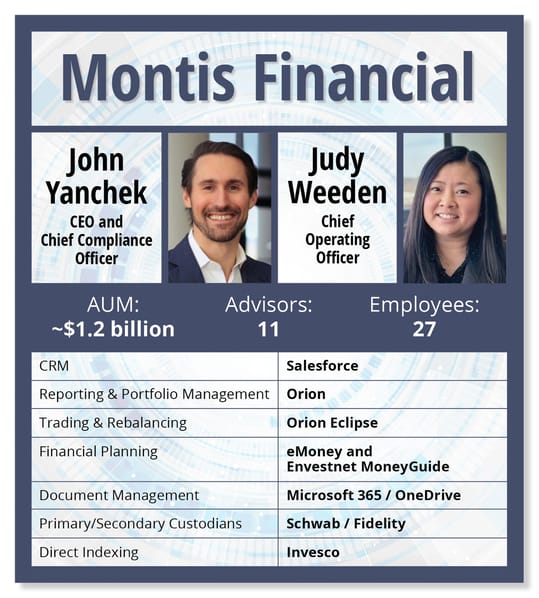

John Yanchek: We like to joke that there is original Montis Financial and Montis 2.0, which is when Tucker {Donahoe} and I bought the company. Montis itself is 30 years old. We inherited some things when we bought the company about 3 1/2 years ago. Then we did deep-dive research to decide what we wanted to keep and what we should make switches on.

We, as the leadership team, view our job as providing the best-in-class resources for our team to do their job. For example, we are originally an eMoney shop. Many of our partners who have come on board have used MoneyGuidePro, and they’re both really great systems, so we decided to have both. If some people want goals-based versus cash flows-based, they can choose that adventure.

Judy Weeden: The overall goal is to make advisors’ lives easier to serve the clients to the best of their ability. We want to create a raving fan experience and offload a lot of what advisors do to the internal resources that we have today. We want to create an all-in-one solution as best we can. That means ensuring the systems are fully integrated and talking to each other, so advisors don’t have to leave and toggle between multiple screens to accomplish a task or two.

CRM: Salesforce

JW: It was really important for us to find a solution with an open API. Salesforce’s framework allows you to grab data from multiple sources and manipulate it to make sense for you.

It’s the same thing with Orion. You can go in and put data where you need it. The integration between Orion and Salesforce is really top-notch. You can customize it and get all the data that you need, so you’re not entering the same information in multiple places.

JY: I would underscore that point. We have an acute focus on having one centralized source of truth. When people enter something into the system, we want it so that they only have to enter it once. Otherwise, it will be an absolute nightmare over time, particularly as you grow in scale.

Reporting & Portfolio Management: Orion

JY: When Tucker and I bought the firm, they were already on Orion. We did a big research project on Black Diamond, Addepar and the other systems because if we were going to switch, we wanted to do that before we started growing the company. We concluded that the best value for the firm that we wanted to build was Orion. Obviously, the value is a big part of that because I know those other systems are significantly more expensive. They do have a lot more bells and whistles. Depending on your firm type, you may need those bells and whistles. But we’re a financial planning-based firm, which creates some simplicity in how we allocate assets.

JW: Orion has been great to work with and has been collegial in that, if I provide feedback, they’re willing to listen. Also, on the acquisition side, they’re working with us hand in hand on every single transaction that we’re doing and when questions come up. They’re prioritizing what we need to get done. So that’s been helpful.

Trading & Rebalancing: Eclipse (Orion)

JW: Eclipse is part of the Orion tech stack, so we have it as part of their platform bundle. We are not using it right now but creating the infrastructure to do so. That’s a goal for us to bring online soon.

Financial Planning: eMoney and MoneyGuidePro

JW: Orion also has a pretty good integration with MoneyGuide Pro, and they have a decent one with eMoney, as well. So, that lends well to what we’re building today by allowing or encouraging our advisors to use eMoney and MoneyGuidePro.

JY: I wanted to note that, from a portal perspective for clients, we have used eMoney in the past. I think it has been good. But we have a couple of unique challenges. For example, once, a client went in and could see their dashboard and net worth. But their house was linked to Zillow, and the value had gone down a ton. We had to deal with this major fire before figuring out it was no big deal. But that was challenging.

We are in the process of moving over to Orion’s portal system. We do some things, such as bulk uploads of quarterly systems or bulk uploads of invoices, and some of those things are a lot easier when Orion is our portfolio management system. So, when we set it up, we can push a button and have everything in the right places. We couldn’t do that necessarily with eMoney. Since we have many more clients and are growing, it’s important to unify the portfolio management system, and the portal made a lot of sense.

Document Management: Microsoft 365/OneDrive

JY: We did a big overhaul after buying the business. It was a total brain dump, and you couldn’t find anything anywhere. We created a whole new system, very similar to a clean folder management structure, just so we could find documents easily and make it very intuitive. That was an arduous process, but once you set it up right, it’s a great system. The only challenge I have had with this system is some syncing issues. It’s kind of minor, but it’s also frustrating when you’re working off a version that you put some time into, and that’s not the latest one. So that’s the only issue I’ve experienced with the system. I think it’s pretty intuitive and easy to use.

Primary/Secondary Custodians: Schwab/Fidelity

JW: We consider them our two main custodians, and truthfully, from a partnership perspective, we encourage folks if they want to join the Montis team, that’s what we would love for them to use, and we can help them with that transition. The service models for both custodians are pretty good. I think all our transactions, or our partnerships, have all been on those custodians.

Altruist is interesting. I know their fees are lower. I know their service model is interesting because I think it’s just a chat feature. We are accustomed to picking up a phone and getting an answer immediately. I think that’s probably a change that maybe someday we’ll have to get comfortable with. But I think as of right now, we feel like Fidelity and Schwab are the big players in the space and feel good about them.

Direct Indexing: Invesco

JY: After evaluating various direct indexing solutions, our investment team decided on Invesco’s 130/30 strategy.

As told to senior reporter Alex Ortolani and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Alex Ortolani at [email protected].

#Montis #Financials #John #Yanchek #Judy #Weeden