On May 22, 2025, the One Big Beautiful Bill passed the U.S. House of Representatives with a narrow vote of 215-214. The bill is now under consideration in the Senate and is expected to undergo changes. Despite the likely modifications, it is still useful to assess the potential impact of the bill as proposed. The effects can be viewed in two ways: (1) on ETF market segments that are directly impacted by specific provisions and (2) the indirect impact on other ETF market segments due to the broader fiscal implications of the bill.

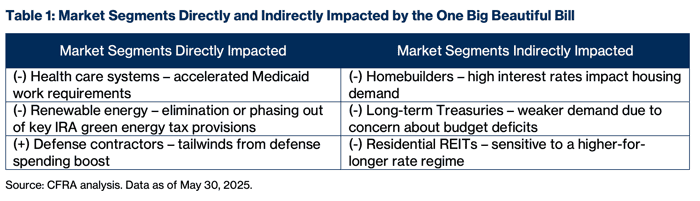

Table 1 summarizes the budget bill’s impact on the select industries that have ETFs linked to them. A smaller segment that is also directly impacted by the bill is the private student loan industry, but there is no ETF that provides targeted exposure to that sector.

The bill passed by the House included several health care-related provisions that will impact Medicaid managed care organizations and hospitals. Most notably, the bill includes new Medicaid work requirements that were accelerated in the final House version to take effect by December 31, 2026, instead of the originally proposed date of January 1, 2029. While these and other reforms are projected to generate savings, they will likely result in further reductions in beneficiary insurance coverage.

According to CFRA’s Washington Analysis policy team, the base case is that Medicaid restructuring presents a modest headwind for Medicaid MCOs, such as Centene, Molina Healthcare, UnitedHealth Group, and Elevance Health, with covered lives expected to decline beginning in 2027. CFRA’s fundamental equity team expects MOH and CNC to be the most impacted since they have the largest Medicaid businesses of the large insurers (Medicaid is 79% and 58% of their managed care businesses, respectively). The fundamental team also expects ELV and UNH to see top-line impacts.

In addition to the impact on MCOs, Washington Analysis expects the financial burden to shift more acutely to hospitals, such as HCA Healthcare, Tenet Healthcare and Universal Health Services, as rising uncompensated care costs begin as early as enactment and are likely to accelerate into 2026 and 2027. The greatest financial pressure is likely to be on rural hospitals, those with high Medicaid exposure, and facilities serving large undocumented immigrant populations.

The ETF that provides the most targeted exposure to MCOs and hospitals is the iShares U.S. Healthcare Providers ETF (IHF). As of May 28, 2025, its top 10 holdings included MCOs such as UNH (15% of the portfolio), ELV (12%), and CNC (5%), as well as hospital system HCA (6%). IHF already had a significant correction recently, as it was down 5.6% in the trailing one-month period through May 30, 2025. This was largely due to UNH, its largest holding, falling by 29% over that period. The other ETF in the category is the SPDR S&P Health Care Services ETF (XHS), but it does not have any MCOs in its top holdings and is therefore a less attractive option for investors looking to respond to Medicaid policy changes.

The bill also includes changes to some clean energy provisions in the IRA. According to the Washington Analysis team, one of the biggest changes in the House bill is that projects seeking Section 45Y (clean energy production) or Section 48E (clean electricity investment) credits must begin construction 60 days from the date this bill becomes law. Impacted listed firms include NextEra Energy and Iberdrola S.A.

Separately, wind and solar projects would be prohibited from entering into leasing arrangements with a third party. New nuclear projects would be exempt from these changes, but would still need to begin construction by year-end 2028. Both credits would also expire at year-end 2028. For rooftop solar installers, new restrictions would be adopted for leasing models, a serious threat to firms like Sunrun.

Washington Analysis expects the Senate to push back and for the reforms in the House bill to be softened. They expect these IRA provisions to be adjusted in a way that is more positive for clean tech, though industry participants will still have their work cut out for them.

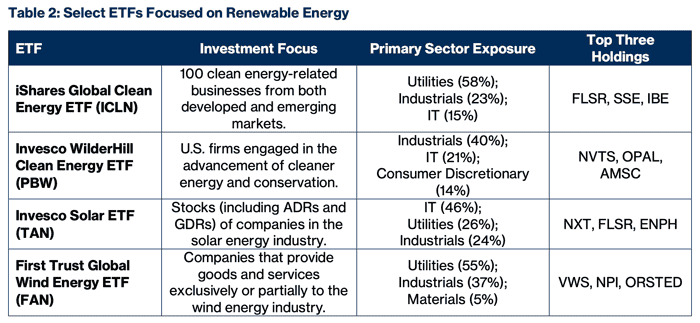

Several ETFs offer exposure to the renewables sector. However, they can vary quite significantly in their geographical and sector exposure as well as top holdings. Table 2 summarizes some of the leading clean energy-focused ETFs to highlight the varying investment objectives.

