Key Points

-

The most anticipated Social Security announcement of the year — the 2026 cost-of-living adjustment (COLA) — will be revealed on Oct. 15.

-

If two independent estimates prove accurate, Social Security’s 2026 raise will do something that hasn’t been witnessed since 1997.

-

However, Social Security’s 2026 COLA is no match for inherent flaws in the program’s inflationary measure or a projected scorching-hot increase in the Medicare Part B premium.

- The $23,760 Social Security bonus most retirees completely overlook ›

The most anticipated Social Security announcement of the year — the 2026 cost-of-living adjustment (COLA) — will be revealed on Oct. 15.

If two independent estimates prove accurate, Social Security’s 2026 raise will do something that hasn’t been witnessed since 1997.

However, Social Security’s 2026 COLA is no match for inherent flaws in the program’s inflationary measure or a projected scorching-hot increase in the Medicare Part B premium.

For 85 years, Social Security has been providing a financial foundation for aging workers who could no longer do so for themselves. Based on nearly a quarter century of annual surveys from Gallup, anywhere from 80% to 90% of retirees lean on their monthly Social Security payout to cover some portion of their expenses.

For these 53.3 million retired-worker beneficiaries, the annual cost-of-living adjustment (COLA) reveal in October (slated for Oct. 15 this year) takes on heightened importance.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

While independent estimates are universally calling for Social Security history to be made for the first time in close to 30 years, this history-making moment is still unlikely to be enough for the retirees who count on their Social Security income as a financial foundation.

Image source: Getty Images.

Here’s why Social Security’s COLA matters so much

Before digging further into the details, you first have to understand what Social Security’s cost-of-living adjustment is and why it matters so much to beneficiaries.

Put simply, the program’s COLA takes into account the effects of inflation on beneficiaries and allows the Social Security Administration (SSA) to pass along a near-annual “raise.”

For instance, if the cost for a large basket of goods and services regularly purchased by retirees increases by 2% from one year to the next, beneficiaries wouldn’t be able to buy as much if their Social Security check remained static. Social Security’s COLA is the raise that directly attempts to combat inflationary pressures.

Prior to 1975, the SSA didn’t have a system in place to ensure program beneficiaries didn’t lose buying power. Following an entire decade (1940s) without a single COLA, Congress passed along the highest adjustment on record — a 77% benefit increase — in 1950. From the mailing of the first retired-worker benefit check in January 1940 through 1974, only 11 COLAs were passed along by special sessions of Congress.

The annual adjustments we’re familiar with today began in 1975 when the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) became Social Security’s inflationary measure. The CPI-W has more than 200 unique spending categories, all of which have individual percentage weightings. This allows it to be chiseled down to a single figure each month and makes for quick and easy year-over-year comparisons to determine if prices are, collectively, rising (inflation) or falling (deflation).

We’re currently in the heart of COLA calculation season, with only CPI-W readings from July through September (the third quarter) factoring into Social Security’s cost-of-living adjustment. If the average Q3 CPI-W reading in 2025 is higher than the comparable period from 2024, beneficiaries can expect a larger monthly benefit check come 2026.

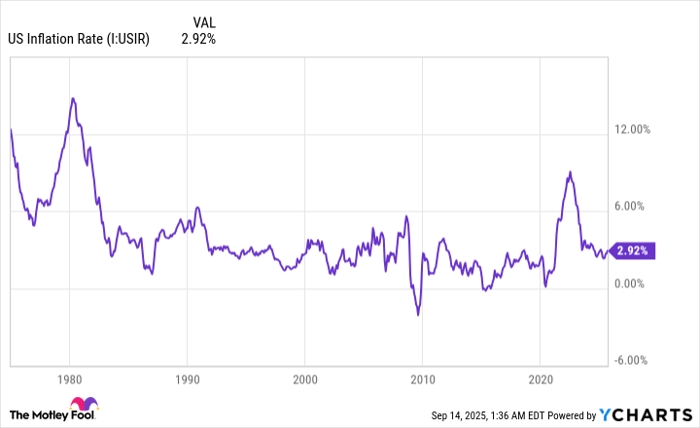

An uptick in the prevailing rate of inflation has lifted Social Security COLAs significantly in recent years. US Inflation Rate data by YCharts.

