wildpixel/iStock via Getty Images

By Erik Norland

At a Glance

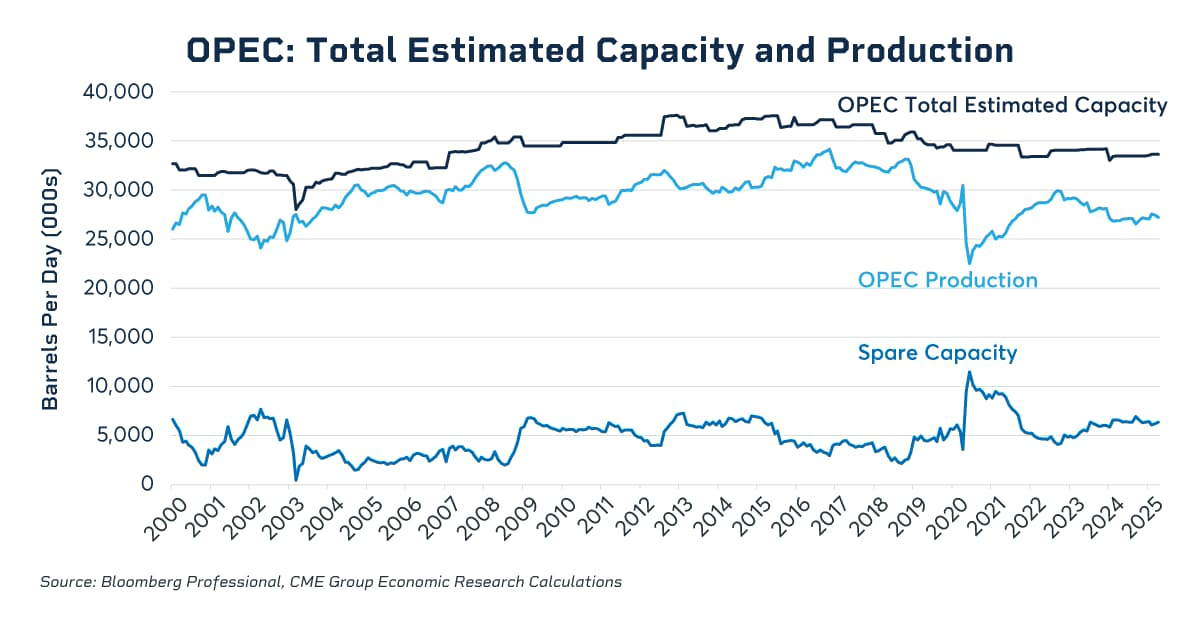

- Although OPEC+ increased output by 1.3 million barrels per day in 2025, their current production remains about 2 million barrels per day lower than levels seen two to three years prior

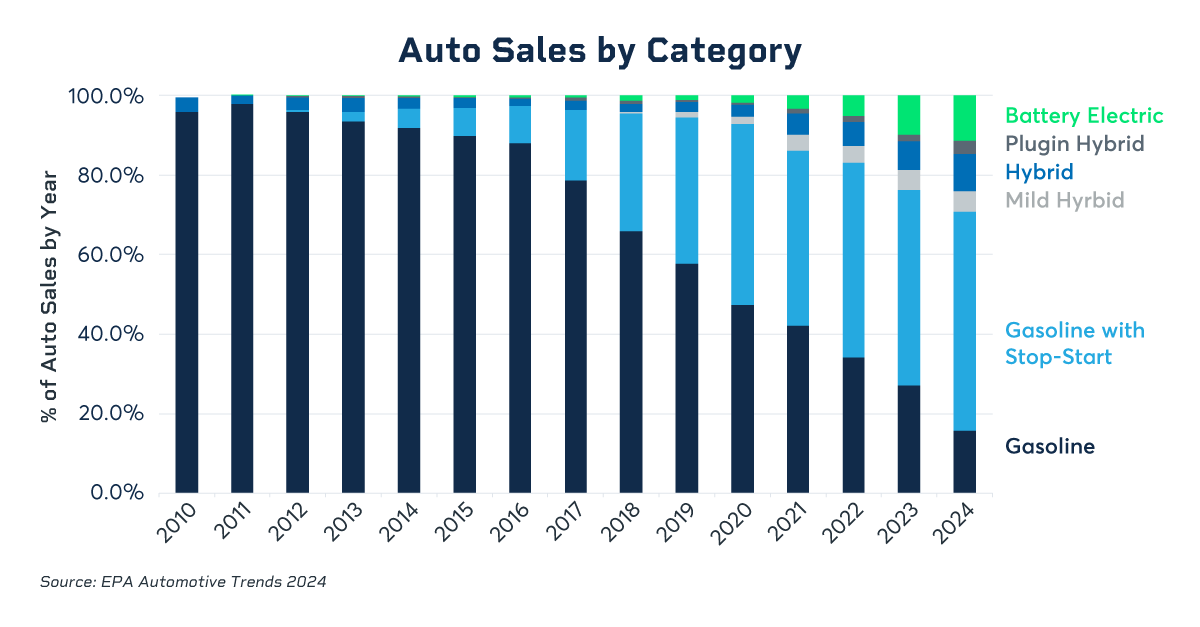

- The rapid advancement in automotive technology, particularly the rise in electric vehicle (EV) and hybrid vehicle sales, is creating a headwind for the oil market

