Bitcoin (BTC) has been trading in an excruciatingly tight range just below $120,000, but the rally is quickly losing momentum as the market enters what has historically been a soft month for the crypto, a report from 10x Research warned.

August has been bitcoin's weakest month over the past decade, with only three positive years and others delivering 5–20% losses, the report noted.

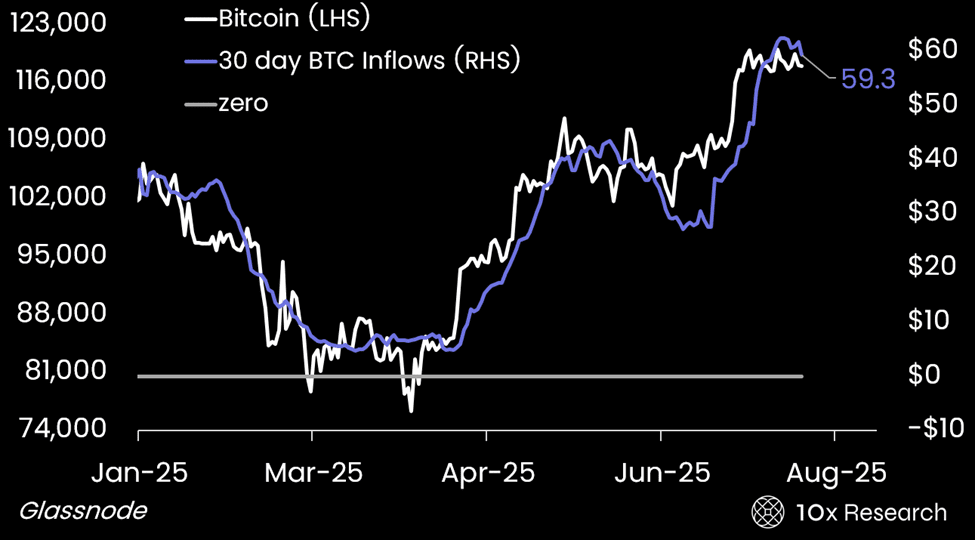

The report also flagged a slowdown in capital flows into the Bitcoin network, a key driver of price action this year. Total cumulative inflows into the network now exceed $1 trillion, with $206 billion arriving in 2025.

But the 30?day rolling average slipped from $62.4 billion to $59.3 billion, that could mark the start of a consolidation phase, the report said, mirroring past peaks in this metric like in Q1 and Q4 2024.

“Time is running short, and despite billions in capital inflows from corporate treasuries, the actual price impact has been surprisingly muted,” wrote Markus Thielen, co-founder and lead analyst at 10x. “This raises the possibility that even with continued support, the market may fall short of delivering the kind of upside many are hoping for.”

The report forecasts a likely break below $117,000, with support at $112,000 and a deeper floor around the $106,000–$110,000 threshold.

Still, BTC bulls may cling to the hope that the outlier August gains happened in 2013, 2017 and 2021, during Bitcoin's post-halving years coinciding with roaring bull markets.

And 2025 might be a year just like those.

Read more: BTC Faces Golden Fibonacci Hurdle at $122K, XRP Holds Support at $3

#Bitcoins #Momentum #Losing #Steam #Seasonal #Headwinds #Loom #10x #Research