Multiple estimates point to Social Security’s COLA doing something for the first time in 29 years

With a better understanding of why Social Security’s COLA is so important, let’s dig into what beneficiaries can expect for the upcoming year.

Following the release of the August inflation report from the U.S. Bureau of Labor Statistics, two independent estimates were refreshed. For the first time in five months, nonpartisan senior advocacy group The Senior Citizens League (TSCL) didn’t increase its 2026 COLA forecast by a tenth of a percent. Rather, TSCL stuck by its prior call of a 2.7% raise next year.

Meanwhile, independent Social Security and Medicare policy analyst Mary Johnson, who retired from TSCL in early 2024, increased her previous 2026 COLA projection by a tenth of a percent to 2.8%.

If these two forecasts are in the ballpark of the announced 2026 COLA on Oct. 15, it’ll mark the fifth consecutive year where beneficiaries have received at least a 2.5% COLA. It would follow respective raises of 5.9% in 2022, 8.7% in 2023 (the highest on a percentage basis in 41 years), 3.2% in 2024, and 2.5% in 2025.

You’d have to look back nearly three decades to find the last time Social Security recipients received at least a 2.5% COLA for five straight years. From 1988 through 1997, Social Security cost-of-living adjustments vacillated between 2.6% and 5.4%. This means history is a near certainty to be made next month when the SSA announces Social Security’s 2026 COLA.

Based on TSCL’s and Johnson’s projections, a 2.7% or 2.8% cost-of-living adjustment would provide a $54 to $56 monthly boost for the average retired-worker beneficiary in 2026. Meanwhile, the average monthly payout for workers with disabilities and survivor beneficiaries would climb by $43 to $44 in the upcoming year.

Image source: Getty Images.

Social Security’s cost-of-living adjustment has a tendency to come up short for retirees

On paper, Social Security’s 53.3 million retired-worker beneficiaries appear to be looking at another year with an above-average COLA. But if you dig beneath the forecast increase for 2026, you’ll find that a world of disappointment almost certainly awaits most aged beneficiaries.

First, Social Security’s trusted inflationary tether, the CPI-W, has built-in flaws that have been costing retirees their purchasing power for more than a decade. According to an analysis by TSCL, the buying power of a Social Security dollar plummeted 20% from 2010 to 2024. In other words, what $100 in Social Security income purchased in 2010 was only able to buy $80 worth of those same goods in 2024.

This persistent decline is a function of the CPI-W tracking the spending habits of folks who make up a very small percentage of program beneficiaries. As its full name implies, the CPI-W tracks the costs that matter most to “urban wage earners and clerical workers,” who in many instances are working-age Americans not currently receiving a Social Security benefit.

In comparison, 87% of traditional Social Security income recipients are age 62 and above. These individuals spend a higher percentage of their monthly budget on shelter and medical care services than working-age Americans. Unfortunately, the CPI-W doesn’t account for this added weighting.

Furthermore, the trailing-12-month inflation rate for shelter and medical care services has been stubbornly higher than the COLA retirees are receiving. As long as these two critical expenses remain higher than the “raise” aged beneficiaries receive, the purchasing power of their Social Security income is almost certain to decline.

The second reason Social Security’s 2026 COLA is likely to come up short for retirees is the expected increase in the Medicare Part B premium. Part B is the portion of traditional Medicare that handles outpatient services.

Most Social Security beneficiaries who are enrolled in traditional Medicare have their Part B premium automatically deducted from their monthly Social Security check. Following back-to-back years of 5.9% increases to the Part B premium, the Medicare Trustees Report forecast a scorching-hot 11.5% jump in 2026 to $206.20 per month. This has the potential to partially or completely offset the 2026 Social Security COLA for a significant percentage of retired workers.

Even with history on their side in 2026, retirees will continue to get the short end of the stick.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Social #Securitys #CostofLiving #Adjustment #COLA #Track #History #Wont #Retirees