Following the recent OPEC+ meeting, oil prices dropped despite a somewhat bullish statement. The statement projected that U.S. energy production would not significantly exceed its current output of 13.5 million barrels per day.

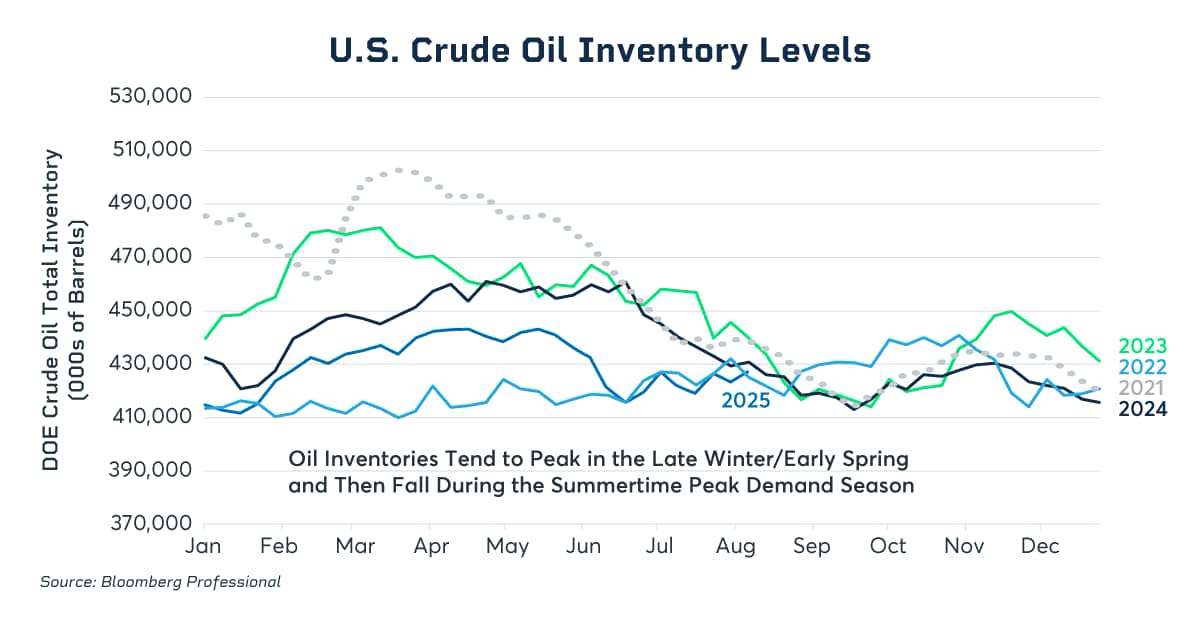

OPEC+ also expressed expectations that global inventories would remain low and demand strong, a combination that would typically boost prices. So why did the market react negatively to this seemingly bullish news? The answer lies in the subtle nuances of the cartel’s message and the broader economic and technological shifts influencing the market.

Factors Influencing the Price Drop

The market’s reaction can be attributed to a perception that OPEC+ is setting the stage for potential production hikes later in the year. While the cartel has already boosted output by 1.3 million barrels per day in 2025, their current production levels are still approximately 2 million barrels per day below those of two or three years ago. This gap suggests ample room for further increases, which could put downward pressure on prices.

Concerns Over Global Demand

Adding to the market’s unease is the growing concern about the sustainability of global oil demand. The rapid advancement in automotive technology, particularly the rise in electric vehicle and hybrid vehicle sales, is reshaping the landscape. Traditional combustion engines are also becoming more efficient, with features like “gasoline stop-start” technology, which automatically shuts the engine off when a car is idle, like at intersections. These technological advancements are expected to reduce the average driver’s fuel consumption by around 3% annually, creating a significant headwind for oil demand.

While OPEC+ appears to be optimistic about near-term oil demand, the combination of potential production increases amid technological shifts in the automotive industry has led to a more cautious outlook among traders, likely contributing to the recent price drop.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#OPECs #Paradox #Bullish #Statement #Led #Bearish #Sentiment