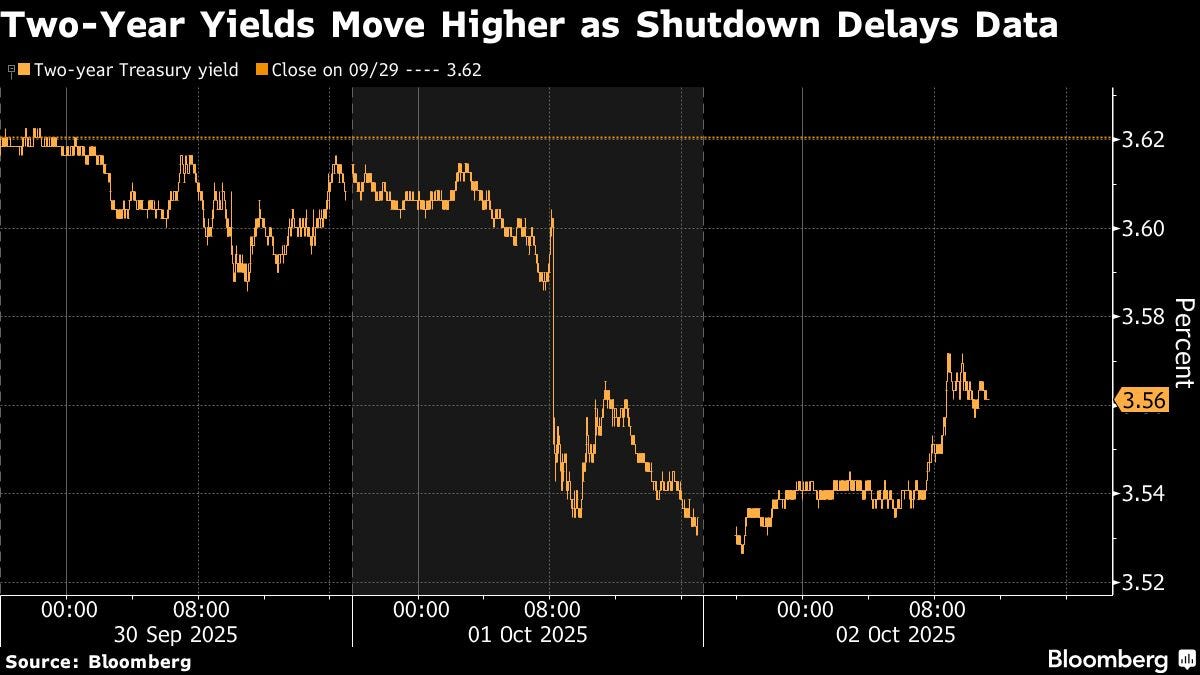

(Bloomberg) — Treasury yields edged higher Thursday as US economic data began facing delays on the second day of the federal government shutdown, leaving investors without labor market readings for signals on the Federal Reserve’s next steps.

The rate on two-year notes, which are sensitive to changes in monetary policy, rose three basis points to 3.56%, while the 10 year’s was little changed at 4.10%. Yields had moved sharply lower Wednesday after a report on private-sector payrolls showed a surprise decline.

Investors in the $29 trillion Treasuries market have focused on labor market data under the assumption the Fed will have to continue cutting interest rates to spur hiring. On Thursday, weekly jobless claims data and a report on factory orders were delayed, while Friday’s release of monthly payrolls was also likely to be pushed back.

The closure itself could add to wagers on lower interest rates if a protracted shutdown deals the economy a blow, according to Elena Amoruso, strategist at UBS Investment Bank.

“A shutdown may be somewhat more of a rates-bullish event as a possible drag on activity,” she wrote in a note. Wednesday’s ISM readings also reinforced the picture of a weakening US economy, Amoruso said.

She recommended a tactical trade that envisages a widening in the spread between five-year and 30-year Treasuries to 106.5 basis points, from around 103 basis points at the moment. That move would be driven by the shorter yield falling on expectations of rate cuts, she said.

Traders are now betting on a more than 90% probability that the Fed will deliver a 25 basis-point rate cut this month.

What Bloomberg Strategists say…

“Revelio Labs showed a more than 60,000 gain in total nonfarm payrolls in September. With official data delayed, such private data gains in importance. And with the Federal Reserve focused weakness in the labor market, the bond markets are uber sensitive to it.”

—Alyce Andres, Macro Strategist, Markets Live

For the full analysis, click here.

The Bureau of Labor Statistics has said that its reports are subject to delay if the shutdown is still in effect. While that has prompted traders to focus more heavily on alternative data sets — such as Wednesday’s ADP numbers — there was limited reaction to data from outplacement firm Challenger, Gray & Christmas on Thursday, which showed reduced hiring and firing in September.

Read More: Trump Raises Stakes for GOP With Shutdown Entering Second Day

US consumer and producer price inflation reports scheduled for mid-October may also be at risk, with the Fed’s next rate decision scheduled for Oct. 29.

Given the dwindling chances of payrolls data being published on Friday, ING strategists predicted that the market will focus on next week’s release of the Fed’s Beige Book for more evidence of slowing employment. The August installment offered a “quite downbeat” picture of the jobs market, the strategists said.

In the past, shutdowns lasting two weeks had a “temporary impact” on the economy, said Kim Crawford, global rates portfolio manager at JPMorgan Asset Management, during an interview with Bloomberg TV.

“But the longer it lasts, the more the non-linear effects will kick through,” she said. A delay in government paychecks would hit general consumption, further slowing the economy, she said.

If the shutdown drags on, the fallout could start appearing in bond markets next week.

“Yields typically drop modestly during government shutdowns that last at least five days,” said Angelo Manolatos, an interest-rate strategist at Wells Fargo Securities.

© 2025 Bloomberg L.P.

#Treasuries #Rally #Stalls #Shutdown #Delays #Data