When Ethereum launched on July 30, 2015, it set out to be more than just another cryptocurrency. It aimed to expand the boundaries of blockchain technology itself. While Bitcoin became digital gold, Ethereum pursued a more expansive vision: to be a decentralized “World Computer”—programmable, extensible, and open-ended.

A decade later, Ethereum has transformed finance, culture and software. Along the way, it has faced existential crises, volatile markets and fierce internal debates. Now, it stands on the cusp of a new era—one that may see it fully embraced by traditional finance.

Ethereum has seen an uptick in the last two months as the project hits the 10 year milestone, with its ETH’s price rebounded, reaching $3,800 in July, after it languished around $1500 just in April.

Over the last few months, the ecosystem has seen a new wave of use cases including tokenization and stablecoin growth, and the network also benefited from the trend of companies holding ETH in their treasuries, not just for long-term value, but to earn yield.

The Whitepaper That Started It All

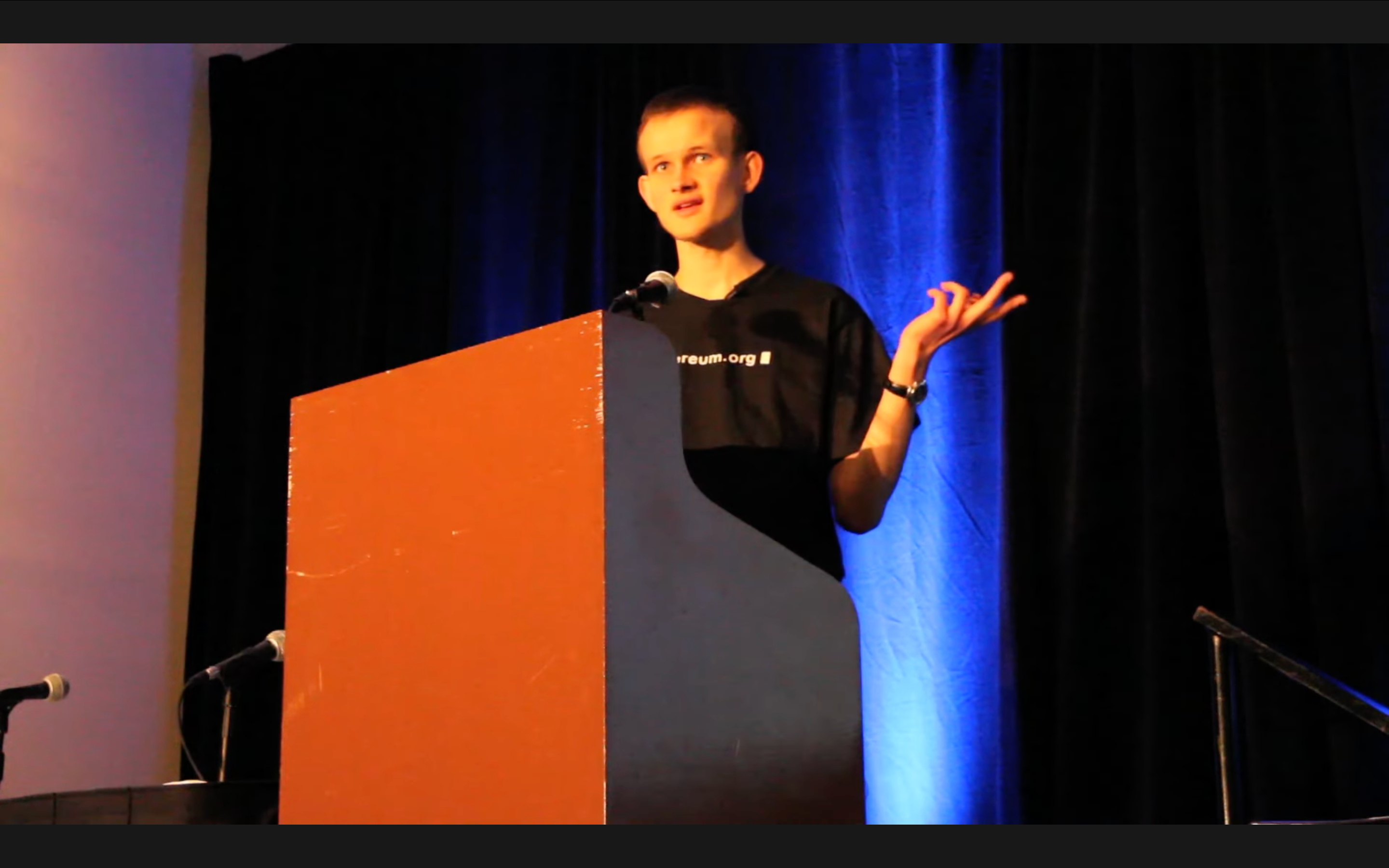

Ethereum was born from a whitepaper penned by then-19-year-old Vitalik Buterin in 2014, a Canadian college dropout and passionate Bitcoin enthusiast who, inspired by the limitations he saw in Bitcoin, envisioned a more versatile blockchain platform. The network went live a year later, backed by the newly formed Ethereum Foundation (EF), which was tasked with supporting development and spreading Ethereum’s mission.

But Ethereum’s honeymoon phase didn’t last. In 2016, the now-infamous DAO Hack nearly broke the network apart when a smart contract vulnerability allowed an attacker to siphon off over 3.6 million ETH, about $13.5 billion at today’s prices. To undo the damage, Ethereum executed a controversial hard fork, effectively creating a new version blockchain.

At the time, many saw that the decision to splinter it off broke with the foundational blockchain principle that transactions are immutable and the system is permissionless, raising concerns that human intervention could undermine trust in the protocol's neutrality. After the split, the original chain continued on as Ethereum Classic.

“We showed that we made the right decision, instead of letting the attacker keep all of that ether back then, and that would have been a burden on us this entire time, with trying to get adoption and [focus on building] different things,” said Hudson Jameson, the former Protocol Community Lead at the Ethereum Foundation, in an interview with CoinDesk.

The ICO Boom and the Road to the Merge

