When considering health-related financial decisions, dental insurance often gets overlooked or oversimplified. Many people automatically assume that a more expensive dental insurance plan must be better. However, as with all insurance products, the reality is far more nuanced. Simply paying a higher monthly premium doesn’t always translate to better value — especially if you understand the mechanics behind how dental insurance actually works.

In this article, we’ll break down when paying more for dental insurance makes sense, and when it likely doesn’t, based on insights from trusted financial education sources.

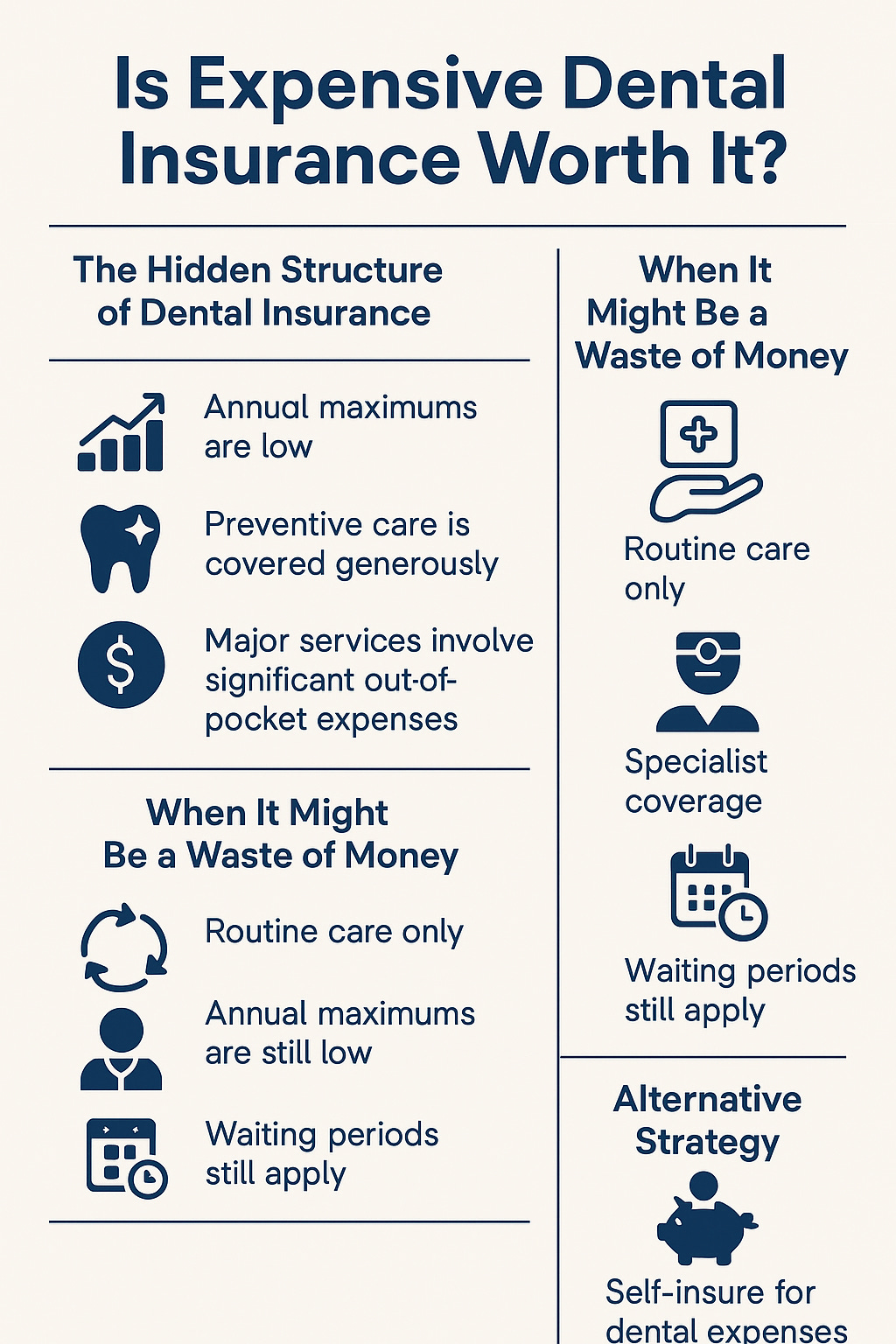

The Hidden Structure of Dental Insurance

First, it’s critical to understand a core principle: insurance is a financial contract, not a guarantee of care.

