Dubai, Palm Beach and Miami Lead the Way

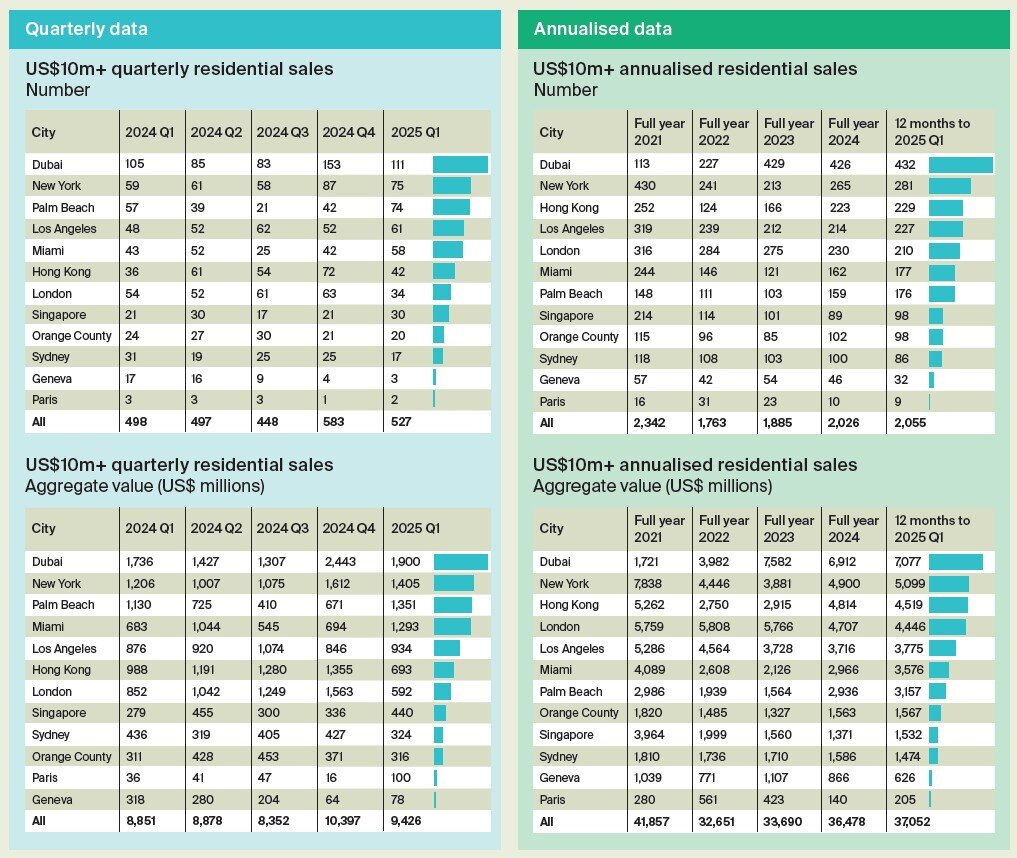

Global super-prime real estate–homes sold for $10 million or more–surged into 2025 with strong momentum, as rising wealth and investor appetite fueled luxury transactions across key global cities. According to new data from the international property consultancy Knight Frank, 527 super-prime deals closed in Q1 2025, up 6% from the 498 recorded in the same quarter a year earlier. The total transaction value also climbed 6% to $9.43 billion.

Dubai led the global market for the fifth consecutive quarter, registering 111 deals totaling $1.9 billion. The Emirate continues to attract ultra-high-net-worth individuals (UHNWIs) drawn to its tax advantages and global connectivity. Meanwhile, South Florida emerged as a standout performer: Palm Beach recorded 74 deals ($1.35 billion), rebounding sharply from just 21 transactions in Q3 2024, while Miami logged 58 sales worth $1.29 billion–marking a 35% year-on-year jump in deal count and nearly doubling in value.

New York remained a key player with 75 super-prime sales totaling $1.41 billion, retaining its place as the top Western market by volume.

In contrast, Asia and Europe posted mixed results. Hong Kong saw a sharp year-on-year decline in Q1, with transactions falling 31% to 42 deals and total volume halving to $690 million. London, too, softened with 34 deals (down 37%) and $590 million in total value. Knight Frank attributes the cooling to a combination of seasonal post-year-end slowdowns and shifting local policies, including taxation changes in the UK.

Over the 12 months to Q1 2025, global super-prime sales reached 2,055 deals. Dubai again led the annual leaderboard with 432 transactions totaling $7.08 billion. New York followed with 281 deals ($5.10 billion), while Hong Kong rounded out the top three with 229 sales ($4.52 billion).

“The super-prime market hit a new gear entering 2025,” said Liam Bailey, Knight Frank’s global head of research. “Dubai maintains its lead, but the resurgence of South Florida and the rebound in Hong Kong show that demand remains truly global. As we move through 2025, deal flow should remain healthy–however, rising macroeconomic uncertainties will demand greater focus from developers and investors.”

Key drivers include rising global wealth–Knight Frank’s Wealth Report cited a 4.4% increase in the UHNWI population in 2024–alongside lifestyle migration, tax arbitrage, and portfolio diversification. While fundamentals remain strong, buyers and developers will need to navigate headwinds including interest rate volatility, currency shifts, and policy interventions.

Real Estate Listings Showcase

#Global #SuperPrime #Housing #Markets #Rally