Following the DAO episode, Ethereum entered a period of explosive growth. The 2017 ICO boom saw startups raise billions using ERC-20 tokens. DeFi protocols like MakerDAO, Compound, and Uniswap emerged, enabling permissionless lending, borrowing and trading.

But Ethereum’s success exposed its weaknesses. Network congestion and high gas fees revealed a dire need for scalability. Developers began work on Ethereum’s most ambitious upgrade: transitioning from proof-of-work to proof-of-stake in what would become known as the Merge. The effort, which began in 2017, culminated on September 15, 2022. The transition reduced Ethereum’s energy consumption by over 90% and opened the door to staking.

At the same time, layer-2 rollups like Arbitrum, Optimism, and zkSync began to take shape. These networks offered faster, cheaper transactions while leveraging Ethereum’s security.

“The moment when we realized that layer-2s were really taking off and we started to see L2 transaction volumes equal or exceed those of the mainnet and at much, much lower costs,” was a turning point, said Paul Brody, global blockchain leader at EY.

Today, layer-2 solutions are bringing in major players. Robinhood announced it will build its own rollup using Arbitrum tech, while Deutsche Bank plans to leverage ZKync for its blockchain initiatives.

A Crisis at the Ethereum Foundation?

After a grueling bear market in 2022–2023, crypto began to recover. Bitcoin surged past $100,000. Solana, offering quicker transactions and lower fees, emerged as a viable competitor, attracting more new developers to its ecosystem than Ethereum, as well as capital and hype. Meanwhile, ether lagged, dropping to a four-year low against bitcoin in December 2024, prompting concerns among some in the community about Ethereum’s future, and whether the EF was doing enough to steer the development in the right direction.

As things started to bubble up into a crisis, core figures at the Foundation started to ask about where the ecosystem was heading. “How do we ensure that it's the best thing by many standards? How does it win? How does it be the thing that is adopted,” said Danny Ryan, former Ethereum Foundation core developer and Merge architect.

Ryan now co-leads Etherealize, which helps institutions integrate with Ethereum.

In February 2025, in response to mounting criticism, the EF restructured its leadership, appointing two new co-executive directors to steer the ecosystem into a new phase, with efforts to be more transparent in its communication and priorities, including being more proactive in the community.

