Mortgage Payments Ease in August say the MBA

Homebuyer affordability strengthened in August for the fourth consecutive month, as easing mortgage rates and rising incomes helped reduce monthly housing costs, according to new data from the Mortgage Bankers Association (MBA).

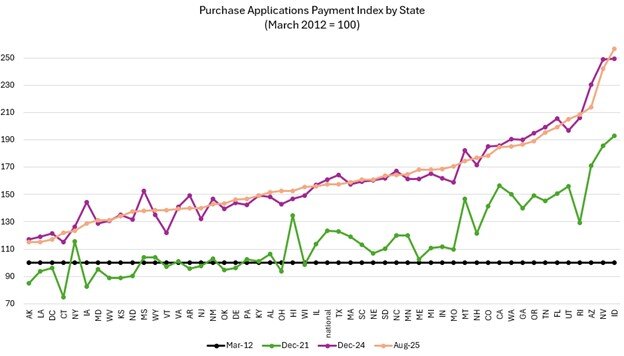

The trade group’s Purchase Applications Payment Index (PAPI) fell 1.2% to 157.5 in August from 159.4 in July, reflecting improved affordability conditions nationwide. A lower PAPI indicates that borrowers are dedicating a smaller share of income to monthly mortgage payments.

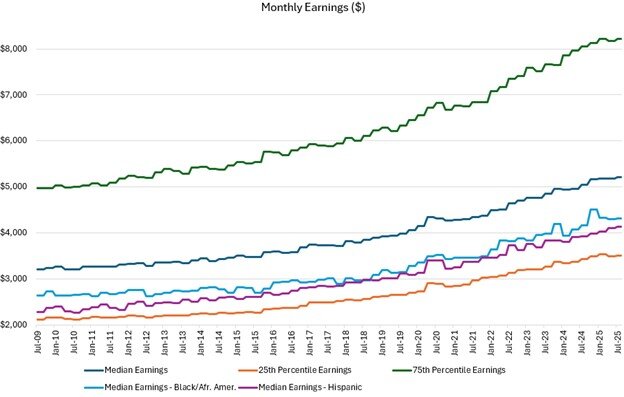

The median monthly payment requested by purchase mortgage applicants declined to $2,100 in August, down $27 from July. Despite that drop, payments remained $43 higher than a year earlier, a 2.1% annual increase. By contrast, median earnings rose 3.2% year over year, helping offset payment gains and leaving affordability 1.1% stronger compared with August 2024.

“For four straight months, affordability conditions have improved, with lower mortgage rates and stronger income growth boosting prospective buyers’ purchasing power,” said Edward Seiler, MBA’s associate vice president for housing economics and executive director of the Research Institute for Housing America. “MBA expects moderating home-price appreciation, coupled with lower rates, will continue to ease affordability constraints and support more housing market activity.”

MBA data showed that borrowers at the lower end of the market also benefited. At the 25th percentile, median monthly payments fell to $1,445 from $1,468 in July. The association’s Builders’ Purchase Application Payment Index, which tracks loans tied to new-home sales, also reported a decline, with the median mortgage payment slipping to $2,210 in August from $2,233 a month earlier.

Loan Type and Demographic Trends

- FHA applicants: Median monthly payment edged down to $1,863 in August from $1,865 in July, but was up from $1,817 a year earlier.

- Conventional applicants: Median payment dropped to $2,112 from $2,160 in July, compared with $2,056 in August 2024.

- By race/ethnicity: Affordability improved across groups, with PAPI falling to 156.9 for Black households (from 158.9 in July), 146.6 for Hispanic households (from 148.5), and 158.5 for White households (from 160.5).

Regional Breakdown

The states with the highest affordability pressures in August were:

- Idaho (256.5)

- Nevada (241.9)

- Arizona (214.0)

- Rhode Island (208.3)

- Utah (205.0)

The most affordable states were:

- Alaska (115.1)

- Louisiana (115.3)

- Washington, D.C. (117.2)

- Connecticut (121.7)

- New York (123.6)

Real Estate Listings Showcase

#U.S #Homebuyer #Affordability #Improves #Fourth #Straight #Month