Even as auto insurance rates level out, drivers are still looking for a better deal.

The rate of U.S. auto insurance premium price increases slowed to less than 2% at the end of 2024, down from 13% at the beginning of the year. However, the percentage of customers shopping for insurance year over year jumped to 57% from 49%, according to a new J.D. Power 2025 U.S. Insurance Shopping Study.

“Auto insurance rate taking reached multi-decade highs in the first quarter of 2024, which put record numbers of customers into the market shopping for lower-priced policies as the year progressed,” said Stephen Crewdson, managing director of insurance business intelligence at J.D. Power.

When consumers hear rates are changing, they start shopping. The 57% of shoppers reported for 2024 is the highest shopping rate ever recorded in the 19-year history of the study. Shopping rates were higher in Q1 2024, in line with record-high insurance rates. As price increases slowed throughout the year, shopping rates increased.

“As rate activity began to fall in the second half of 2024, many shoppers were successful at finding lower-priced policies,” Crewdson said. “That combination of increased shopping and less rate taking created a bit of a snowball effect for much of the year, but we are seeing signs that shopping rates are starting to normalize.”

One-third (33%) of customers who are actively shopping for an auto policy are hoping to save by bundling their auto policy with a homeowner’s policy. It’s a plus for insurers, as customers who bundle insurance have longer tenures with their insurer (7 years on average vs. 5.5 among those who do not bundle).

“A potentially bigger concern for the industry right now might be the increased interest many consumers are showing in embedded insurance providers, like auto dealers, financing companies and manufacturers,” Crewdson said.

More than one-third (37%) of auto insurance customers say they are interested in embedded insurance sold directly through the automobile dealer or manufacturer. Interest in embedded policies is highest among Generations Y/Z (47%), and those who say their primary reason for shopping their auto policy is service (48%).

And many customers are confident that their driving could earn lower rates. This year, 17% of insurers offered UBI programs using telematics software to monitor an insured’s driving style and assign rates based on safety and mileage metrics. Offerings are up from 15% in 2024 but down from 22% in 2023.

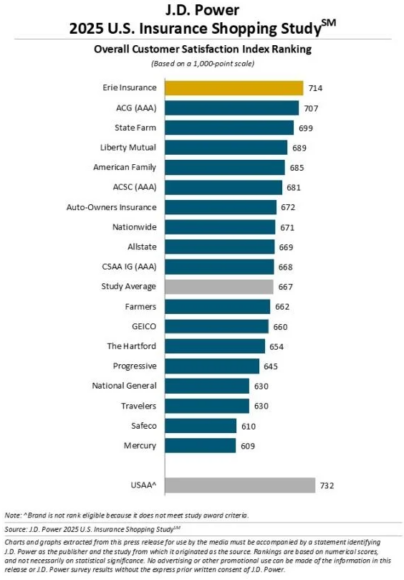

Among large auto insurers, Erie Insurance ranks highest in providing a satisfying purchase experience for the second consecutive year, with a score of 714 out of a 1,000-point scale. ACG (AAA) (707) ranks second, and State Farm (699) ranks third.

The J.D. Power U.S. Insurance Shopping Study is based on responses from 12,720 insurance customers who requested an auto insurance price quote from at least one competitive insurer in the previous six months and captures advanced insight into each stage of the shopping funnel. The study was fielded from April 2024 through January 2025.

Topics

Trends

Auto

Personal Auto

Pricing Trends

Interested in Auto?

Get automatic alerts for this topic.

#Drivers #Shopping #Auto #Insurance #Price #Increases #Slow