Dental insurance, particularly standalone dental plans, often works differently than medical insurance:

-

Annual maximums are low. Most plans cap their annual payouts around $1,000–$2,000.

-

Preventive care is covered generously. Cleanings, exams, and x-rays are often 100% covered.

-

Major services involve significant out-of-pocket expenses. Crowns, implants, and orthodontics usually have coinsurance (e.g., 50/50 cost sharing) and are subject to waiting periods.

This structure explains why a more expensive plan may not automatically provide better value. You’re still likely capped at the same benefit maximum, even if you’re paying double the monthly premium.

When a More Expensive Dental Plan Might Be Worth It

Paying for a higher-tier dental plan can make sense in specific situations.

Predictable High Dental Costs

If you already know that you need extensive dental work — multiple crowns, root canals, periodontal treatments — a richer plan with:

-

Higher annual maximums, or

-

Shorter waiting periods

may allow you to partially offset those upcoming expenses.

In this case, it’s like pre-paying for benefits you’re certain to use.

Specialist Coverage

Some cheaper plans exclude specialists like periodontists or oral surgeons. If you require specialist treatment, a more expensive plan may be your only option for financial protection.

Bundled Vision/Dental/Hearing Plans

Certain Medicare Advantage plans and private policies bundle dental, vision, and hearing benefits. These “enhanced” packages can offer good combined value, especially if you also need new glasses or hearing aids.

However, it’s critical to carefully review what’s actually covered — not all bundled plans are created equal.

When Expensive Dental Insurance Is Probably a Waste of Money

Upgrading to a more expensive dental plan often doesn’t make sense in these situations:

Routine Care Only

If your dental needs are mainly preventive — cleanings, occasional x-rays, minor fillings — a basic plan will cover these without needing to overpay for richer benefits you’ll never use.

You may be better off setting aside cash for anything more serious.

Annual Maximums Are Still Low

Many “expensive” plans still have the same $1,500 limit as cheaper plans. If you’re paying $40–$50/month more for the same cap, you’re essentially buying your own benefit back at a poor exchange rate.

Waiting Periods Still Apply

A higher premium doesn’t necessarily eliminate the 6–12 month waiting periods for major services. Always check the fine print. Paying more while still waiting a year for major coverage doesn’t make much sense.

Alternative Strategy: Self-Insurance

An increasingly popular approach among financially-savvy individuals is self-insuring dental expenses:

-

Set up a “dental fund” for larger procedures.

-

Carry a basic preventive-only plan to negotiate fees for routine care.

-

Pay cash for major dental work when needed.

This eliminates waiting periods, low annual maximums, and gives you more control over your care.

Final Takeaway

Buying more expensive dental insurance isn’t automatically better — it needs to align with your specific, predictable needs. Otherwise, you’re likely paying too much for a financial contract that doesn’t truly reduce your exposure to volatility.

If you have known, upcoming major dental work, consider a richer plan.

If not, stick to basic coverage and save the difference.

TOMORROW at 10A ET (press the image and notification bell).

I always struggle with one thing. That is how to get the diverse set of information into your hands, eyes and ears, without killing you with too many details. Without swerving into tangents which I think are important, but you may not.

I have also said that AI will be vital but it is flawed due to the incorrect or misleading narratives that exist everywhere.

So I filtered the information for you, I raised the bar very high, and created a location where you can ask.

#Custom #GPT #Live #Jae