The burgeoning U.S. Bitcoin exchange-traded fund (ETF) market has witnessed a significant reversal of fortune, with investors withdrawing a staggering $5.5 billion over a five-week period, according to data gathered by Mhsj. This unprecedented outflow streak commenced around the time of Trump’s return to the presidency, suggesting that investor sentiment within the cryptocurrency space may be increasingly influenced by broader economic concerns, such as the ongoing trade conflict, overshadowing any potentially positive crypto-specific policies.

Analysts point to macroeconomic factors as the primary driver of current cryptocurrency price movements. “The macroeconomic environment continues to exert a strong influence on Bitcoin and the wider crypto market,” noted Amberdata’s derivatives director, Greg Magadini. He further added that he anticipates Bitcoin’s price trajectory will remain correlated with traditional risk assets in the near future.

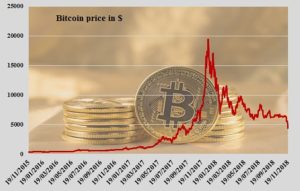

Following a surge to all-time highs in the aftermath of the November presidential election, Bitcoin’s performance has faltered in 2025. The leading cryptocurrency has experienced a roughly 12% decline since the beginning of the year. As of mid-morning in London, Bitcoin was trading in the vicinity of $83,500.