Home flippers in the U.S. are seeing profits evaporate to levels not seen since the financial crisis, as surging acquisition costs squeeze margins even in traditionally hot markets.

Roughly 78,600 single-family homes and condos were flipped in the second quarter of 2025, accounting for 7.4% of all U.S. home sales, according to ATTOM’s latest U.S. Home Flipping Report. That share was down from 8.3% in the first quarter and slightly below the 7.5% recorded a year earlier.

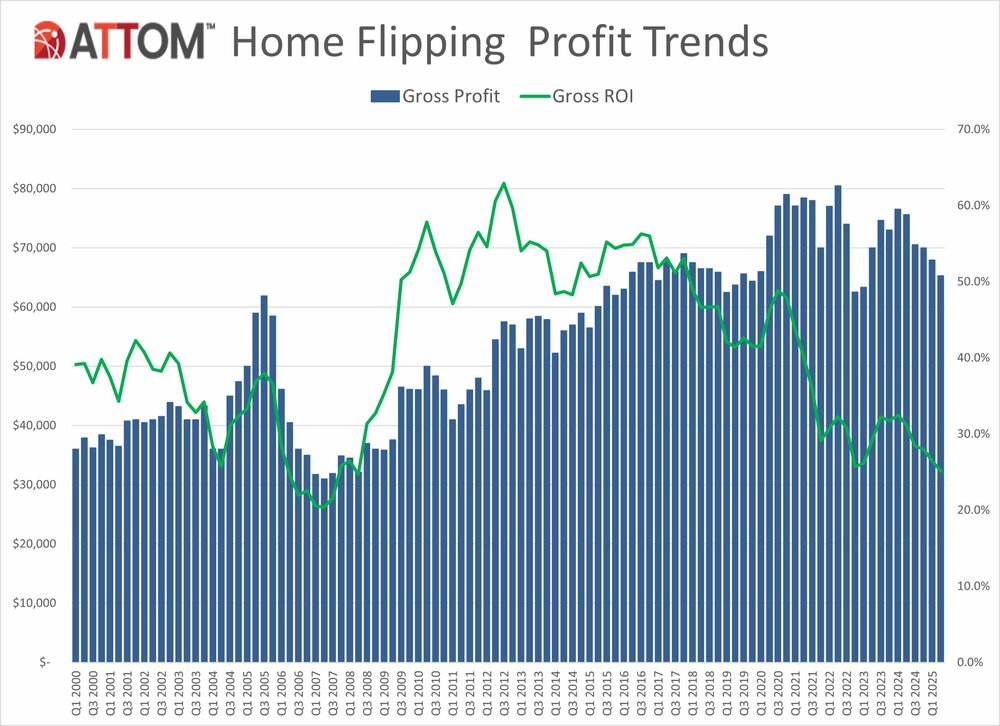

But the bigger story is profitability: The typical gross return on investment dropped to 25.1%, the lowest since the second quarter of 2008. That’s a far cry from the 62.9% margins investors earned at the peak of the post-crisis flipping boom in 2012.

“The initial buy-in for properties that are ideal for flipping, often lower-priced homes that may need some work, keeps going up,” said Rob Barber, CEO of ATTOM. “As prospective homeowners get priced out of the middle and high end of the market, they’re more likely to be competing with flippers over the same homes.”

The median purchase price for a flipped property hit $259,700, the highest in ATTOM’s records dating back to 2000. The median resale price held steady at $325,000, leaving typical investors with a gross profit of $65,300 — down 4% from the first quarter and 14% from a year ago.

Regional Picture

Flipping activity contracted across much of the country, with the rate of flips declining quarter-over-quarter in 86% of metro areas analyzed. Georgia remained a national standout: Warner Robins (18.5%), Macon (15.5%) and Atlanta (13.6%) led the country in flipping intensity, with nearby Columbus, GA (13%) and Memphis, TN (12.5%) close behind.

