Key Points

-

Government shutdowns can increase uncertainty, but they don’t always lead to market downturns.

-

The market’s long-term potential is far more important than its performance in the coming weeks.

-

History shows that given enough time, the market can recover from just about anything.

- 10 stocks we like better than S&P 500 Index ›

Government shutdowns can increase uncertainty, but they don’t always lead to market downturns.

The market’s long-term potential is far more important than its performance in the coming weeks.

History shows that given enough time, the market can recover from just about anything.

The U.S. federal government officially shut down on Oct. 1 after President Trump and Congress failed to come to an agreement on funding.

While government shutdowns aren’t unheard of (the most recent one occurred from late 2018 to early 2019 during Trump’s previous term), they are relatively uncommon. So if you’re feeling nervous about what it might mean for the market, that’s normal. However, there’s no cause for panic. Here’s why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Short-term volatility is a possibility

Government shutdowns can cause short-term uncertainty. Hundreds of thousands of federal workers and active-duty service members are either furloughed or working without pay, which could potentially turn into layoffs.

Uncertainty and fear among investors can sometimes result in market sell-offs, especially when many Americans are already concerned about economic instability. But that’s not always the case.

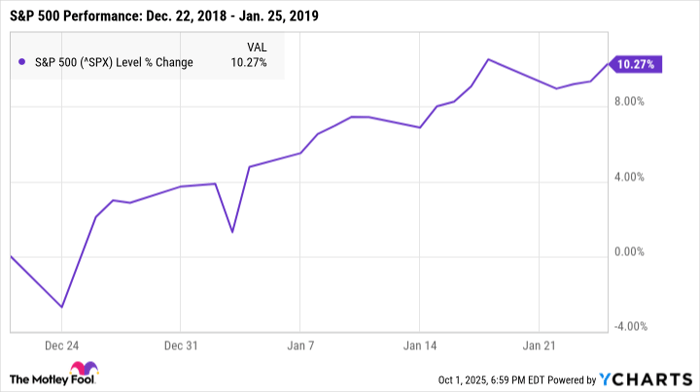

For example, let’s take a look at what happened during the previous government shutdown. It began at midnight on Dec. 22, 2018 and lasted until funding was restored on Jan. 25, 2019. Not only was this the most recent shutdown, but it was also the longest in U.S. history.

Despite falling by close to 3% in the following 48 hours after the shutdown began, the S&P 500 index (SNPINDEX: ^GSPC) surged by an overall 10.27% by the time the government reopened in January.

^SPX data by YCharts

Of course, this doesn’t necessarily mean that this shutdown will play out the same way. The market is incredibly unpredictable in the short term, and this shutdown is different in many ways from those in previous presidential terms.

That said, the closing of the federal government doesn’t necessarily mean that market turbulence is inevitable. While there may be some short-term volatility, the market could very well continue thriving.

Long-term investors can rest easier

The market’s long-term potential is far more important than its short-term performance. And in that regard, investors have plenty of reasons to be optimistic.

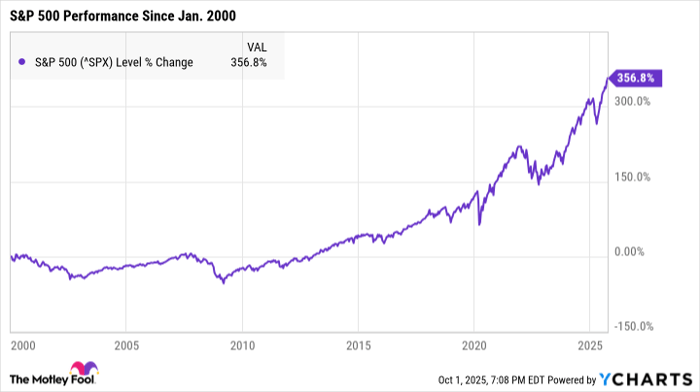

Let’s say, for example, that the U.S. does enter a recession later this year. Recessions sting in the short term, but history shows that the market has a flawless track record of recovering and even thriving after them.

Since 2000 alone, we’ve faced multiple severe recessions, crashes, and bear markets — from the dot-com bubble burst in the early 2000s to the Great Recession from 2007 to 2009 to the COVID-19 crash to the most recent bear market throughout 2022.

All of those downturns were difficult to stomach at the time. However, the S&P 500 has also soared by nearly 357% since Jan. 1, 2000.

^SPX data by YCharts

Again, this doesn’t necessarily mean that things won’t be tough in the short term if a downturn is looming. Historically, though, those who earned the most were investors who stayed in the market despite all of this volatility.

Selling your investments right now may feel safer if you believe a sell-off is coming, but mis-timing the market can be incredibly risky.

If you sell now but the market continues to thrive, you could miss out on potentially significant gains. Then if you decide to reinvest after stock prices have increased, you might end up paying more for the exact same investments you just sold — potentially costing you thousands of dollars.

Nobody knows what the coming weeks or months will hold, but staying calm and maintaining a long-term outlook are key to protecting your portfolio. If you’re investing in quality stocks and holding them through the market’s rough patches, you’re far more likely to see positive total returns over years.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $646,567!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,143,710!*

Now, it’s worth noting Stock Advisor’s total average return is 1,072% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 29, 2025

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Shutdown #Adds #Market #Uncertainty #Heres #Staying #Calm #Pays