost the economy and the currency,” she noted.

Still, it would take at least a decade for the renminbi to have any impact on the dollar’s reserve status, if at all, she said.

On the other side of the world, the Mexican peso is facing challenges that could keep it stagnant after big gains this year. Uncertainty persists as Trump announced a 90-day extension of his tariff deadline for Mexico on July 31. Trump officials have also indicated they want to renegotiate the United States-Mexico-Canada Agreement (USMCA) trade agreement when it’s up for review next July.

Is U.S. Exceptionalism at Risk?

Jeff Young, head of investment strategy at PGIM Quantitative Solutions, is more bullish on the dollar.

“U.S. economic growth has been rock steady despite risks like tariffs, last year’s unprecedented political events, and the Fed’s dramatic rate cuts,” he said. “This shows there are sources of resiliency that go very deep and can even offset [the impact of] things like tariffs.”

Added Young: “The underlying growth trends in the U.S. are still a bit firmer than in the Euro area. For example, the AI scene is much stronger in the U.S. than in Europe. Everyone wants to get their hands on the AI theme, and it is happening here. So there is still a lot of dynamism that makes the U.S. an investment magnet.”

Kim Forrest of Bokeh Capital dampened concerns that American exceptionalism is weakening.

“Our economic structure remains exceptional,” she said, adding that U.S. benchmark rates remain higher than many countries. “We are still the easiest country to open a business in the world, and we have a well-defined case law so people know what to expect in our court.”

The U.S. futures and options market is also the most liquid in the world, enabling investors to quickly and efficiently offset losses from the dollar’s depreciation, according to Forrest.

“If you make a five-year investment in Europe, you can buy futures and options to limit any kind of cross-currency risk,” Forrest said. “This makes dollarization incredibly easy.”

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#Decline #Dollars #Influence #Persists