Key Points

-

In a much-awaited move, the Federal Reserve cut its key interest rate by 0.25 percentage points last week.

-

Realty Income should benefit from the difference in its borrowing costs and how much it collects from tenants.

-

Bank of America’s net interest income will likely fall because it will receive less in interest income from loans.

- 10 stocks we like better than Realty Income ›

In a much-awaited move, the Federal Reserve cut its key interest rate by 0.25 percentage points last week.

Realty Income should benefit from the difference in its borrowing costs and how much it collects from tenants.

Bank of America’s net interest income will likely fall because it will receive less in interest income from loans.

When inflation reached its highest levels in decades in 2022, the Federal Reserve began tackling the issue by raising interest rates. At its peak, the federal funds interest rate reached 5.5%, its highest level since 2001. On Sept. 17, the Fed cut the interest rate by 0.25 percentage points to a target of 4% to 4.25%.

The rate cut didn’t come as a surprise to most people, and there are thoughts that the Fed may cut rates once or twice again this year, per the latest “dot plot” (a chart showing where each Fed policymaker expects interest rates to be in the future).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Interest rates have ramifications for the U.S. economy. Higher rates make borrowing more expensive, which aims to slow growth and cool inflation. Lower rates make borrowing cheaper, which helps business expansion and consumer spending. This will affect many businesses, but there are three in particular I want to keep an eye on.

Image source: Getty Images.

1. Realty Income

Realty Income (NYSE: O) is a real estate investment trust (REIT), meaning it pools investors’ money to buy and manage income-producing real estate, then distributes most of the profits back to shareholders as dividends.

It’s the sixth-largest REIT in the world, with properties in nine countries worth around $61 billion in real estate value. Realty Income’s business model is buying single-tenant properties and renting them out to tenants who are responsible for the rent, maintenance, and taxes.

The recent and anticipated interest rate cuts will affect Realty Income’s business by lowering its cost of capital, making it cheaper to borrow money for new acquisitions and refinancing its current loans. This increases the difference between the costs of financing properties and the income collected from tenants. This should be music to Realty Income investors’ ears because it supports growth and dividend stability.

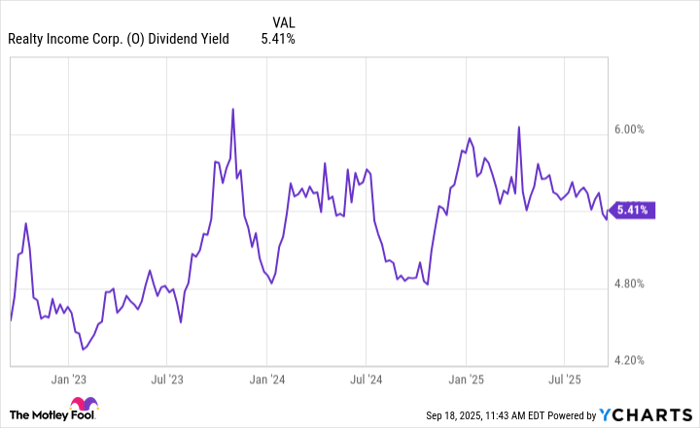

O Dividend Yield data by YCharts

Realty Income already has an attractive dividend, but lower rates can make its yield look more attractive relative to bonds, potentially drawing in more investors.

2. Bank of America

Bank of America (NYSE: BAC) is one of the world’s largest banks, operating in 36 countries (including the U.S.). Bank of America operates in virtually all facets of the finance world, but its main income source is net interest income (NII).

When you hold money in a bank account, the bank pays you interest on the money that’s in there. However, the banks typically use this money to loan out in the form of mortgages, auto loans, and other consumer and business loans. If you’ve ever taken one of these loans, you’re well aware of how much more the interest rate you pay on those is than the interest the bank pays on your deposits. This is the NII.

With a lower interest rate, Bank of America collects less interest on the loans it gives out, yet it still needs to pay interest on the deposits it receives. This means its NII is likely to shrink in the short term because loan yields drop faster than deposit costs.

In the second quarter, Bank of America’s NII grew 7% year over year to $14.7 billion (55% of total revenue). I wouldn’t expect a dramatic drop anytime soon, but it’s worth keeping an eye on how lowering interest rates affects this growth.

3. Visa

Visa (NYSE: V) is the world’s largest payment network, accepted by over 150 merchants worldwide and processing hundreds of billions of transactions worth trillions of dollars.

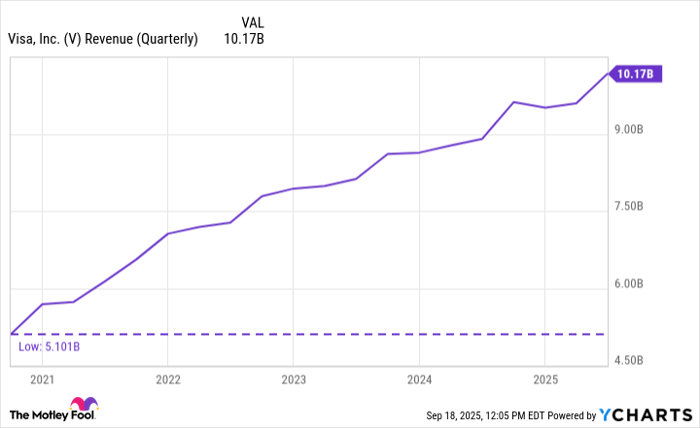

Unlike Realty Income and Bank of America, interest rate cuts will have more of an indirect effect on Visa’s business, and it comes down to its business model. Visa has a fairly simple business model: It takes a percentage of every transaction that happens on its network. It’s a simple model that continues to make Visa tons of money, with its revenue nearly doubling in the past five years.

V Revenue (Quarterly) data by YCharts

If interest rates make it cheaper to borrow money and boost consumer and business spending as intended, Visa’s volume is likely to increase. More volume equals more money because more transactions are happening on its network.

In its fiscal third quarter, Visa’s total payment volume increased 8% year over year, and processed transactions increased 10% year over year. This is already impressive growth given Visa’s size, but this could increase once the new interest rates begin to reflect in spending.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 15, 2025

Bank of America is an advertising partner of Motley Fool Money. Stefon Walters has positions in Visa. The Motley Fool has positions in and recommends Realty Income and Visa. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Fed #Decision #Stocks #Watch #Jerome #Powells #Latest #Move