sommart/iStock via Getty Images

Mortgage spreads have been blown out for a long time, with agency-backed mortgages trading at times more than 200 basis points above the respective Treasury yield. The mortgage REITs recognized this as an opportunity to buy government backed assets at unusually high yields.

This article is not about Dynex (DX), but we will start there as they epitomize what is going on in agency mREITs right now.

Terrence Connelly, CIO of Dynex, noted on the 2Q25 earnings call:

“Increasingly, there’s a need for more private capital in the agency mortgage market and we are it. The mortgage REIT community is a huge marginal player ( ). And on many days during the quarter, mortgage REITs were the marginal buyer, and we are continuing to raise capital to deploy it. In my mind, we’re the manager of choice for the agency mortgage market, we, the mortgage REIT community.”

Dynex, along with most of the other agency and hybrid mREITs, saw the opportunity in buying agency backed mortgages at blown out spreads.

So they issued equity and bought a ton of mortgages.

Connelly continued:

“We grew the investment portfolio by over $3 billion in the quarter. As Rob mentioned, we raised capital methodically above book value, and we deployed that capital in Agency MBS”

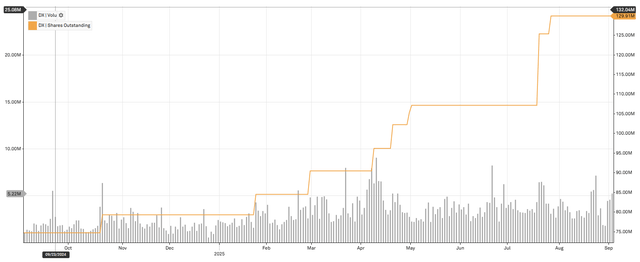

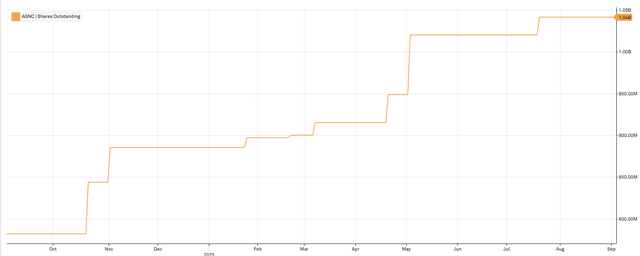

This was financed by a massive equity issuance.

S&P Global Market Intelligence

That is roughly the pattern of action most of the mREITs have followed.

Why was this such a big opportunity?

Well, agency backed mortgages are nearly as “safe” as treasuries because they are also backed by the U.S. government (albeit indirectly through the agencies). They are slightly more risky because they have prepayment risk in addition to the duration risk that is present in both treasuries and mortgages.

However, prepayment is not all that material of a risk right now because a large portion of mortgages are trading at a discount to par due to the fact that over the past 5 years mortgage rates have generally moved up. Thus, if a mortgage does get prepaid, it can sometimes even be a profitable event for the mREIT.

The idea was that there would be significant profits both in carrying yield of the securities and in mark-to-market gains if spreads ever tightened back up.

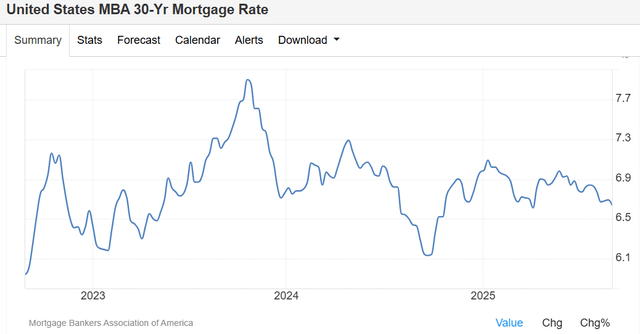

In recent weeks, the spreads have indeed tightened. 30-year mortgage yields have dropped materially, having previously been sitting at about 7%.

TradingEconomics

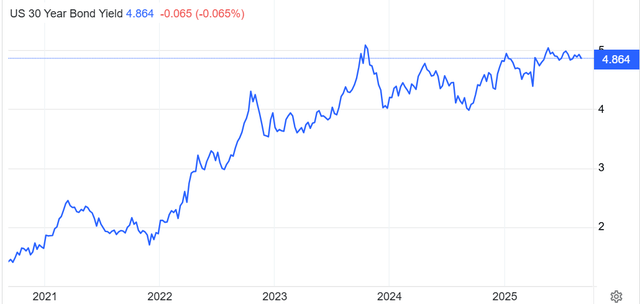

At the same time, 30-year treasury yields have not had the same correction, still sitting near recent highs.