The iShares Global Clean Energy ETF (ICLN) holds global solar, wind, and utilities stocks that cut across traditional GICS sectors. Its top holdings include First Solar, SSE plc and IBE. Its largest exposure is to the Utilities sector, and it holds stocks across developed and emerging markets. In contrast, the Invesco WilderHill Clean Energy ETF (PBW) is more U.S.-focused and has more exposure to the industrials sector (40% of the fund). Its top three holdings are Navitas Semiconductor, OPAL Fuels and American Semiconductor.

Investors who want to trade solar exposure in a more targeted way could consider the Invesco Solar ETF (TAN). Nextracker, FSLR and Enphase Energy are its largest holdings. TAN was down 32.7% in the trailing-one-year period, but rebounded by 7.8% in the trailing one month through May 29, 2025.

Investors who want to make a wind energy-focused trade could consider the First Trust Global Wind Energy ETF (FAN). The underlying index is designed such that companies that provide goods and services exclusively to the wind energy industry are given an aggregate weight of 66.67% of the index. Those that are not exclusive to this industry are given an aggregate weight of 33.33% of the index. This ensures that companies that are exclusive to the wind energy industry, which generally have smaller market capitalizations relative to their multi-industry counterparts, are adequately represented in the index. FAN’s top three holdings are Vestas Wind Systems A/S, Northland Power and Orsted.

The bill passed by the House proposes $150 billion in new mandatory funding to reinforce national defense. This funding will be in addition to the annual defense budget, which is currently operating under a continuing resolution, at approximately $850 billion. According to Washington Analysis, Lockheed Martin, Huntington Ingalls Industries, General Dynamics, Northrop Grumman, RTX Corporation, The Boeing Company and L3Harris Technologies are positioned as the primary beneficiaries of the $150 billion defense spending boost through reconciliation legislation.

Of the $150 billion, $27 billion is set aside for a proposed next-generation missile defense shield (the “Golden Dome”). In addition to LMT, NOC, and RTX, the unlisted SpaceX could also benefit from this project. Software and business process automation providers like Palantir Technologies, C3.ai and Science Applications International are also expected to benefit from the additional defense spending.

There are 16 ETFs focused on the aerospace and defense sector listed in the U.S., with a total of $19 billion in assets. The iShares U.S. Aerospace & Defense ETF (ITA) is a good option for investors targeting the larger, more traditional defense contractors like RTX, BA, LHX, and LMT. As of May 29, 2025, it held 37 equally weighted stocks. The Invesco Aerospace & Defense ETF (PPA) holds 56 stocks, including the more technology-oriented firms in the space like SAIC and AI. This ETF may be a better option for a broader defense spending trade related to the budget bill.

The bill also has significant implications for the future fiscal situation of the United States. Based on estimates by the Congressional Budget Office and commentary by various think tanks, the bill is expected to add at least $2.5 trillion to the debt over the 10-year budget window. This projected increase concerns investors in U.S. long-term government debt, as evidenced by weak demand at the U.S. Treasury auction on May 21, 2025.

Despite this, ETF investors have put an additional $3.1 billion of new money into iShares 20+ Year Treasury Bond ETF (TLT) in the trailing week through May 29, 2025. This may be due to investors trying to “buy the dip” on long treasuries based on relatively benign recent inflation numbers. However, CFRA’s analysis in the past has shown that ETF investors often lose money on TLT since timing the top on rates is extremely difficult.

If long-term yields continue to stay high due to weak demand for treasuries, they will impact other rate-sensitive sectors like homebuilders and residential REITs. The SPDR S&P Homebuilders ETF (XHB) and Residential REIT ETF (HAUS) were both down 6% in the trailing three months through May 29, 2025.

Investors will be watching closely as the Senate debates and revises the bill. Republicans have a 53-47 majority in the Senate, with Vice President J.D. Vance as a potential tie-breaking vote. If the Senate passes an amended version, it will then be sent back to the House.

#Impact #ETFs #Healthcare #Clean #Energy #Defense