For many investors, the phrase “alternative minimum tax” tends to raise eyebrows or trigger confusion, if not concern. However, within the municipal bond market, AMT-designated bonds are quietly offering one of the most attractive opportunities in today’s investment-grade sector. And thanks to recent tax legislation, a primary risk that may have once deterred investors from these instruments has, in our opinion, significantly diminished.

Understanding AMT and Its Impact on Bonds

The individual alternative minimum tax is part of a parallel tax system that requires some taxpayers to calculate their tax liability twice—once using the standard rules and again using AMT rules. The AMT calculation includes certain deductions and additional adjustments. Taxpayers must pay the higher liability from the two calculations.

Some municipal bonds—generally those issued in sectors where private entities may benefit, such as airports or solid waste facilities—are designated as AMT. Although interest from these bonds is technically tax-exempt, it may be included in an investor’s AMT calculation, reducing the overall tax advantage. AMT bonds are generally issued at higher yields than comparable non-AMT bonds to offset this risk.

How Market Conditions Created Opportunity

The 2017 Tax Cuts and Jobs Act significantly reduced the number of individuals subject to the AMT. According to the Tax Policy Center, AMT filings fell from over 5 million in 2017 to just 200,000 in 2018. For most individual investors, AMT ceased to be a factor.

Still, the additional yield for AMT bonds persisted, and in 2022, it was amplified by market volatility, rising rates, and widespread outflows from municipal bond funds. These conditions caused municipal bond yields to increase, especially among lower-rated bonds and those with AMT status.

Yet while spreads for lower-quality bonds have narrowed, AMT spreads remain elevated. We believe investors can still access strong income levels without sacrificing credit quality.

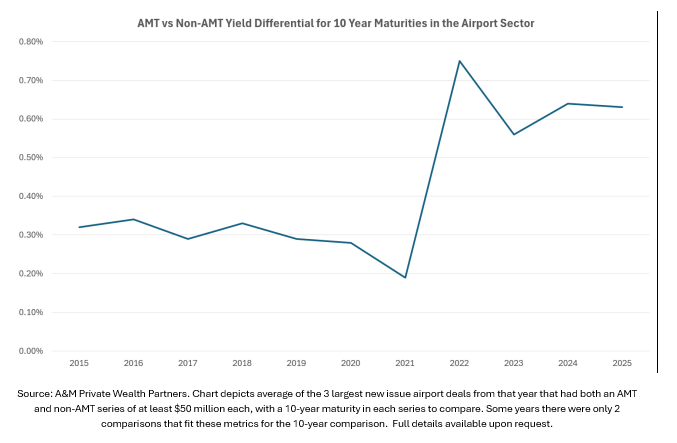

Consider the 2021 issuance from the Atlanta Department of Aviation, benefiting Hartsfield-Jackson Atlanta International Airport. At the time, the 10-year AMT bonds offered just 0.20% more than the non-AMT equivalent. As of July 2025, that spread has widened to 0.72%—an exceptional relative value in today’s market (Source: Bloomberg, as of July 1, 2025).

The Case for AMT Bonds Today

In June 2025, the Metropolitan Washington Airports Authority issued bonds that illustrate the potential of this market. A 2036 AMT bond from that offering carried a yield of 4.37%. For an investor in the top federal tax bracket, that equates to a taxable equivalent yield of 7.38%, using a 40.8% tax rate (37% top tax bracket rate and 3.8% investment income tax). The bond was rated Aa3 by Moody’s and AA- by S&P.

On that same day, an index of 10-year revenue bonds with similar credit quality yielded just 3.63% (Source: Bloomberg US Revenue AA- Muni BVAL Yield Curve 10 Year). The AMT bond offered a substantial yield premium without added credit risk, highlighting the value in this corner of the market.

What Changed: One Big Beautiful Bill Act

Much of the hesitation around AMT bonds stemmed from uncertainty. The 2017 tax cuts included a sunset clause that would have reinstated the pre-2018 AMT rules at the end of 2025. That possibility made many investors reluctant to embrace AMT bonds.

Now, uncertainty seems to have largely been resolved. The One Big Beautiful Bill Act, a new reconciliation bill recently passed into law, extended many of the 2017 tax reforms with no sunset clause attached. This includes the reduced scope of the AMT. While minor adjustments to the code may increase the number of AMT filers slightly, the overall footprint remains far below pre-2018 levels.

In practical terms, the tax concern has largely faded for many investors, but market pricing has not yet fully adjusted. We believe this presents a window of opportunity for those willing to reconsider AMT exposure after verifying their tax situation with an expert.

Where to Focus: The Middle of the Curve

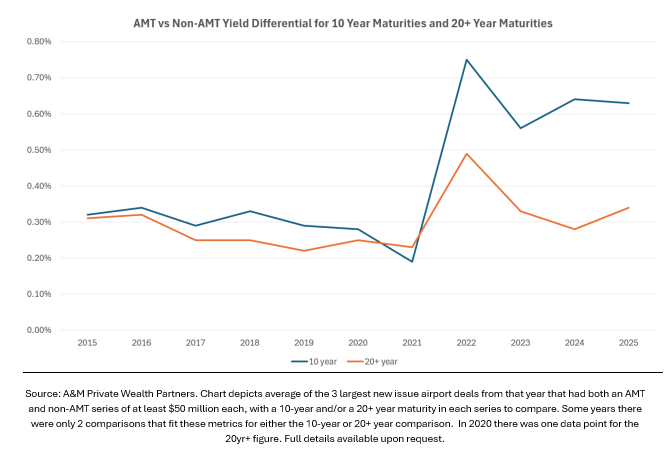

Currently, we see the most compelling value in AMT bonds to lie in the ten-year maturity range. Longer maturities have largely reverted to historical norms, but intermediate AMT bonds continue to offer higher yields compared to similar non-AMT bonds.

In the airport sector, for instance, the yield spread between AMT and non-AMT bonds in the ten-year range remains well above the average seen before 2022. For maturities of twenty years or more, spreads have tightened and no longer offer the same level of relative value.

Adding AMT bonds, particularly those with 10-year maturities, can benefit investors twofold: first, the yield advantage is evident, as high levels of income can be achieved without having to venture into lower-quality bonds. Second, these bonds may also experience meaningful price appreciation relative to the broader market if AMT bond valuations converge to their longer-term averages, as shown in the previous charts.

Conclusion

For years, AMT bonds have been overlooked due to tax concerns that were once valid but now appear largely outdated. Today, these bonds offer a rare combination of strong yields, high credit quality and favorable tax treatment for many individual investors.

With clearer legislative landscape and the market mispricing the associated risk, AMT bonds deserve a fresh look, especially in the ten-year maturity range. For investors seeking tax-aware income solutions, this may be one of the more underappreciated segments in the municipal market.

#Big #Beautiful #Opportunity #Municipal #Bond #Market