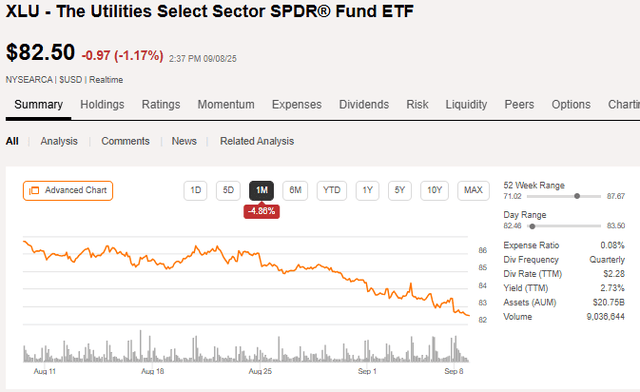

In the last month, the utilities sector became opportunistically cheap with strong growth and a significant price drop. We believe the Utilities Sector ETF (NYSEARCA:XLU) will substantially outperform the broader market while also providing defensive benefits in the event of a weakening economy.

Last month pricing went the wrong way

Utilities are generally considered an interest-rate-sensitive sector. Since they provide steady dividend income, they often compete with bonds for attention. As such, they tend to move inversely with yields.

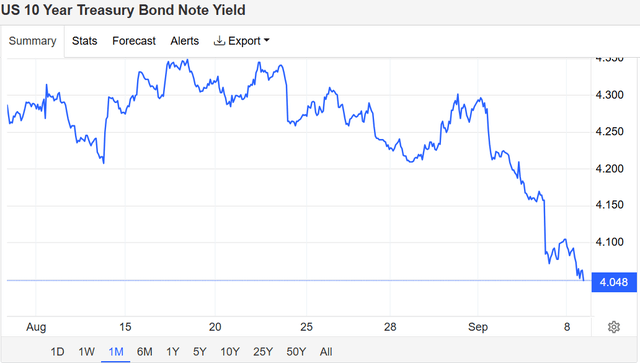

This pattern was broken last month as utilities fell almost 5% while interest rates dropped 30 basis points.

SA

The drop above was simultaneous with the significant decline in 10-year Treasury yields shown below.

TradingEconomics

That is rather unusual for an interest-rate-sensitive sector and has left utilities at what I believe are opportunistically cheap multiples.

Substantially discounted multiple

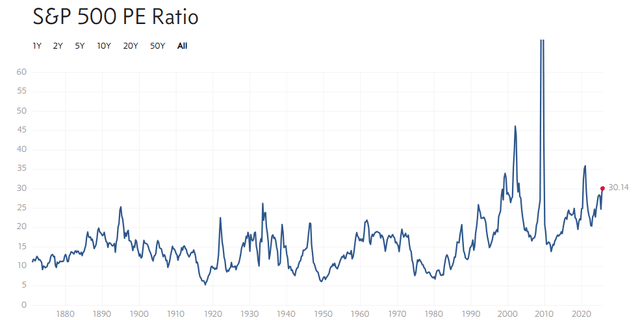

The S&P is trading at 30X trailing reported earnings.

Multpl.com

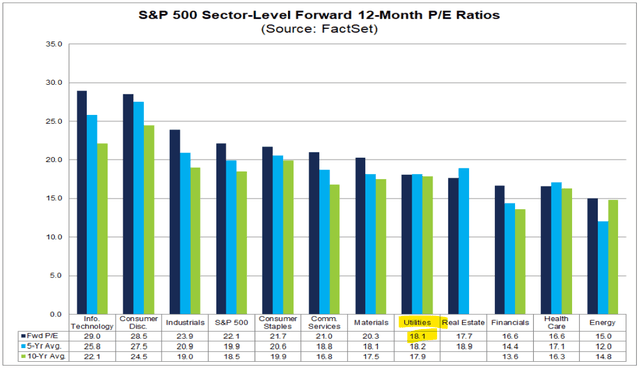

The market looks slightly cheaper but still expensive on forward adjusted earnings, with FactSet reporting a 22.1X forward multiple.

Utilities are trading at 18.1X by this same measure.

FactSet

Notably, utility multiples are right in line with their 5-year and 10-year averages, while the S&P 500 multiple is substantially higher than normal.

So while utilities often have traded at a slight discount, they are currently trading at a rather large 4-turn discount.

Historically, the utility discount could have been attributed to the somewhat slower growth of the sector. Utility growth has been consistent but usually just a few percentage points.

That is no longer the case, with booming electricity demand fueling growth throughout the sector for what appears to be the foreseeable future.

Above-average revenue and earnings growth

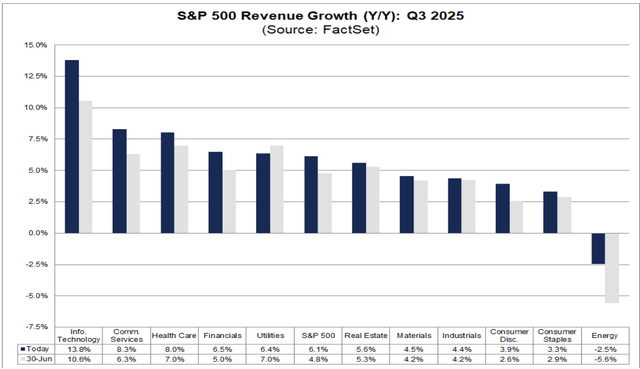

Given the fundamental changes brought about by the AI infrastructure buildout, utilities now have an above-average growth rate in both revenue and earnings.

