Just_Super

By Bruce Blythe

At a Glance

- Despite a period of lower prices, long-term demand for lithium and other battery metals appears strong

- CME Group battery metals futures are seeing greater uptake as the industry looks to manage risk

From cattle to copper to corn to crude oil, the global commodity arena has for decades featured a formidable lineup of heavy-hitters. More recently, amid rapid growth in electric vehicles (EVs), a few newer names are muscling into the market spotlight: battery metals.

Long-term demand for cobalt, lithium and other battery and minor metals are poised for growth as the world increasingly shifts to EVs and alternative power sources.

EV Adoption on the Rise

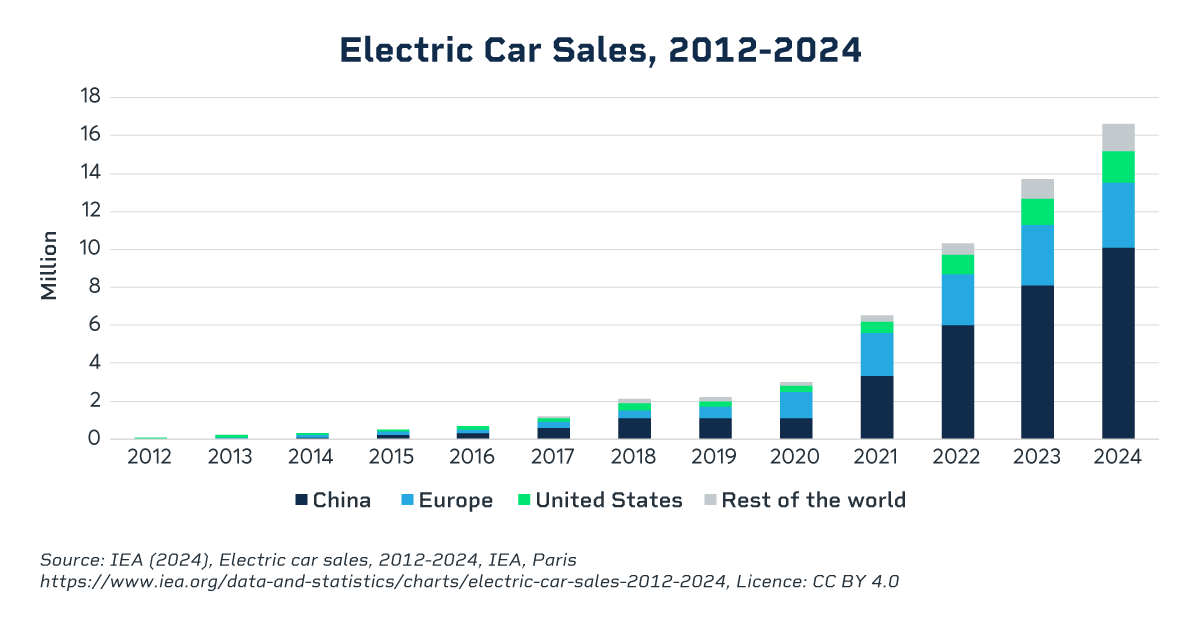

In 2024, sales of EVs surged 25% to 17 million, according to the International Energy Agency (IEA). Fueled by cheaper minerals, global battery production capacity is poised to triple over the next five years. The global battery materials market was valued at $63 billion in 2024 and is expected to grow to $98.9 billion by 2032, according to SkyQuest Technology Consulting.

The global battery industry has “entered a new phase” of development, growing rapidly as demand rises and prices decline, IEA analysts said in a March 2025 report.

“While markets used to be regionalized and small, they are now global and very large, and a range of technological approaches is giving way to standardization,” the analysts said. “Looking ahead, economies of scale, partnerships along the supply chain, manufacturing efficiency and the capacity to bring innovations swiftly to market will be crucial to compete.”

Battery metals are core to this shift and could see additional growth as the world becomes increasingly electrified.

Big Dig: Basics of Battery Metals

Battery metals include the raw materials vital to the performance, efficiency and capacity of batteries – the ability to hold more and more power for longer and longer periods. Some of the most important battery metals include:

-

Lithium – Perhaps the battery metal most in-demand today, lithium is a key component in lithium-ion batteries (i.e. Li-ion or LIB), which power EVs, energy storage systems and smartphones. Lithium is especially valued for its light weight, high-energy density and ability to hold a charge for extended periods.

-

Cobalt – The so-called blue metal is essential for lithium-ion batteries, helping improve stability, longevity and performance. Cobalt is used in EVs, mobile devices and power tools.

- Nickel – A versatile metal, nickel is particularly important for high-energy, high-density batteries, such as those used in EVs. Nickel’s primary function is to increase energy storage capacity and improve the overall performance.

