GettyTim82/iStock via Getty Images

Tim Murphy, Investing Groups Team

Today we continue our Investing Groups Roundtable series – offering readers a window into what our Investing Group Leaders are discussing with their subscribers. Part 1 looked at Income and Value investing, while today we have responses from services who want to discuss the macro picture. Then look for our final installment soon, which will cover a range of investing sectors and ideas. Again, we posed the following two questions (responses submitted between April 26 and April 30):

1. What have you been discussing with your subscribers about the effects of the recent trade policy changes – and how they’re shaping your view in the near and long term?

2. In light of the new trade policies and their impact, what’s a current Top Idea you’re focused on in your service – and why?

Andres Cardenal of The Data Driven Investor: Markets tend to bottom at times of extreme pessimism, when things continue to be bad, but perhaps getting “less bad than before.” From this perspective, we may have already reached the bottom of this bear market. At the same time, we know that a full-blown global recession is not reflected in prices at this point in time. We have been discussing the importance of being open to opportunities in this market, but also making active decisions about how to manage portfolio risk by raising cash levels and/or hedging if things turn for the worse.

Idea: MercadoLibre (MELI) is the undisputed leader in e-commerce and fintech in Latin America, the company has no direct tariff risk, and it’s even benefiting from improving fundamentals in Argentina under the Milei administration. Brand, scale, and logistic capabilities provide key sources of competitive strength for MELI, and the company is arguably led by the best management team in Latin America. Revenue growth is on track to exceed 24% this year, with free cash flow margins around 32%. The stock trades at less than 15 times free cash flow.

Disclosure: Long MELI

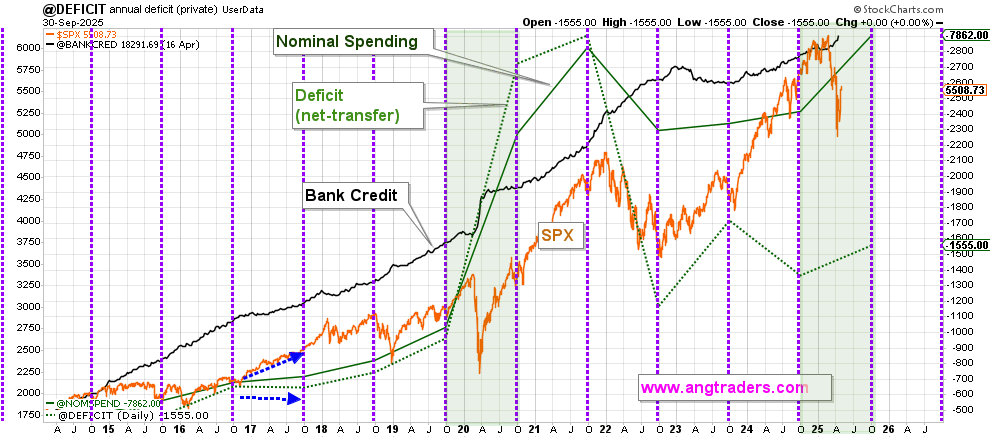

ANG Traders of Away From the Herd: It’s possible that the market recovers from the tariff shock and continues to rally like it did after COVID, but the loss of trust in the U.S. as a safe investment destination will set up the next bear market sometime in the future.

We don’t see a full-blown bear market and recession in the near term (2025) because the fundamentally important net money-creation is much stronger than in the last three years which acts to support the stock market and provides “inertia” to the economy. It will take many months or years to overcome this positive inertia.

