The U.S. Securities and Exchange Commission is fast helping to transform digital assets into a mainstream fixture of U.S. markets.

This week, the regulator cleared two key changes: one that streamlines how crypto funds trade, and another that broadens how investors can bet on them. Taken together, the moves signal something larger — an agency that

The SEC on Tuesday authorized the use of in-kind creation and redemption mechanisms for crypto ETPs — a significant shift from the cash-only model that had been required until now. It also approved a tenfold increase in the position limits for options on

While cash versus in-kind redemptions is an arcane subject, it’s become a hot topic in the crypto community, especially given the Gary Gensler-led SEC’s reluctance to allow broker-dealers to handle crypto.

READ MORE:

An in-kind redemption is a common mechanism for traditional ETPs like those holding stocks or bonds that allows an authorized participant — typically an institutional investor or market maker — to exchange a large block of ETP shares directly with the issuer for a basket of the underlying assets held by the fund. While this mechanism is relatively straightforward in traditional asset classes, it’s far more complex in crypto products due to challenges around custody, security and settlement.

“The biggest takeaway is symbolic. It means there is a new sheriff in town,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “Gensler’s SEC did not want this to happen. This is the first of what will be several steps toward a more pro-crypto SEC.”

Since the debut of

“In approving this longstanding request, the SEC Staff is demonstrating a productive, thoughtful stance on crypto in America going forward,” said Hunter Horsley, chief executive officer of Bitwise Asset Management, which offers its own spot bitcoin and ether funds. “It’s great news.”

All in, it’s a technical tweak but it marks another step toward digital assets fitting into the financial mainstream. It won’t impact things for end-investors anytime soon, but for ETF professionals the regulatory blessing removes a sign of crypto’s second-class status.

“Having in-kind creation/redemption issue will simply give the ETPs better plumbing,” Balchunas said. But “it won’t make a meaningful difference to end-investors.”

The SEC said it will approve on a “merit-neutral approach” other crypto-based products, including applications that seek to hold mixed products like bitcoin and ether.

READ MORE:

The regulator also gave the green light to a Nasdaq proposal to increase a position limit for options on BlackRock’s IBIT to 250,000 contracts, up from 25,000.

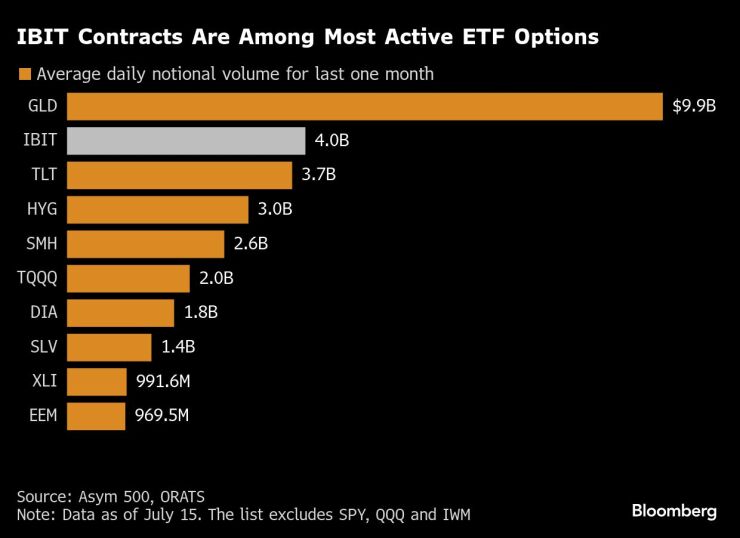

Even under the more onerous cap, open interest in IBIT-linked options has more than tripled this year to around $34 billion, a scale that signals the fund’s emergence as a core engine of crypto risk pricing. Daily volumes have averaged $4 billion in recent trading, surpassing heavyweight funds in credit and emerging markets. Only the most liquid ETFs tied to U.S. equities, gold and small caps trade more actively.

“This will help bring in bigger institutions and be helpful during volatility,” Balchunas said in a social media post.

#Crypto #ETFs #step #closer #mainstream #SEC #rule #shift