Key Points

Costco Wholesale (NASDAQ: COST) once again turned in another strong quarter, but its stock wasn’t able to gain any traction. The stock is up about 165% over the past five years, but is flattish year to date.

While the retailer has seen a lot of operational momentum, its stock now appears stuck in the mud. Let’s take a closer look at Costco’s latest results to see if now is a good time to buy the stock or if it may remain rangebound.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Another strong quarter

Like most retailers, Costco has had to navigate tariffs this year. It has largely tried to minimize price increases, instead working to leverage its buying power and sourcing strategies. It’s also leaned more into its Kirkland Signature private-label brand, where it offers lower prices than national brands.

The company has been doing a nice job of bringing in younger members, especially through its digital channels. Now it is working hard to improve engagement and renewal rates with these members. This quarter, the company said it improved its search functionality and added a password-less sign-in to its mobile app.

Overall, Costco continues to roll along. Fiscal Q4 revenue climbed 8% to $86.16 billion, and adjusted earnings per share (EPS) increased 11% to $5.87. That was just above the analyst consensus for EPS of $5.80 on revenue of $86.06 billion, as compiled by LSEG.

Same-store sales rose by 6.3% when adjusting for changes in gasoline prices and foreign currency. U.S. same-store sales climbed 6% (adjusted), while Canadian comparable-store sales jumped 8.3% (adjusted). Other international same-store sales increased 7.2% (adjusted). E-commerce revenue surged 13.5% on an adjusted basis.

Excluding gasoline and currency effects, the average transaction was up 2.6% worldwide and 2.4% in the U.S. Traffic rose by 3.7% worldwide and 3.5% in the U.S. Meat sales continue to be strong, while gold and jewelry, gift cards, majors (appliances and electronics), toys, and men’s apparel sales all rose by double-digit percentages.

Membership-fee revenue climbed 14% year over year in the quarter to $1.72 billion, as the company continued to benefit from the fee hike that went into effect last September. Memberships, meanwhile, rose by 6.3% to 81 million paid households. Higher-cost executive memberships climbed 9.3% to 38.7 million. These customers are only 48% of total paid memberships, but accounted for 74.2% of Costco’s worldwide sales.

The membership renewal rate was 92.3% in North America and 89.8% worldwide. Renewals continue to be affected by lower rates from younger consumers who sign up through its digital channels, and Costco is focusing on improving its digital communication and enacting auto-renewals to help increase renewals by these customers.

Costco opened 10 new locations in the quarter and 27 during its fiscal year, of which three were relocations. It ended the year with 914 warehouse stores. It is looking to pick up the pace in fiscal 2026, with plans to open 35 new locations, of which five will be relocations.

Is Costco’s stock a buy?

Costco continues to outpace its brick-and-mortar general merchandise retail peers. Its same-store sales have easily outpaced those of others in the space like Walmart, which saw 4.6% U.S. comps, and Target, whose same-store sales fell 1.9%. The company provides good value, and it continues to bring in new customers.

At the same time, it got a lift this past year from a membership price increase. That’s pure gross margin and drops right to the bottom line, but it will not lap that going forward.

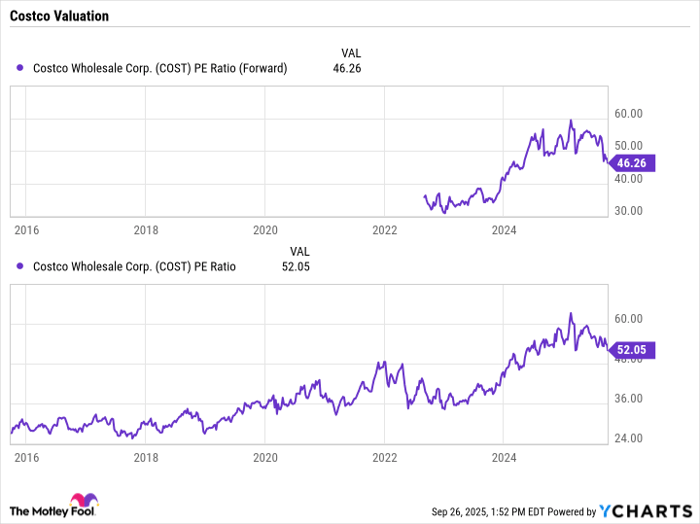

Why Costco’s stock hasn’t responded to its strong operational performance this year likely has to do with valuation. The company has always traded at a premium, but it’s ballooned in the past few years. Its forward price-to-earnings (P/E) ratio now sits at 47 times. That’s below where it traded at earlier this year, but it’s still at an elevated level.

Data by YCharts.

While Costco’s momentum is likely to continue, I think the stock will likely remain stuck in the mud given its high valuation. I wouldn’t be surprised to see the stock be pretty rangebound over the next couple of years until its earnings catch back up with its valuation.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $652,872!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,092,280!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 29, 2025

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Costcos #Momentum #Continues #Stock #Buy