Key Points

-

Buffett has commented in recent years that Berkshire Hathaway has relatively few opportunities because it’s grown so big.

-

While everyone knows that Buffett likes a good bargain, few realize that he also factors in growth opportunities when determining what a good value stock is.

- 10 stocks we like better than MercadoLibre ›

Buffett has commented in recent years that Berkshire Hathaway has relatively few opportunities because it’s grown so big.

While everyone knows that Buffett likes a good bargain, few realize that he also factors in growth opportunities when determining what a good value stock is.

I’ve written more than 3,000 articles for The Motley Fool and I don’t think I’ve ever been more humbled by a headline than the one I’m writing now. Warren Buffett is a great investor and his company Berkshire Hathaway has returned close to 20% annually for 60 years, putting it in a class of its own. Who am I to pick a stock on Buffett’s behalf?

I’ll be the first to admit that Buffett is on the Mount Rushmore of investing, whereas I’m out in the parking lot of the visitor center. But that’s why I’ve studied his investing approach — I’m a Buffett fan.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: The Motley Fool.

This article, therefore, isn’t an arrogant explanation of how I could better invest Buffett’s billions. To the contrary, I want to explain why I believe that MercadoLibre (NASDAQ: MELI) would be a perfect addition to Berkshire Hathaway’s portfolio, based on everything that I know about the Oracle of Omaha.

Go big or go home

As of this writing, Berkshire Hathaway has a market capitalization of just over $1 trillion and it has $340 billion in cash and short-term investments on the balance sheet. This means that if Buffett is going to make a needle-moving investment, it needs to be an investment in a big company.

In his 2023 letter to Berkshire Hathaway shareholders, Buffett lamented, “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire.” Consider that if Berkshire invested in a company valued at $1 billion, it could go to $10 billion and outperform the S&P 500. But that gain would barely register for Berkshire, since it’s worth over $1 trillion.

To find a stock for Buffett, I stuck with businesses valued at over $100 billion. As of this writing, MercadoLibre is valued at about $120 billion. That’s big enough to qualify for Berkshire’s investing universe.

MercadoLibre is the e-commerce and financial giant of Latin America. And some readers might object to this idea considering that in 2023 Buffett also wrote, “Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire.” But note that Buffett didn’t exclude all international stocks, but rather said that there were essentially no options. MercadoLibre is one of the few exceptions in international markets that’s big enough for Buffett’s attention.

Value and growth

For Buffett, investing is all about value. In fact, in 1992 he wrote, “The very term ‘value investing’ is redundant” because for him, every investment should be a value investment.

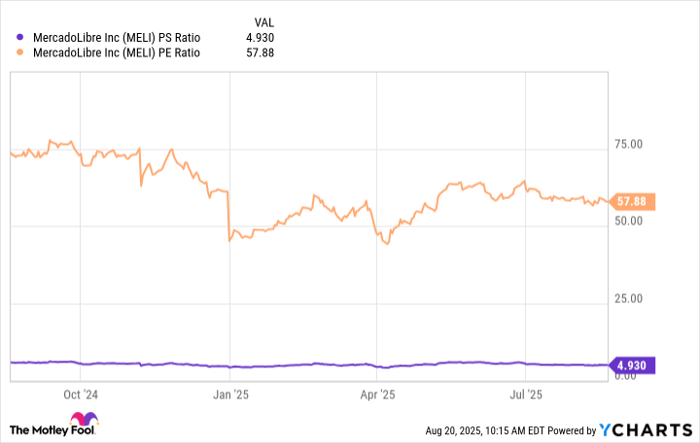

On the surface, MercadoLibre wouldn’t seem to conform to the principles of value investing. After all, it trades at a price-to-sales (P/S) ratio of about 5 and a price-to-earnings (P/E) ratio of about 58. On both counts, there are plenty of cheaper-looking stocks out there.

MELI PS Ratio data by YCharts

However, Buffett doesn’t determine good value in the stock market by solely using these popular valuation metrics. These metrics measure past results and don’t account for future growth.

Value investors can’t neglect to account for business growth. As Buffett wrote, “Growth is always a component in the calculation of value” (emphasis his). And fortunately, MercadoLibre delivers when it comes to growth.

MercadoLibre’s revenue grew by 38%, 37%, and 49% in 2024, 2023, and 2022 respectively. Few businesses have grown at such a high rate.

What truly makes MercadoLibre compelling from a growth perspective is its ongoing opportunity. Between economic growth, the adoption of e-commerce, and growth in digital financial products, the company could continue to expand for the next decade or more.

When factoring in its penchant for growth and its large market opportunity, MercadoLibre stock is still a good value today.

But can MercadoLibre compete?

In 2007, Buffett wrote, “Long-term competitive advantage in a stable industry is what we seek in a business.” I’d say that e-commerce is certainly a stable industry. It’s unfathomable to think that people will buy fewer things online in the future. But does MercadoLibre have a moat?

I believe it does. MercadoLibre has built an extensive shipping and logistics network, which is uncommon in Latin America. Over half of its shipments can now be delivered the same day or next day, which is an impressive feat. And it’s something that can keep its more than 70 million active buyers in the platform.

This growing base of buyers is key for MercadoLibre’s future growth. Right now, the business is growing with third-party listings, subscription products, and advertising demand. All of these things are bolstered by a fast-growing user base. And it’s reasonable to expect the user base to grow because MercadoLibre has an advantage when it comes to logistics.

MercadoLibre is a big business with competitive advantages and a large opportunity for future growth. This is why I believe it would make a nice addition to Berkshire Hathaway’s portfolio.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $650,499!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,072,543!*

Now, it’s worth noting Stock Advisor’s total average return is 1,045% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 18, 2025

Jon Quast has positions in MercadoLibre. The Motley Fool has positions in and recommends Berkshire Hathaway and MercadoLibre. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Pick #Stocks #Warren #Buffett #Choose