(Bloomberg) — For years, software companies were the toast of Wall Street. High profit margins, low capital requirements and vast runway for growth prompted the venture capitalist Marc Andreessen in 2011 to famously declare “software is eating the world.”

Fourteen years later, artificial intelligence is inspiring similar euphoria and some investors are preparing for a hefty slice of the software industry to become the feast.

Salesforce Inc., Adobe Inc. and ServiceNow Inc. are among the worst performers in the S&P 500 this year, down at least 17%, or roughly $160 billion in combined market value. Investors pulled money from the software and services sector for two consecutive months through June after just one monthly drawdown in the prior 18, according to data from EPFR.

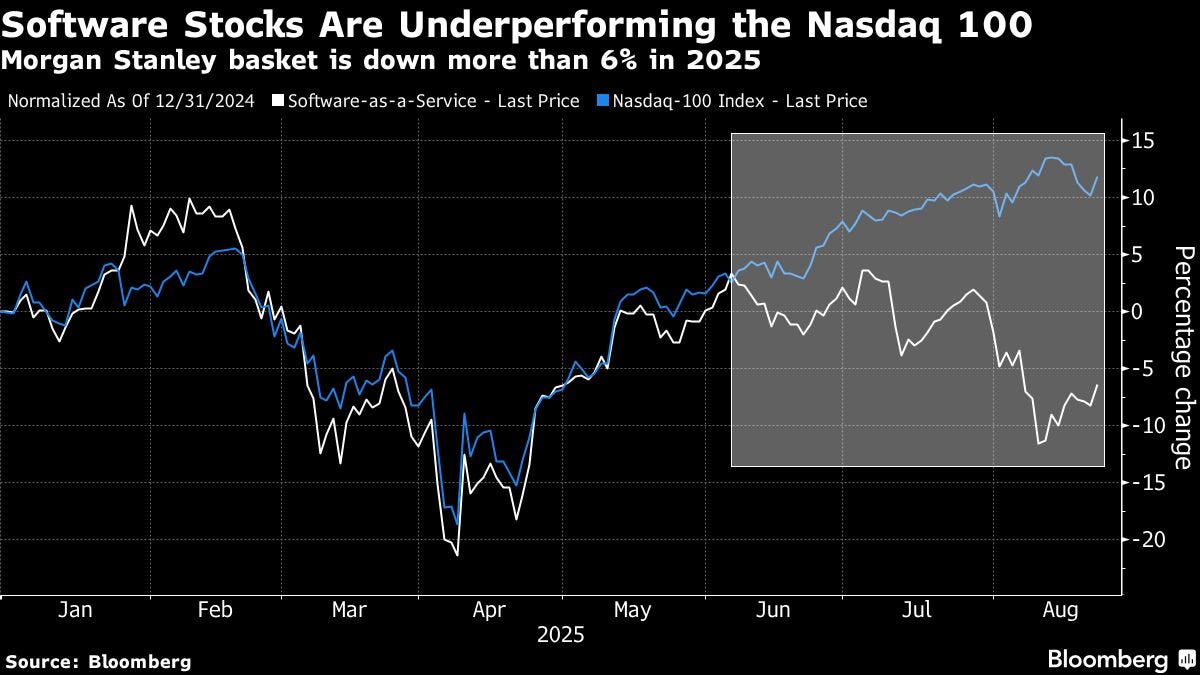

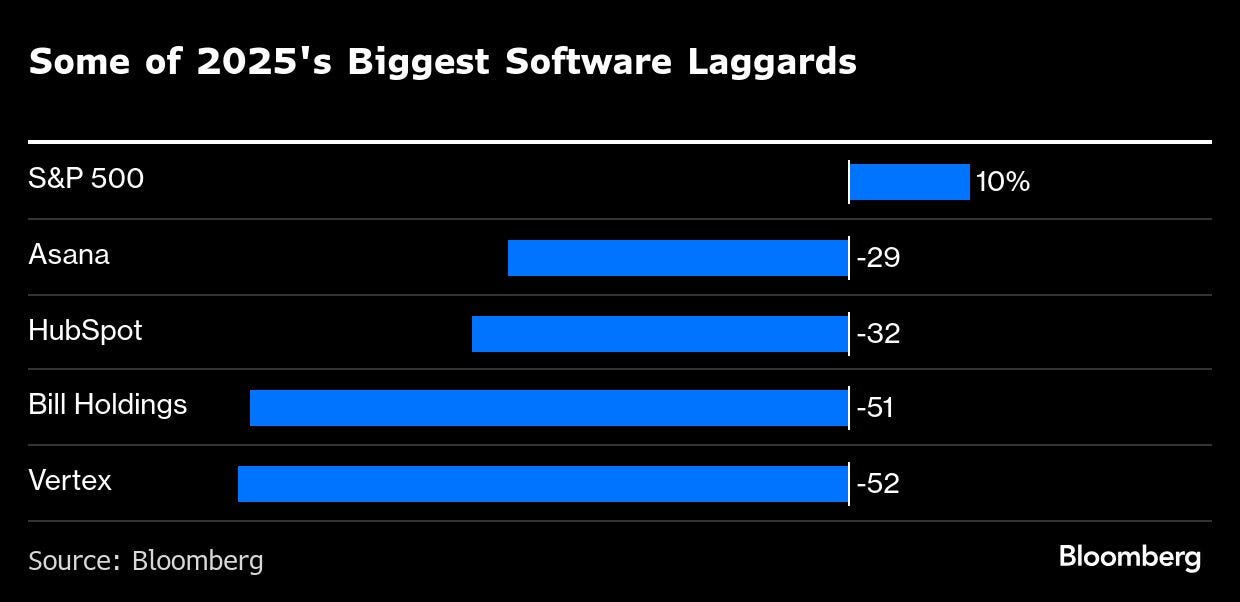

A Morgan Stanley basket of software-as-service stocks has fallen more than 6% this year, compared with an 11% advance for the tech-heavy Nasdaq 100. The bank doesn’t disclose the group’s components, but Asana Inc., Hubspot Inc., Bill Holdings Inc. and Vertex Inc. are some of the biggest software laggards, all down at least 29%.

While AI threatens to disrupt industries as diverse as education and staffing services, investors are seeing a more imminent threat to software firms that write the code behind digital services like customer-relationship management and back-office functions.

“Tech obsolescence can come out of nowhere,” Robert Ruggirello, chief investment officer at Brave Eagle Wealth Management, said. “There’s good reason people are growing cautious.”

The trepidation, while painful for share prices, doesn’t mean investors have soured on the sector altogether. After all, Microsoft Corp., Oracle Corp. and Palantir Technologies Inc. are all software makers and among the year’s best performers in the S&P 500.

What sets those companies apart from the likes of Salesforce and Adobe is the perception they are playing offense with AI, rather than defending their turf, with tech giants spending tens of billions to develop products and add capacity for AI computing.

Meta Platforms Inc. is seeing accelerating revenue expansion as its AI investments improve ad targeting and engagement. Palantir’s AI products are expected to help fuel sales growth of 45% this year. Crowdstrike Holdings Inc. and other cybersecurity stocks have thrived as investors bet AI can’t easily replace their offerings.

For many other software firms, though, the threat is all too real as AI risks upending the sector’s value proposition of providing customers with digital tools that boost productivity at premium prices. If cost-conscious customers, like banks or retailers, can get virtually the same services for much less, entire business plans get destroyed.

Investors can’t know for certain whether AI can displace Asana’s work management software, but a slowdown in customer additions in the first quarter raised enough alarm that the shares tumbled. HubSpot, too, might be able to adapt to AI, but investors worry its CRM tools could face greater competition.