Utilities are forecast to increase revenue by 6.4% compared to the S&P at 6.1%.

FactSet

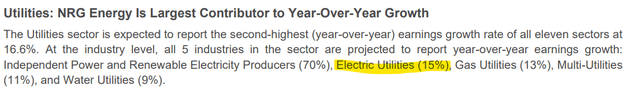

Earnings growth of the sector shows an even bigger gap over the S&P 500, with utilities forecast to grow 16.6%. Within the sector, that is led by independent power producers (IPPs), which are temporarily growing at 70% (forecast by FactSet) due largely to a spike in auction energy prices.

However, regular electric utilities are also growing at a respectable clip of 15%.

FactSet

That substantially outpaces the S&P 500, which is anticipated to grow 11%

The growth in utilities is not a one-time factor, with many of the large electric utilities forecasting substantial load growth for the next 5 to 10 years.

Mispricing

I posit that utilities are substantially undervalued relative to the broader market, as they are forecasted to grow faster and trade at lower multiples.

Faster growth and lower multiples can only make financial sense if they are higher risk such that the higher returns would be some sort of compensation or risk premium.

However, that does not ring true to me, as utilities are some of the most reliable businesses in the entire S&P 500. Many of these companies have been growing earnings consistently for decades in a row. They were resilient in the Great Financial Crisis (2008-2009) and again during the COVID recession.

The recession resistance seems particularly relevant today given the weak jobs numbers.

I don’t necessarily think a recession is coming, but a potentially weak economy does seem likely, as jobs were revised lower by 911,000. That, in my opinion, bodes well for defensive sectors like utilities relative to the S&P 500.

Summary of bull thesis

- Utilities are trading at a wider than normal discount – 4 turns cheaper on forward earnings multiple compared to the historical norm of about 1 turn cheaper.

- The greater-than–normal discount is unwarranted as the relative growth rate of utilities has improved and even surpassed the S&P 500.

- Growth appears both robust and resilient to a potentially weakening economy.

Better growth and a discounted valuation are a recipe for outperformance. Therefore, I think the XLU is positioned to outperform the stock market.

Catalyst for sector

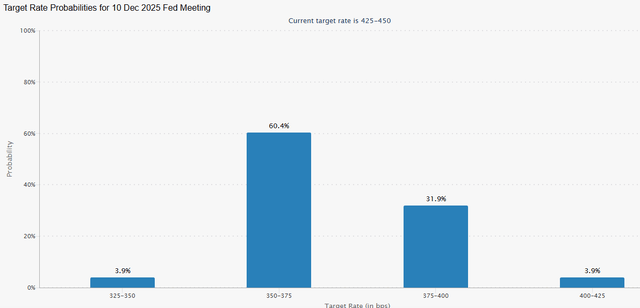

Despite the recent month when utilities moved down with interest rates, we still believe the sector will benefit from lower yields.

It is now anticipated that there will be three cuts in 2025, with CME Group projecting a Fed Funds rate of 350-375 basis points after the December meeting.

CME Group

I doubt the 10-year Treasury yield would fall the full 75 basis points for a parallel shift but likely some portion of that. A further 25-basis-point decline in Treasury yields would likely route a higher portion of dividend investors’ capital into the utility sector rather than bonds.

This thesis has largely been at the sector level, but I think one can do even better than the XLU ETF by selecting individual securities that have the best growth-to-valuation ratios.

Pinpointing undervalued names within sector

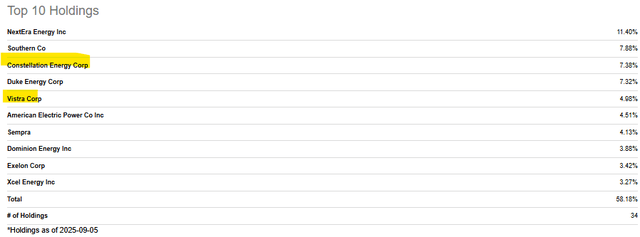

The 18.1X forward multiple of the sector is being pulled up by the IPPs, which are trading at rather ambitious valuations.

Companies like Constellation (CEG) and Vistra (VST) have traded up hundreds of percent as excitement builds for their rapid growth in the face of AI development. While we believe these are fine companies, the market price may have extrapolated the growth a bit too far, as auction prices could come back down as more power supply comes online.

The XLU has large holdings in the IPPs with Vistra and CEG in its top 10.

SA

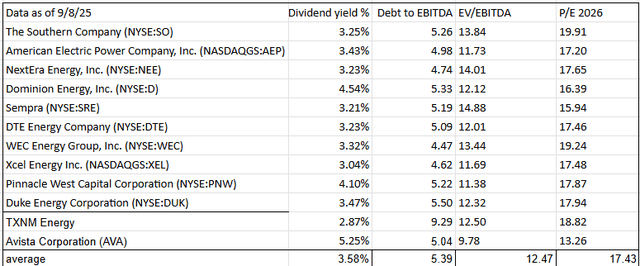

Without these names, the sector is even cheaper. We calculate an average earnings multiple of 17.4 among the electric utilities we track at 2nd Market Capital.

2nd Market Capital

I particularly like the fundamental positioning of Dominion (D), American Electric Power (AEP), and Pinnacle West (PNW). Our reasoning on each is posted here: AEP, Dominion, and PNW.

It is not often that such a reliable and defensive sector also offers moderate growth and value. I find the total package to be highly opportunistic.

#XLU #Buy #Thesis #Cheap #Growth #NYSEARCAXLU