Memorial Day weekend marks the traditional kickoff to summer, often leading to multi-generational gatherings at the family vacation house. Estate planning may not be at the top of anyone’s list of fun family activities, but it can be an opportune time to discuss what’s best for the shared family home.

When executed correctly, estate planning involves maximizing wealth transfer while minimizing tax exposure. Yet one powerful strategy often goes overlooked by families and their advisors: gifting undivided real estate interests.

Many families jointly own properties such as vacation homes, investment real estate or inherited land. These assets can offer an efficient means of passing wealth down generations. However, estate planners are often unaware of the idiosyncrasies and valuable opportunities that these present.

Attorneys and other advisors who proactively introduce this strategy to clients not only help them preserve wealth but also build trust by demonstrating forward-thinking tax mitigation techniques. By incorporating undivided real estate interests into estate planning conversations, families can transfer assets in a tax-efficient, legally sound way that ultimately secures their financial legacy.

What Are Undivided Real Estate Interests?

Before going further, let’s make sure we’re clear about what an undivided real estate interest is. Simply, it’s a fractional share of a property in which multiple owners (often family members) hold joint rights without specific portions designated to any one party. This means that each owner has equal access to the entire property. Common examples of undivided real estate interests are inherited homes passed down to multiple heirs, rental properties jointly owned by siblings or business partners and family land that’s held for generational stewardship. Undivided real estate interests are also referred to as “tenancy in common,” and the two terms may be used interchangeably.

This type of shared ownership comes with inherent limitations. For starters, major decisions require consensus from all co-owners, reducing the degree of control held by any single owner. Owners lack the ability to sell their joint rights to the property because there isn’t a ready and active pool of buyers for undivided real estate interests.

These circumstances reduce control for the individual owners and make it harder for them to achieve liquidity. These restrictions bear a striking resemblance to concepts in business valuation, lack of control and lack of marketability, to which we apply discounts to address. These discounts can be leveraged as tax advantages under the right circumstances.

Why Discounts Apply

As mentioned above, undivided real estate interests warrant valuation discounts due to their inherent limitations on control and marketability. Unlike wholly owned properties, fractionally owned real estate restricts an individual’s ability to sell, develop or refinance independently, as all co-owners must agree on major decisions.

Because of these practical constraints, the IRS recognizes that undivided real estate interests don’t hold the same fair market value as an equivalent pro-rata share of the same property. Qualified valuation experts can substantiate these discounts, using well-established methodologies to demonstrate the reduced value of the property. The valuation professional’s expertise allows families to claim meaningful value reductions while complying with tax law. There’s too much at stake to leave the valuation to an unqualified professional.

Inheriting a Family Vacation Home

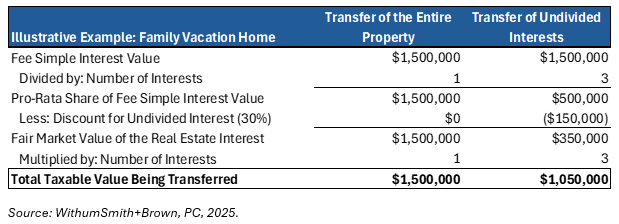

The following example illustrates the benefits of transferring undivided real estate interests. Say three siblings inherit a family vacation home valued at $1.5 million. Each sibling receives an undivided one-third interest in the property, meaning they jointly own the entire asset without designated portions. While the total appraised value is clear, none of the siblings can easily sell their share. Further, any decisions regarding maintenance, rental income or renovations require unanimous agreement. While there’s a market of potential buyers looking for a new vacation home, they aren’t inclined to share that property with the seller’s siblings. This makes the undivided interest far less marketable than a wholly owned property.

Appraisers can rely on to estimate an appropriate discount reliably. For example, a weighted-average income approach can be used with multiple liquidity scenarios for the fractional interest. This can include contested and non-contested scenarios, in which the relative likelihood of a dispute among siblings is considered. Additionally, the market approach can be used to observe discounts on actual transactions involving undivided real estate interests for similar properties. Based on the discounts observed for similar properties, the appraiser may estimate a discount for the undivided real estate interest, considering factors such as location, ownership, income produced, and so on.

After a rigorous analysis, a qualified appraiser concludes a 30% valuation discount for the undivided interest. The FMV of the taxable gift is $350,000 per sibling, and the total amount transferred for tax purposes is reduced to under $1.1 million from the original $1.5 million.

How To Use the Strategy Defensibly

The above example is for illustrative purposes only. In practice, the best and most defensible discounts are achieved by incorporating facts and circumstances unique to the specific property. A qualified appraiser will work with families and their attorneys to determine the best approach for their specific situation.

Careful planning and thorough documentation are essential to apply valuation discounts defensibly for undivided real estate interests. The Internal Revenue Service scrutinizes valuation discounts closely, making it critical to establish the legitimacy of marketability and control limitations. A professional valuation backed by real market data objectively supports the discount applied. This approach ensures compliance and mitigates audit risk. Relying on boilerplate or formulaic discount percentages without real-world justification can lead to successful challenges from tax authorities. Families can maximize legitimate savings by focusing on actual circumstances and expert analysis while maintaining credibility in their estate and gift tax planning strategies.

Remember, the IRS reviews valuation discounts for undivided real estate interests similarly to how it reviews fractional business interests. As with valuation discounts for fractional business interests, there’s a long history of Tax Court precedents relating to undivided real estate interests. While every case is unique, the general takeaway from the Tax Court history is that meaningful valuation discounts are typically substantiated for most undivided real estate interests.

Final Thoughts: Securing Your Clients’ Legacies

Families holding inherited homes, rental properties or land may not realize the tax advantages associated with undivided real estate interests. By identifying these cases early, legal professionals can implement strategies that maximize valuation discounts and reduce tax burdens. However, successful execution requires working with qualified valuation experts who understand real-world market constraints and IRS scrutiny. Partnering with experienced appraisers ensures defensible, data-driven valuations that stand up to IRS review. Attorneys who incorporate this approach not only provide sophisticated tax mitigation strategies but also strengthen client trust by demonstrating forward-thinking guidance.

#Powerful #Estate #Planning #Strategy