TradingEconomics

On 9/4/25 the 30-year Mortgage rate ticked all the way down to 6.5%.

That represents nearly 50 basis points of spread tightening in just a couple months. Basic bond math will tell you how profitable that is to buy a long duration bond (or mortgage in this case) at a 7% yield and then have yields move to 6.5%.

The move to a 6.5% yield is accomplished by the price moving up since the coupon or interest payment is fixed.

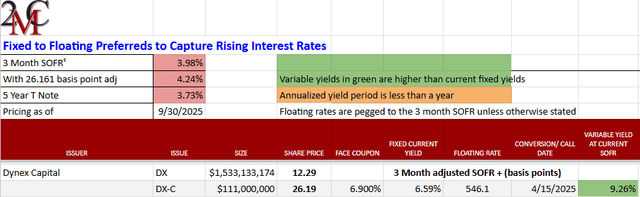

So, Dynex is looking at a large gain on their securities portfolio. As an investment, neither DX nor its preferred look compelling. DX is trading at a significant premium to book and, in my opinion, it is a sin to buy an mREIT over book value.

mREIT preferreds are generally better buys than their commons but in the case of DX-C it is trading above par and is callable. Thus, a simple redemption at the company’s option could put an investor in the negative.

2MC

Dynex, in my opinion, is not an opportunity, but the pattern of issuing equity to buy mortgages at blown out spreads was executed by many mREITs and it has made some of their preferreds quite interesting.

AGNC Investment (AGNC) has a massive portfolio of agency RMBS that has substantially increased in value on the recent spread tightening. That asset portfolio was recently expanded with large equity issuance.

S&P Global Market Intelligence

Equity issuance is a bit of a mixed bag for common shareholders. While it expanded their capital base to take advantage of the opportunity, it also dilutes their ownership.

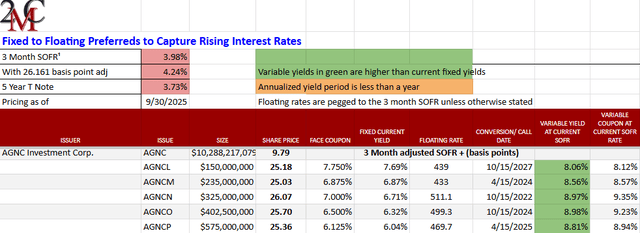

However, such issuance of common equity is unequivocally beneficial to the preferreds as it expands the cushion of equity underneath them. AGNC has a variety of preferreds from which to choose. We have been writing about the opportunity in these for years.

Portfolio Income Solutions

That opportunity is diminished today because it has already played out. Each of these issues has appreciated to par or above par so the capital gains potential has already been realized.

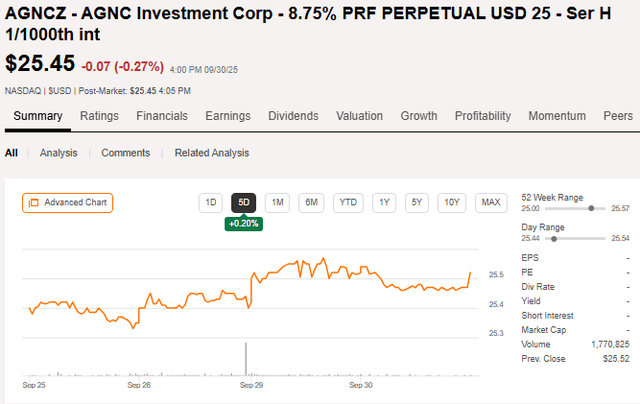

However, there is a new Series H AGNC preferred just issued with an 8.75% fixed rate coupon. It is currently trading under the ticker (AGNCZ).

SA

It might be a bit tricky to trade for a little while, but at $25.16 I think it is a great deal. It locks in that yield and is not callable for quite a while. As it is slightly above par, one would just get the 8.75%, but that is decent income.