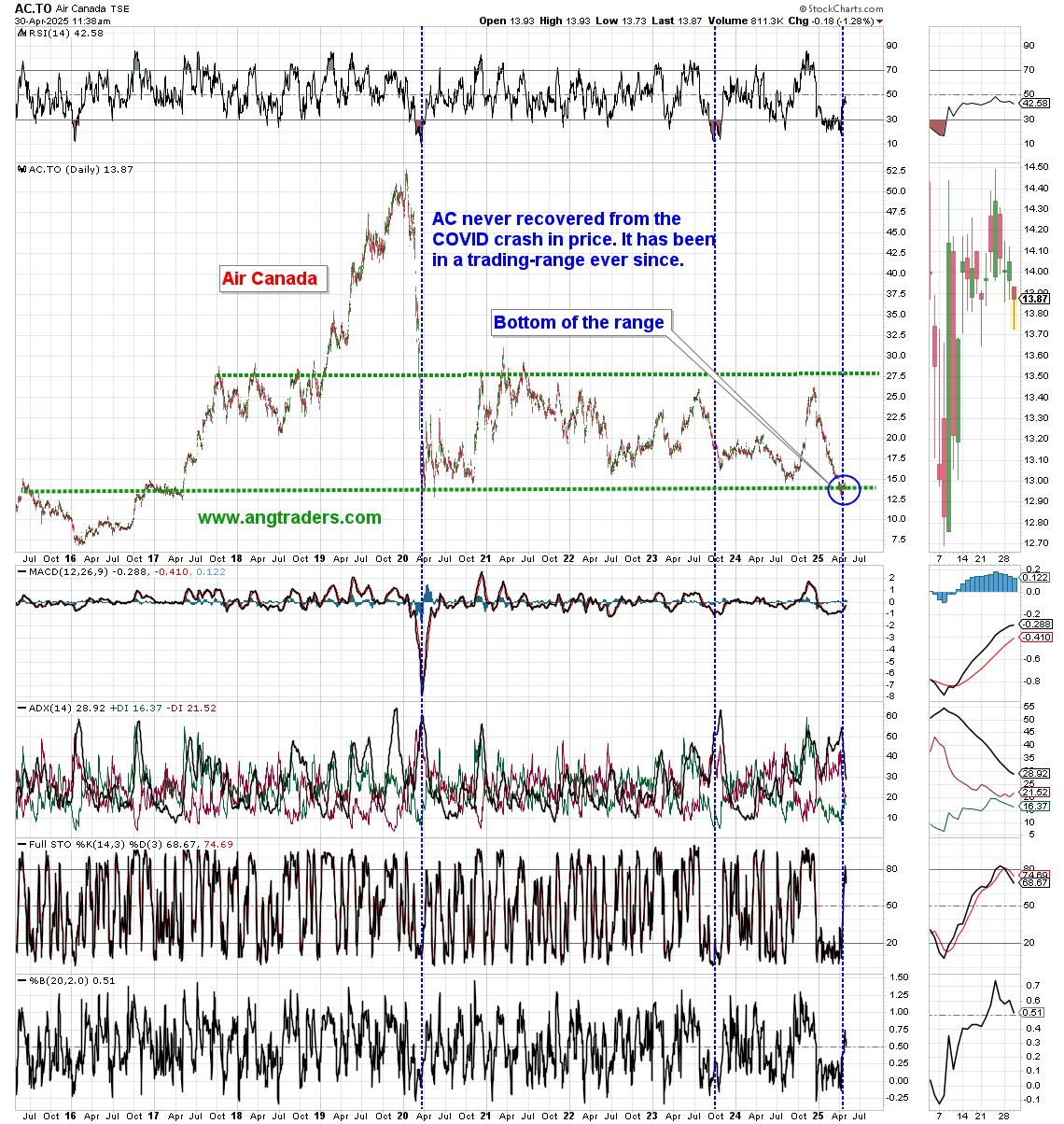

angtraders.com

Idea: Air Canada (AC.TO) has never recovered from the COVID crash (see chart). It has been in a trading-range for the last five years. Air Canada is benefiting from low fuel prices and from the loss of trust in the U.S. airline safety regimen (since DOGE started making cuts). But the stock price is at the lower boundary of the trading range. We’re bullish on AC.TO.

angtraders.com

Disclosure: Long AC.TO

Fear & Greed Trader of The Savvy Investor: I’ve maintained the same stance and forecast that was used as we entered the year. After back-to-back years with 20%-plus gains for the S&P, the markets were due for consolidation, resulting in a trading range. That called for caution, adding more defensive positions and raising some cash. Core holdings were maintained.

Market participants responded to the tariff noise with an “emotional” overreaction. So far, the cautionary stance (without hedging), with advice to hold core positions has paid off. As of April 28, the S&P is 9% off the highs and 3% lower since “Tariff Day,” which is typical corrective activity. In a backdrop dominated by headline noise, stay focused on what matters – price action.

Idea: A current top idea is abrdn Healthcare Opportunities Fund (THQ) at its recent $19.30. The fund seeks income and long-term capital appreciation with a yield of 11.3%. THQ focuses on late state biotechnology and pharma product pipelines, which could deliver significant increases in biotechnology sales. The investment opportunity spans 11 sub-sectors: Biotechnology, healthcare, technology, managed care and REITs. M&A activity in healthcare may create investment opportunities. A perfect holding for the current backdrop.

Disclosure: Long THQ

James A. Kostohryz of Successful Portfolio Strategy: The tariffs are one of three major policy shocks that will hit the economy in 2025 – trade (tariffs), labor (immigration), and fiscal (DOGE cuts). This will be followed by a negative wealth effect shock from stock market declines. Financial conditions will also tighten. Other major shocks may be forthcoming, including possible conflict with Iran and a blockade of Taiwan. Thus, we are forecasting a recession in 2025 and a major bear market in equities. For more insights, here’s my recent Premium article.

Idea: Our top idea – with a multi-week time-frame only – is currently to be short implied volatility. There are several vehicles for this.

Disclosure: N/A

The Macro Teller of Macro Trading Factory: Did the S&P 500 make its 2025 lows on April 8?

Augur Infinity

A “yes” answer hinges on the VIX’s crisis-level high that day (52) and the idea that the current US admin has shifted to a more market-friendly approach to trade policy.

A “no” answer recognizes that the US economy is at a tipping point and prolonged macro uncertainty will almost certainly push it into slowdown, if not recession, a scenario current valuations are far from discounting. For more insight, here’s my recent Premium article on the markets.

Idea: (Fix-to-) Floating Preferred Shares remain one of our preferred (pun intended) areas. Not only do they provide significant income streams, but the expected monetary policy path (a few rate cuts over the next 12 months, yet “higher-for-longer”) makes those floating, with high spreads over the benchmark rates, instruments very attractive from both current and future yields. It’s important to pick issuers that deliver sufficient cash flows (to support distributions) and high enough spreads, so that even when rates fall the relative value (excess yield) remains high, providing a much needed margin of safety.

Disclosure: Long DFP, NPFD

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

#Investing #Groups #Roundtable #Tariff #Policy #Impact #Part