Despite its influence, the EF has long resisted becoming the definitive authority on Ethereum’s future. “So the Foundation definitely never wanted to be a critical player, but wanted to do a lot of good for Ethereum,” said Tomasz Sta?czak, one of the new co-executive directors, in an interview with CoinDesk.

“The Foundation still wants not to be central, but the times are that everyone can be a bit louder. So it's totally fine for Foundation to be as visible as possible, as impactful as possible, because it knows that others can play the same thing,” Sta?czak added.

The Foundation remains focused on catalyzing progress, whether that’s scaling Ethereum or supporting institutional adoption. “This is exactly when we are needed to coordinate quicker,” said Sta?czak.

“So now is the time to make sure that we provide those Ethereum values and make an impact through the institutional integrations. The Foundation should have a focus on it now [meaning institutional onboarding], when it's needed,” Sta?czak added.

Regulatory Clarity and Institutional Momentum

One of the biggest catalysts for Ethereum’s recent momentum came with the approval of spot ETH ETFs in July 2024. Managed by legacy financial giants like BlackRock or Fidelity, the spot-ETFs, which now there are nine of in the U.S., marked a watershed moment, opened up access for investors to buy into ETH without having to own the underlying asset.

But getting there was not easy. Under former SEC Chair Gary Gensler, many in the industry believed that the regulatory hostility stifled crypto innovation.

The landscape shifted dramatically after the 2024 U.S. elections, which ushered in a more crypto-friendly Congress and administration. Since then, with the passage of the GENIUS Act (and prior to it), stablecoins and tokenized real-world assets have flooded Ethereum, cementing its place at the heart of institutional crypto adoption.

“Now, with a much healthier regulatory environment in the United States, companies can get serious about this stuff, and builders can get serious about this stuff without worrying about a love note from chair Gensler,” said Joseph Lubin, CEO of Consensys and an Ethereum co-founder. “So the applications and the users and the transactions will come.”

More recently, a new trend has emerged with companies focusing on treasury strategies that includes buying up ETH, to not just hold the asset, but for staking and to generate yield. The shift signals that some are looking to leverage Ethereum’s staking system to earn rewards and integrate with a wider DeFi ecosystem.

SharpLink Gaming (SBET), the Nasdaq-listed crypto treasury firm helmed by Ethereum co-founder and ConsenSys CEO Joseph Lubin, has emerged as one of the leading firms in this field.

“I think DeFi is going to be the first major use case, and you can call it real world assets and stablecoins and lending, borrowing, etc. DeFi will be the first real use case that enterprises and financial institutions adopt,” Lubin said. “If you pay attention to what's going on with these ether treasury companies like, like our own, SBET, it's clear that Wall Street is paying attention.”

What’s Next for Ethereum?

Ethereum now stands at an inflection point, as some of the world’s biggest financial institutions come into crypto through Ethereum’s rails. “Five years ago, a lot of these banks and financial institutions understood, or were beginning to understand the value of a digitally native, programmable environment,” said Ryan of Etherealize. “Although there were people that kind of understood the value of public blockchains in banks, still a little more than a year ago now, they were like ‘we get it, but we can't touch it,’ given the regulatory uncertainty.”

With institutions now onboard, the next year will likely define its long-term relevance. Developers are focusing on both user experience and scalability, not only via layer-2 expansion but also through improvements to the base layer itself.

“We've solved most of our problems, doesn't mean we have the final state. There's still tons of improvements, and we need so much more scalability,” said Lubin.

Beyond the technical, Ethereum’s stewards are also contemplating its role in a rapidly changing world.

“When we think about the next 10 years of Ethereum, I think the questions we [the EF] are asking [are] ‘what are the biggest fears of centralization for humanity, globally nowadays, and mostly it's AI,’” said Sta?czak at the EF.

“Now is the time to spark with people some excitement with being meaningful and having big, moonshot projects around something that is really, really important for the next 10 years.”

The interviews in this piece have been edited for brevity and clarity.

Read more: Institutions Are Driving Ethereum's 'Comeback'

#Ethereum #What039s #World #Computer