Being able to clearly convey to clients that they will be OK has gotten even easier for advisors using the asset allocation and portfolio design platform Nebo Wealth.

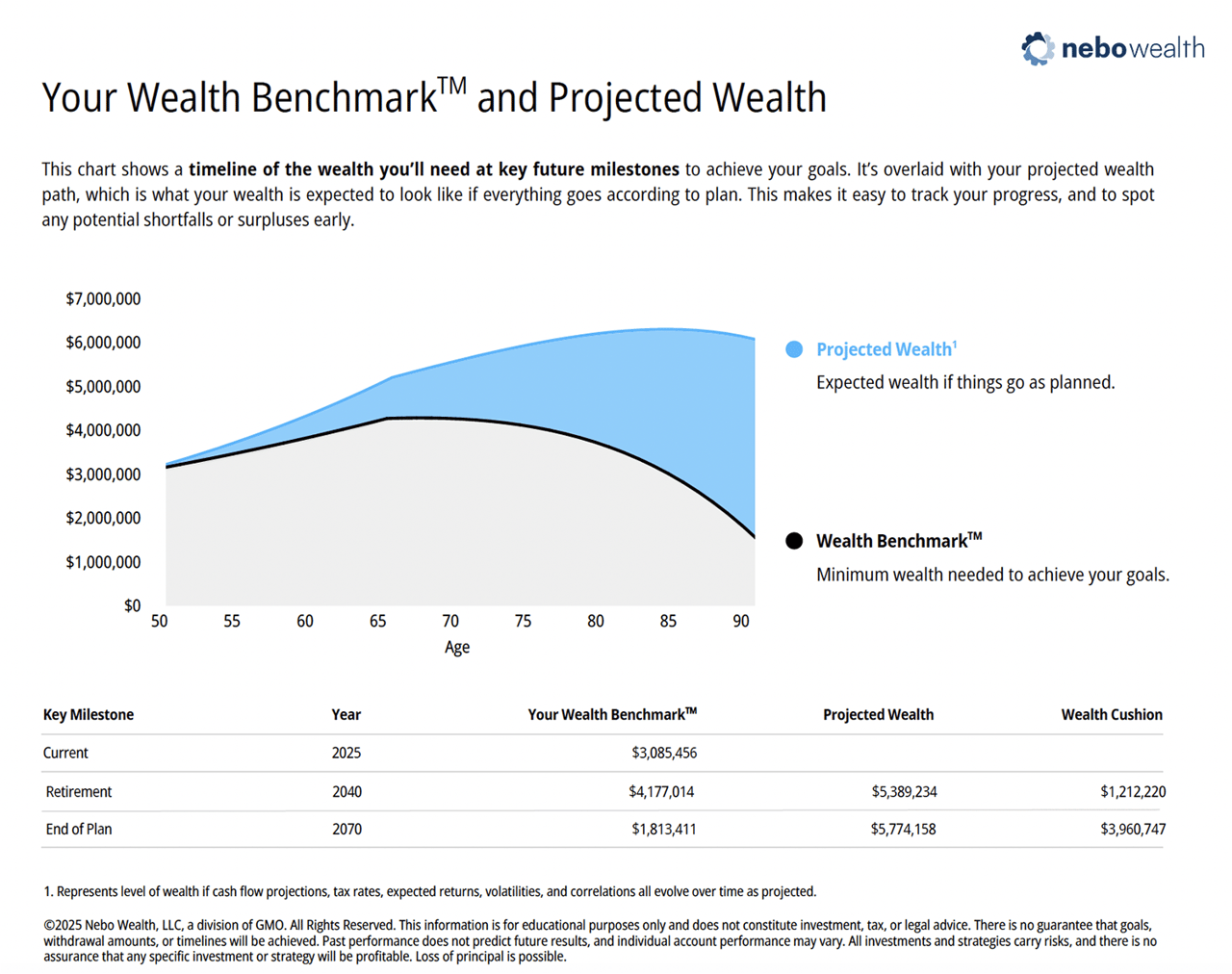

The global asset manager Grantham, Mayo, Van Otterloo & Co., better known as GMO, the firm behind Nebo, announced this week its Wealth Benchmark, a personalized measure and prediction of the amount of wealth needed at each stage of a client’s life to meet their specific goals.

“It is an evolution, a re-framing of the conversation advisors have been having with their clients for years about outperforming the markets or beating an index, with the Wealth Benchmark we are shifting it to a conversation personalized to them, their goals and doing so in units that make sense to them—dollars,” said Martin Tarlie, Nebo product lead at GMO.

“This is the minimum amount of money you need over time to meet the goals you established in your financial plan, as long as you are still above your benchmark you are still OK,” he said, describing, in simplest terms, the meaning for clients behind the Wealth Benchmark.

The tool helps further bridge the long-existing gap between the financial plan that the advisor and client build and the creation and implementation of a goals-based investment portfolio.

The Wealth Benchmark has been incorporated as the foundation of the Nebo Wealth platform, helping it drive the smart Model Selector engine, which advisory firms use with clients to match them with the best investment model based on their plan. It is also meant to work in tandem with personalized target portfolio allocations that can be used to power a Unified Managed Account program.

Launched in 2022 after nearly a decade of development, the open architecture Nebo platform (Nebo being short for needs-based optimization) has a proprietary multiperiod shortfall optimizer at its core.

In early 2024, GMO launched Nebo Wealth, an end-to-end platform for RIA firms, adding many new features, including automated trading and rebalancing, performance reporting, billing, advisor and client portals, and back-office support for account opening and administration.

In March, the firm rolled out its enterprise product, which was meant to be scalable, providing goals-based investing tools for larger firms that want to create personalized portfolios, at scale, for all their clients and included a white-label portfolio construction engine and a goals-based model selector.

Nebo has won numerous industry accolades beginning with a 2022 Industry Disruptor award at WealthManagement.com’s annual Industry Awards, followed by wins in 2023 and 2024 for Best Goals-Based Investment Platform. Is again a finalist in multiple categories 2025.

The new Wealth Benchmark is now live and available to those advisors and firms using the platform.

#Nebo #Launches #Wealth #Benchmark