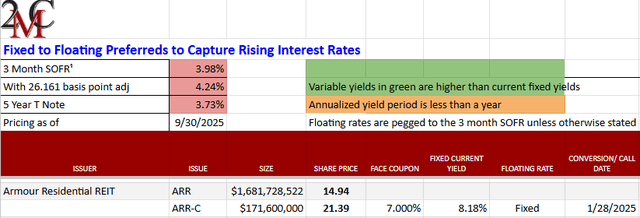

There are some other preferreds which have capital gains potential on top of big yields. I like Armour’s (ARR) preferred C (ARR-C). At $21.39 one can potentially capture significant upside to its $25 par.

Portfolio Income Solutions

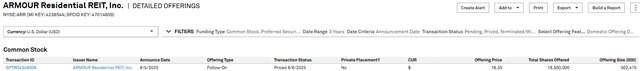

Armour is admittedly further out on the risk spectrum due to its smaller size, but recent events have significantly bolstered the fundamental safety of the preferred. ARR had a massive $302 million equity issuance in August.

S&P Global Market Intelligence

They similarly benefit from the mark-to-market gains of the spread tightening in mortgages.

A stronger and larger company makes ARR-C a bit safer, and I think it will trade up to reflect that.

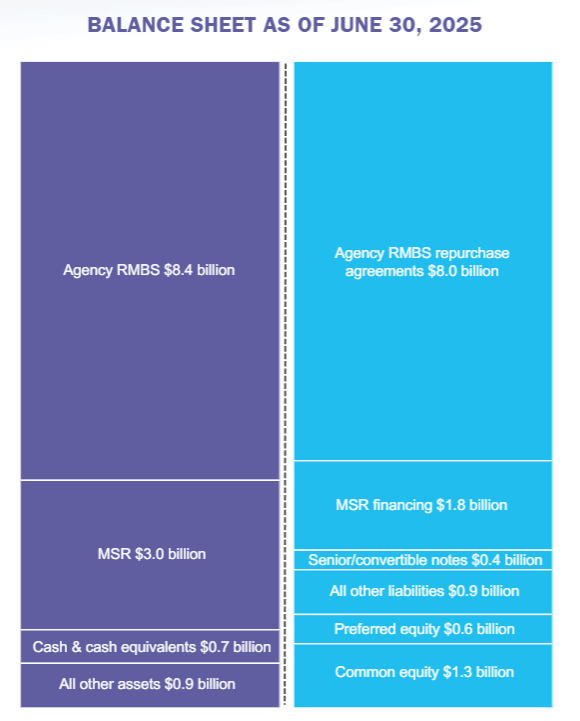

Two Harbors (TWO) is traditionally considered a hybrid mREIT, but they have an $8.4B agency RMBS portfolio against an $11.2B enterprise value.

TWO

With that much capital invested in agency RMBS, they are looking at significant gains in 3Q from mortgages appreciating as mortgage rates moved down to 6.5%.

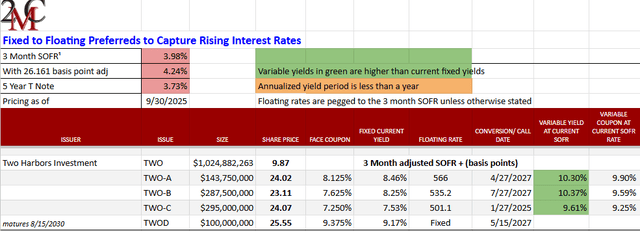

Two Harbors (TWO) has a whole slate of preferreds trading at significant discounts to par.

Portfolio Income Solutions

These are big yields and I think the firming of company fundamentals will help them trade closer to par.

General trend

mREITs have issued a ton of equity which is dilutive or neutral to common shares but a boon for preferreds. I don’t think the market is fully aware of the gains these companies have experienced from spread tightening because it won’t show up until 3Q earnings reports.

Since spreads were so wide until recently, these companies have continually lost book value. In 3Q I anticipate most of them will gain a significant amount of book value, even on a per share basis. I think it will cause a sentiment shift reducing the risk premium attributed to both common and preferred shares.

There probably is opportunity to play the common shares as well, but I generally think mREIT commons are poor investments. The preferreds strike me as the much better play with many discounted to par and large dividend yields in the 8%-11% range.

Portfolio Income Solutions has a live updated data sheet to track the price movement and opportunity in each mREIT preferred.

#Mortgage #Rate #Decline #Fuels #High #Yield #mREIT #Preferreds