Every effective estate plan should grow with the changes in life circumstances. Helping clients adjust their estate documents after a move, a change in family, career or health, or a shift in finances is essential for making sure your client’s wishes remain clear and their loved ones are protected from unnecessary complications.

Why Regular Reviews Matter

An estate plan is not a one-time project; it’s a responsive legal framework. Changes in family, law, assets and relationships can all affect how your client’s wishes are carried out. Regularly reviewing an estate plan is essential to avoid potential adverse tax consequences, administrative delays and disputes among beneficiaries.

Common Life Changes That Require Updates

Certain personal, financial and legal events should always prompt a review of documents:

-

Birth or adoption of children or grandchildren

-

Marriage, remarriage, divorce or separation

-

Death or incapacity of a spouse, beneficiary or fiduciary

-

Substantial shifts in asset values or acquiring major new property

-

Selling a business, receiving an inheritance or retiring

-

Changes in state of residence or new tax legislation

-

Health events, such as a diagnosis of illness, disability or incapacity in the family

-

Changing relationships with appointed agents, guardians or trustees

Administrative Details Not to Overlook

Alongside the will or trust, it is essential to update beneficiary designations, review the location of key documents and keep an inventory of significant assets. Non-probate assets (including but not limited to life insurance policies and retirement accounts) are transferred by operation of law outside of the will, and their respective beneficiary designations must be maintained current to effectuate your intended distribution.

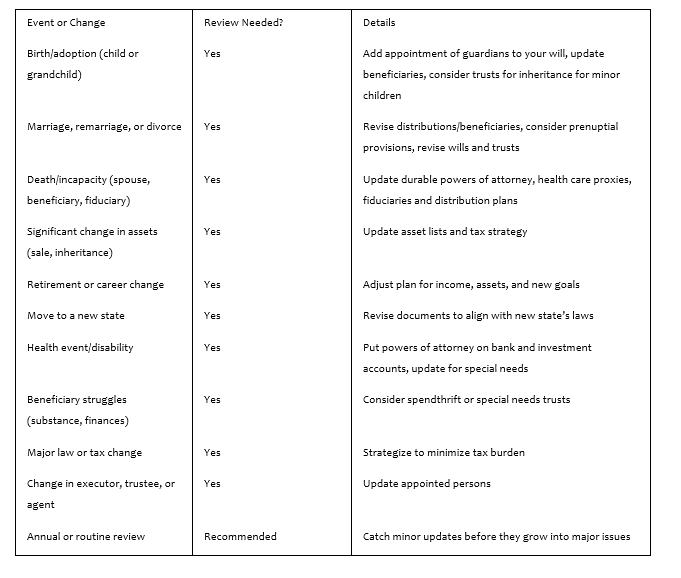

Checklist for Estate Plan Review

The following table provides a non-exhaustive checklist of events that should trigger a review of your estate plan. This checklist should be consulted annually and following any significant life events.

Establishing a Review Schedule

It is recommended that annual reviews be conducted to address minor updates, with a comprehensive review every 3-5 years or following any significant life event, to ensure that your client’s estate plan remains consistent with their objectives and compliant with current applicable laws.

By taking proactive steps and using the checklist above, it’s possible to maintain an estate plan that reliably carries out your client’s intentions and minimizes potential administrative complications and legal challenges for their beneficiaries.

#Estate #Plan #Update #Checklist