It’s a similar story at Monday.com. The firm’s software to centralize workflow processes doesn’t face obsolescence, but investors fear AI could sap growth. Monday’s disappointing revenue forecast on Aug. 11 was enough to prompt an exodus that shaved 30% off its share price that day.

“Any company wedded to old tech is going to suffer or have to pivot, and you’ll see that in the shares unless they succeed,” said Mark Bronzo, chief investment strategist at the Rye Consulting Group.

For now, investors are selling the shares of software companies without convincing AI strategies or obvious defenses against the technology.

“In the past, people would circle back to a company like Salesforce and buy if it got to be cheap relative to its historical value,” Bronzo said. “We’re not seeing that kind of mentality now.”

The damage is not limited to US companies. SAP SE — Europe’s biggest company by market value — dropped along with smaller peers like Sage Group Plc and Dassault Systemes SE following Monday.com’s warning.

Read more: AI Disruption Fears Hit Software Shares

With OpenAI’s ChatGPT now boasting roughly 700 million weekly users, Ruggirello likens software firms to “an energy company waking up and realizing there’s now a company the size of Exxon it’s competing with.”

That fear is showing up in the sector’s valuations, which for years were well above the broader market due to rapid sales growth and subscription models, which Wall Street prizes for reliable revenue streams.

The Morgan Stanley software basket hit 23 times projected earnings this month. That’s half the average of the past decade and the lowest in Bloomberg data going back to 2014. The Nasdaq 100 trades just under 27 times forecast earnings.

Strategists at UBS said the beatdown in some corners of the software sector could provide opportunities. They recommended earlier this month that investors look at internet and software firms that have lagged behind in the AI craze.

“While AI revenue growth has yet to match the industry’s aggressive spending, rising monetization and AI adoption trends have been encouraging,” strategists led by Ulrike Hoffmann-Burchardi, chief investment officer Americas and global head of equities, wrote in a research note.

Still, investors’ wariness about software at the moment is unmistakable.

In the two decades preceding the 2021 market peak, no industry group in the S&P 500 saw its weighting in the index rise as much as the software and services group, increasing from less than 6% to nearly 14.5%, even after stocks like Google, Facebook and Amazon.com were shuffled into other sectors in 2018.

The group’s heft in the market capitalization-weighted S&P 500 now sits around 12% of the benchmark, and has been eclipsed by semiconductor companies that are benefiting from soaring demand for computing hardware. If it weren’t for the outperformance from Microsoft, Oracle and Palantir, the software group’s weighting would be even lower.

“The perception is that risk has gotten much higher, and we’re not going to get clarity anytime soon,” said Brave Eagle’s Ruggirello. “All we can really say right now is that a few companies like Meta and Microsoft seem to be winning, and they keep winning. It certainly isn’t everyone.”

© 2025 Bloomberg L.P.

#Disruption #Fear #Sparks #Scrutiny #Software #Stocks