An Evolving Landscape

Balancing supply and demand in the relatively young and developing battery metals markets is a tough act, explaining some wide price swings in recent years. Prices for cobalt, lithium and other related metals plunged in 2023 and many remain near multi-year lows, reflecting a mix of oversupply and slower economic growth in key markets such as China. So far this year, the average nickel price is 29% lower than the 2023 average as supply kept growing much faster than demand.

However, these dynamics can quickly change. Cobalt, for example, experienced a price rebound after the Authority for the Regulation and Control of Strategic Mineral Substances’ Markets (ARECOMS) – an entity created by the Democratic Republic of Congo (DRC) government as the strategic minerals watchdog – announced a temporary suspension of exports on all cobalt products (mainly crude cobalt hydroxide) for an initial period of four months on February 22, 2025, later extended by another three months on June 22. This move was presented as an attempt to balance the market.

“In my ten-plus years in the cobalt industry, I’ve never seen such direct state intervention,” said David Brocas, CEO and co-founder of metals trading and advisory firm Voltaire Minerals. “I think it took everyone by surprise. Most market participants knew that the price levels were unsustainably low but yet everyone seemed bearish until the ARECOMS announcement.”

A similar story around state intervention is unfolding in Indonesia as concerns persist around the environmental impact of mining operations, said Abdessadek Ait Si Brahim, Head of Advisory and co-founder at Voltaire Minerals. In early June, the Indonesian government revoked mining permits for four companies operating in Raja Ampat after local protest. This decision highlights Indonesia’s growing scrutiny of nickel mining impacts even as it remains the world’s top nickel producer for EV batteries and stainless steel.

“It’s clearly an issue that needs to be addressed,” Ait Si Brahim said. “I think it has contributed to decreased nickel demand and incentivized other technologies or chemistries, like lithium iron phosphate (LFP).”

Zooming in on Lithium

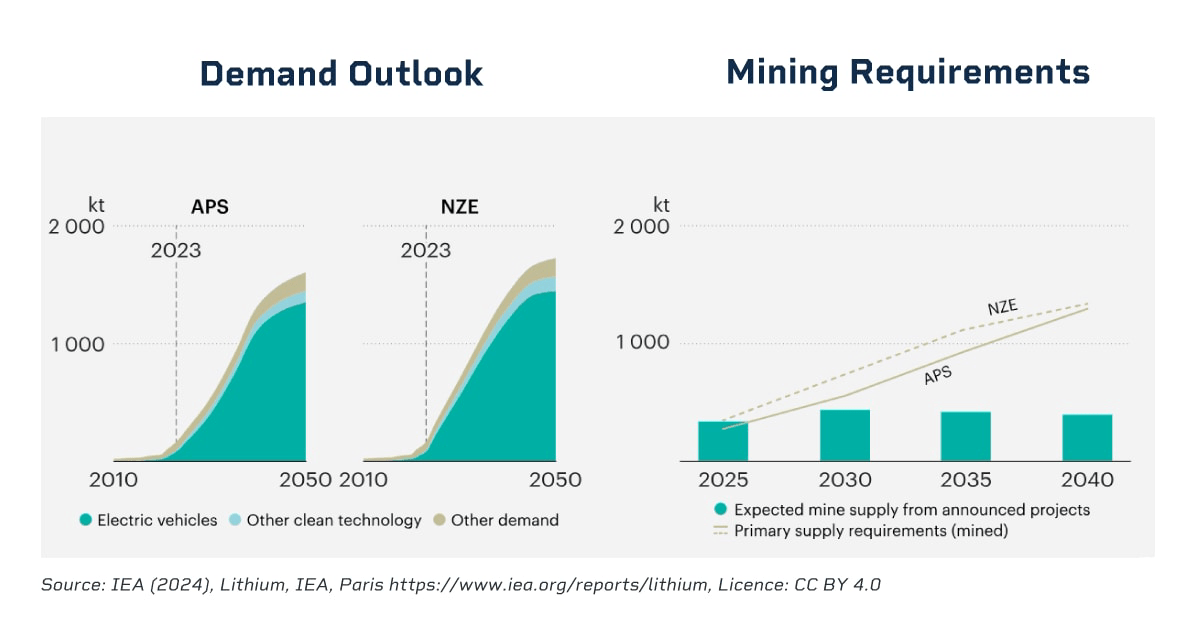

Depressed commodity prices typically lead to lower production, which could set some battery metals prices up for a rebound over the next few years as demand accelerates, analysts said.

Daniel Jimenez, Managing Partner at iLiMarkets, an industry consultant, said lithium’s “enormous” longer-term demand growth prospects – in excess of 20% a year – are unprecedented in the history of commodities.

Just a decade or so ago, “nobody dreamed lithium was going to be where it is today,” in terms of growth and potential market size, Jimenez said. “We’ve seen new types of resources, new geographies, new players – it’s a completely different world. The world has underestimated the lithium demand growth in general.”

