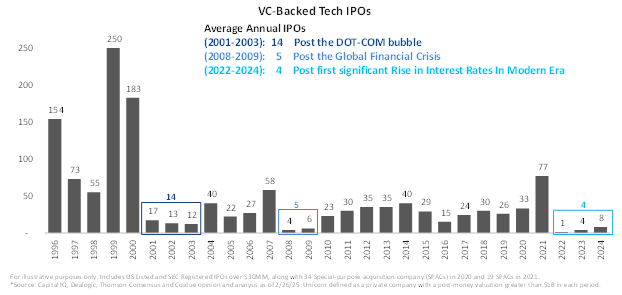

Many investors entered 2025 with renewed optimism fueled by improving capital formation and exit activity in late 2024. This long-awaited development became particularly apparent with late-stage venture capital and growth-stage assets. This asset class’s capital formation and exit activity had basically stalled during the previous three years. For context, from 2022 to 2024, the late-stage VC market averaged just four tech IPOs per year—comparable to the global financial crisis period of 2008–2009, which averaged five. So far in H1 2025, there have been 24 tech-focused IPOs with more anticipated on the horizon.

While this optimism ran into a buzzsaw in April due to the rollout of the Trump administration’s new tariff plan, investor sentiment around public and private markets swiftly rebounded as concerns over trade tensions and economic impacts to inflation, supply chains, etc. eased. As articulated almost uniformly by many market pundits, lingering uncertainties around tariff announcements and potential implications became no match for the animal spirits that had awoken.

We believe the primary impetus behind these animal spirits is the innovation economy, driven now more than ever by private markets. We can see clear examples of this in sectors like artificial intelligence, the space economy, advanced manufacturing, hardtech/robotics, fintech/digital assets, big data/analytics/cloud, quantum computing, etc., where venture-backed companies largely drive the most groundbreaking disruption.

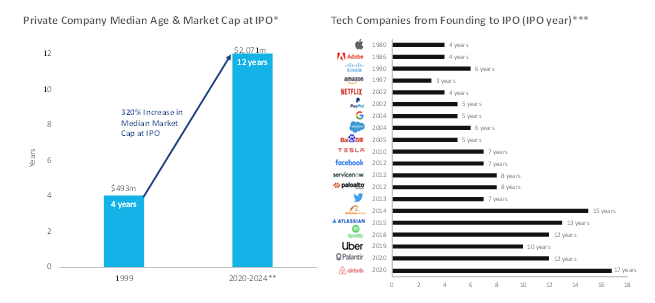

In parallel, many of these disruptive companies continue staying private for longer, and in some cases, may never actually go public.

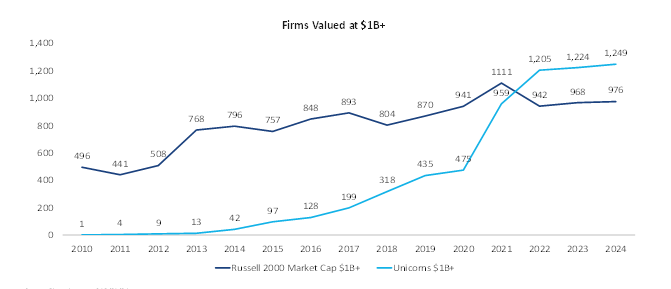

In fact, there are currently more companies valued at greater than $1 billion in the private market than in the Russell 2000 index.

We find that many financial advisors are increasingly aware of this development and, as such, are actively using late-stage private innovation strategies as a proxy for small-to-mid-mid-cap growth listed options. Other common reasons we see financial advisors looking to late-stage private innovation include enhanced return potential, access to opportunities that have been historically unavailable in public markets, diversification, and volatility reduction potential.

We believe the first trillion-dollar private market capitalization company is soon upon us. Assuming that is the case, it is possible that the next mega-cap tech companies may continue generating alpha for investors outside of listed markets, and thus beyond the reach of many investors who have historically lacked private market accessibility. Now more than ever, we believe it is paramount for institutional and individual investors to incorporate private market strategies into their portfolio construction to achieve proper diversification, given this public-to-private paradigm shift.

That said, we must also acknowledge that the private market has become quite bifurcated in recent years, following more than a decade of historically low interest rates which led to less disciplined capital deployment, much of that during an inflated valuation environment. Subsequently, the 11 consecutive rate hikes beginning in 2022 triggered a significant shift in investor behavior, which led to a substantial supply-demand imbalance for the innovation ecosystem as much of the available capital became sidelined. Historically, these are often attractive periods for capital deployment as investors gain negotiating leverage due to various macro and micro dislocations.

While we have seen increased levels of private capital deployment in recent quarters at valuations that are broadly within historical ranges, we believe there may be pockets of valuation froth, particularly in areas like AI, and premiums being paid for premier assets. While this valuation run-up is more concentrated than the prior cycle, we advise investors to exhibit caution, be selective and learn from the past.

As long-term investors focused on private innovation companies that improve efficiency, productivity, and ultimately profitability for end customers across many sectors of the economy, we are encouraged by improving market sentiment, rising valuations, lower interest rates and renewed investor confidence, which set the stage for a sustained acceleration of IPO, M&A, and financing activity in the months ahead.

#Private #Markets #Drive #Innovation #Economy