Among larger metros, Birmingham, AL (11.8%), Cleveland, OH (11.2%) and Columbus, OH (10.5%) posted double-digit flipping rates, while Seattle, WA (4.1%), Boston, MA (4.8%) and Honolulu, HI (5%) were among the weakest.

Margins Under Pressure

Profitability eroded in the majority of U.S. markets. More than half of metro areas saw quarterly declines, with sharpest drops in Fort Smith, AR (ROI down from 76.3% to 13.1%), Green Bay, WI (70.1% to 19.3%) and Clarksville, TN (65.5% to 26.2%).

Still, some markets delivered eye-popping returns. Pittsburgh topped the list with a 107% gross margin, followed by Shreveport, LA (104.2%) and Scranton, PA (104.1%). Large metros with notable returns included New Orleans (78.1%), Baltimore (75.5%) and Memphis (70.6%).

At the other end of the spectrum, Austin, TX (5.5%), San Antonio, TX (7.7%) and Dallas, TX (9.3%) offered little reward for flippers.

Financing and Timing

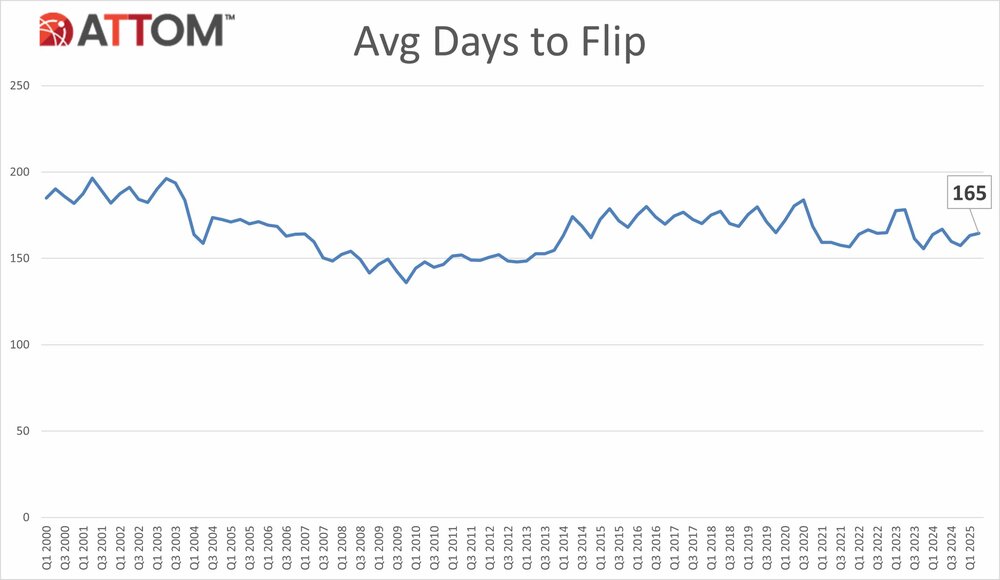

Cash remained king: 62.6% of flipped homes were purchased without financing, a share that has held steady over the past year. Typical holding times edged up to 165 days between purchase and resale, compared with 163 days in the first quarter.

Meanwhile, more flipped homes are ending up in the hands of first-time buyers. FHA-backed loans accounted for 11.2% of sales in the second quarter, up from 10.9% a year earlier.

Georgia Counties Dominate

Thirteen of the 20 U.S. counties with the highest flipping rates were in Georgia. Cobb County (23.1%), Clayton County (21.4%) and Douglas County (20.5%) all ranked among the nation’s leaders.

Bottom Line

Despite broad activity, home flipping is becoming a thinner-margin game. With acquisition costs at record highs and resale prices flattening, investor profits are being squeezed to crisis-era lows. For now, Georgia remains the epicenter of flipping activity — but nationally, the easy money in flips looks to be long gone.

Real Estate Listings Showcase

#U.S #HomeFlipping #Profits #Sink #Lowest #Level #Financial #Crisis #Costs #Climb