Key Points

-

Bitcoin’s value exceeds $2.3 trillion, but it remains relatively small compared to the rest of the global economy.

-

Inflation probably isn’t stopping, which bodes well for Bitcoin’s price.

-

However, Bitcoin isn’t right for everyone. It’s best to include it among a diverse basket of investments.

- 10 stocks we like better than Bitcoin ›

Bitcoin’s value exceeds $2.3 trillion, but it remains relatively small compared to the rest of the global economy.

Inflation probably isn’t stopping, which bodes well for Bitcoin’s price.

However, Bitcoin isn’t right for everyone. It’s best to include it among a diverse basket of investments.

Broadly speaking, more and more investors view cryptocurrencies as an increasingly mainstream asset.

Bitcoin (CRYPTO: BTC) helped blaze that path. The original cryptocurrency is still the world’s largest by market value today, and has returned more than 50,000% during the past decade alone. It doesn’t take a mathematician to know that those are life-changing returns.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Now, it’s a fair question whether Bitcoin can still set investors up for life.

While it may take much longer this time around for Bitcoin to repeat its past returns (if it ever does), there may still be enough upside left to make it worth holding in a diversified portfolio. Here is why Bitcoin can still help investors build life-changing wealth over the long haul.

Image source: Getty Images.

Bitcoin is still small, relatively speaking

Bitcoin’s market value continues to swell as its price climbs higher. The cryptocurrency’s current fully diluted market value is about $2.3 trillion (as of Sept. 19). Bitcoin isn’t exactly flying under the radar anymore.

Yet, Bitcoin’s growth could have quite a bit of runway left.

When you compare Bitcoin to other types of assets, it’s still relatively small. For instance, the world’s existing gold supply, excluding gold still in the ground, is worth about $25 trillion at its current market price. There is about $95 trillion in fiat currency (via the four major central banks) sloshing around the global economy. That doesn’t include trillions of dollars more in real estate wealth.

Bitcoin’s long-term price performance will depend on multiple factors, such as the extent to which the world’s economies adopt digital currencies and assets during the coming decade and beyond, and whether Bitcoin retains its leadership status. Nevertheless, there is a clear path to much higher valuations if things work out in Bitcoin’s favor.

Fiat currencies could continue to lose value

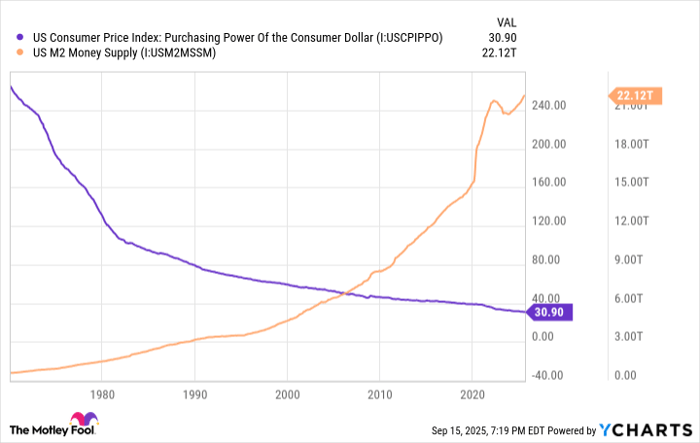

One of the primary forces driving Bitcoin’s price higher is the continued erosion of fiat currency, or, more specifically, the U.S. dollar.

The U.S. has run fiscal deficits for years now, and the continued spending has steadily pumped the money supply higher and faster than the value of the economy’s goods and services has risen. That’s how inflation occurs, which means it costs more fiat money to purchase the same goods and services.

U.S. Consumer Price Index: Purchasing Power Of the Consumer Dollar data by YCharts.

Bitcoin is priced in U.S. dollars, which makes it an anti-inflationary asset. Even this year, with additional tariff revenue pouring in, the U.S. government continues to spend well beyond its means. I won’t speculate too much on the potential big-picture outcomes of that. To be sure, it seems that continually increasing government debt may serve as a strong undercurrent for accelerating inflation, which might push Bitcoin’s price higher over time.

Can buying Bitcoin today set you up for life? Yes, but with two crucial caveats

As long as inflationary trends continue and society adopts Bitcoin and sees it as an anti-inflationary asset, the price can continue to rise. Yes, it could produce more life-changing returns, even if it takes much longer this time around.

But there is always fine print.

Bitcoin will likely remain a more speculative investment for most people. Real estate is a tangible asset. Stocks represent corporations, which sell goods and services, and generate profits. Bitcoin is different because it has no underlying mechanism to support its valuation. Instead, it’s dependent on what someone else is willing to pay for it.

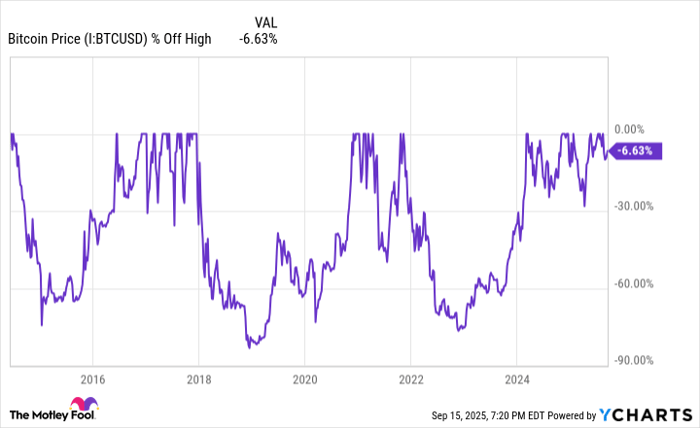

If society were to stop valuing Bitcoin, its price could theoretically evaporate. As a result, Bitcoin has historically been a very volatile investment. Bitcoin’s price has endured multiple severe plunges during the past decade, so investors will want to take the likely volatility into account when considering holding it.

Bitcoin Price data by YCharts.

Unfortunately, past results don’t guarantee future outcomes. Bitcoin has a wider potential range of outcomes than most other types of assets, but it also offers potential upside that, arguably, no stock or real estate can match. Yes, Bitcoin can set you up for life — just make sure it’s right for you before putting your hard-earned capital at risk.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 15, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Buying #Bitcoin #Today #Set #Life