It’s all about supply and demand – if lithium inventories become depleted amid ongoing demand, prices could begin to rapidly rise, Jimenez said. He expects lithium demand to grow 250,000 to 300,000 tons a year through the end of this decade.

“On the supply side, the big risk today is the additional capital,” Jimenez added. “I do not think that there will be sufficient capital in the industry until we start seeing prices go up again.”

Battery Metals Market Grows Deeper

Amid fluctuating prices and changing supply and demand dynamics, the long-term need for a robust battery metals market appears strong. Over 50% of vehicles sold in China are EVs, and the country has been open about their willingness to reduce their dependency on oil imports, according to Brocas.

“The adoption of this new technology should be seen for what it is – it’s a fuel diversification strategy,” said Brocas, noting that the aim to lower emissions remains important, but it is just one driver. “Many oil and gas trading companies are building trading desks to trade the metals of the energy transition, as yet another sign that our societies will become more metals intensive.”

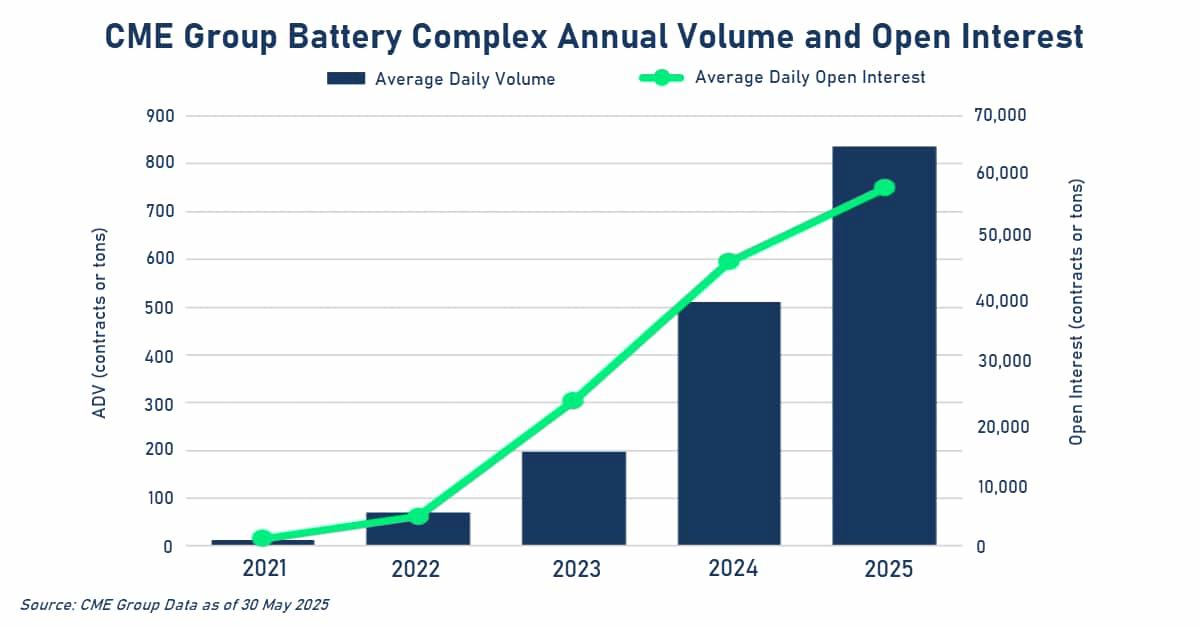

This uptick in interest in this space is reflected in the growing futures markets for battery metals, such as lithium and cobalt, which can help producers and industry participants manage risks and respond more efficiently to market changes. On May 29, a record 2,587 contracts were traded across CME Group’s battery metals complex, and combined open interest reached an all-time high of 65,553 contracts on July 2.

“For a higher-cost producer, it can become very sensitive to have a hedge or a call when [lithium] prices are very low,” said Jimenez said, noting that he believes futures and options on lithium markets will be increasingly demanded, especially by these end users. “There’s nothing car Original Equipment Manufacturers (OEMs) like more than a stable price.”

Brocas also sees the potential for further growth in the space, especially for those looking for exposure to the energy transition. He notes that markets like cobalt are more specialized, and it has historically been challenging for generalist investors to find the right tools that fit their existing investment framework.

“I think it’s only a matter of time before they get involved, by choice or by obligation, in cobalt,” he said.

Looking Ahead

While the EV market has been in focus in recent years, more counterparties are becoming increasingly interested in battery metals markets given the growing number of potential use cases on the horizon.

“It could be robotics, portable electronics, or drones,” said Brocas on areas where lithium-ion batteries could play a larger role long-term. “There is no electrification without batteries.”

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#Surge #Battery #Metal #Mining