Key Points

-

Apple has yet to launch a widely adopted breakthrough in the artificial intelligence (AI) landscape, instead opting for incremental iPhone updates and grand visions for products not yet launched.

-

Tesla has built an autonomous driving system and a humanoid robot, but neither business is moving the needle financially for the company.

-

Apple and Tesla were rumored to have explored a tie up about a decade ago; now may be even more compelling than ever for the two trillion-dollar behemoths to explore a partnership again.

- These 10 stocks could mint the next wave of millionaires ›

Apple has yet to launch a widely adopted breakthrough in the artificial intelligence (AI) landscape, instead opting for incremental iPhone updates and grand visions for products not yet launched.

Tesla has built an autonomous driving system and a humanoid robot, but neither business is moving the needle financially for the company.

Apple and Tesla were rumored to have explored a tie up about a decade ago; now may be even more compelling than ever for the two trillion-dollar behemoths to explore a partnership again.

One of Silicon Valley’s most famous “what-if” stories centers on a rumored deal that never happened. According to reports, Apple (NASDAQ: AAPL) had the chance to acquire Tesla (NASDAQ: TSLA) roughly a decade ago — but the deal never materialized.

In the years since, Tesla has cemented itself as a global leader in electric vehicles (EV), while Apple has remained a dominant force in consumer electronics. Yet despite their respective clout, both companies share a surprising weakness: Unlike Microsoft, Alphabet, Amazon, and Meta Platforms, neither Apple nor Tesla has built a truly scaled artificial intelligence (AI) business.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Apple’s foray into the AI arena has been relatively muted, relying on incremental iPhone upgrades rather than a bold, stand-alone AI platform — a departure from its decorated history of innovation. Tesla, on the other hand, has ambitious plans for its humanoid robot, dubbed Optimus, and its robotaxi network, but these initiatives remain unproven at scale.

This is what makes the prospects of a strategic partnership between Apple and Tesla so intriguing right now. Each could help cover the other’s blind spots, and in doing so, build the foundation of scaled AI platforms that their rivals already enjoy.

Why Apple needs Tesla

Apple’s legacy has always been rooted in consumer devices, pioneering category-defining products such as the iPod, iPhone, and iPad. For years, the company was seen as the undisputed master of uncovering latent needs and turning them into must-have innovations.

In recent years, however, Apple’s push into advanced hardware has struggled to live up to the company’s historic track record.

Last year, the company scrapped its car initiative, Project Titan, after years of research and development. The ambitious project ended without a formal product launch — leaving Apple with no presence in the automotive market despite years of speculation.

More recently, Apple unveiled its Vision Pro headset, a foray into augmented and virtual reality. The device has widely been viewed as a disappointment — a high-end luxury gadget rather than a mass-market breakthrough, limiting its adoption among everyday consumers.

Now, as rumors swirl around a Siri-powered robot in Apple’s pipeline, management faces a critical decision: pursue yet another hardware moonshot from scratch and risk billions in capital expenditures (capex), or align with a partner that’s already in production.

In my view, Apple doesn’t need to reinvent the wheel by sinking more time and money into developing products that may never launch. Instead, Apple could thrive by positioning itself as the software and services layer powering intelligent hardware that already exists in the market.

By joining forces with Tesla, Apple could leverage the company’s expertise in autonomous driving systems and robotics while integrating its own AI-powered software ecosystem and consumer marketing prowess.

Such a collaboration could allow Apple to leapfrog into both consumer and enterprise adoption of smart devices — staking a claim in the robotics and autonomous era of AI, without repeating costly mistakes of the past.

Image source: Getty Images.

Why Tesla needs Apple

Tesla’s robotaxi and Optimus both carry transformative potential. But bringing these projects to life requires massive investments in compute power and AI infrastructure.

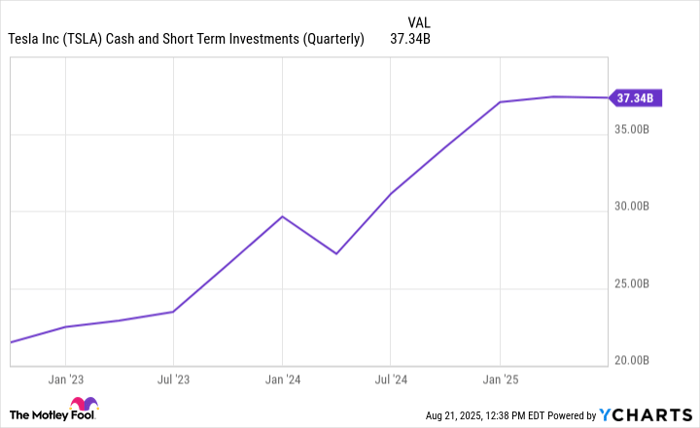

While Tesla’s balance sheet boasts a healthy cash cushion, it’s worth noting that, like Apple, the company has also made some controversial capital allocation decisions in recent years.

TSLA Cash and Short Term Investments (Quarterly) data by YCharts

Case in point: Tesla recently scaled back its in-house Dojo AI supercomputer project, opting instead to revert to proven infrastructure from Nvidia and Advanced Micro Devices. Similar to Apple’s Project Titan, the recent moves around Dojo underscore how costly and uncertain it can be to build proprietary systems at scale.

This is where a joint venture with Apple could reshape Tesla’s financial trajectory. Apple sits on more than $132 billion in cash, equivalents, and marketable securities, and it commands unmatched global distribution channels. By partnering with Apple, Tesla could accelerate the commercialization of Optimus and robotaxi without overplaying its hand financially.

Moreover, Apple’s unparalleled brand equity could help transform Tesla’s AI-driven machines from prototype concepts into mainstream products — bridging the gap between Musk’s futuristic vision and tangible household and enterprise adoption.

A second chance that no one sees coming

Apple’s decision not to acquire Tesla is often portrayed as a missed opportunity. But having spent a decade working in mergers and acquisitions as an investment banking analyst, I can say with confidence that deals rarely unfold as neatly as the financial models suggest. In many cases, strategic partnerships can unlock far greater, more accretive opportunities than an outright acquisition.

As the last of big tech to scale an AI business, both Apple and Tesla now sit at a pivotal crossroad. A collaboration between the two would represent a rare second chance for trillion-dollar innovators to join forces and reshape the future of the technology landscape.

By combining Apple’s ecosystem with Tesla’s progress in robotics and autonomous systems, the companies could fast-track the commercialization of next-generation AI applications — moving them from research labs and into the hands of consumers worldwide.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $461,605!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,287!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $649,657!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of August 18, 2025

Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Prediction #TrillionDollar #Artificial #Intelligence #Stocks #Strike #Megadeal #Wall #Street #Isnt #Ready