Key Points

It used to be that most companies provided a pension plan, in which the employer took care of retirement savings for the employee. That’s not as common today as it once was, with many pension plans replaced by 401(k) plans. Although a 401(k) probably isn’t as good as a pension, it is still a valuable tool for savers. Make sure you maximize the benefit by taking full advantage of the so-called match.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Saving is all on you now

Pension plans are expensive for companies to provide because it places all of the financial risk on the company. And as people live longer, the costs go on for years and years. It is little wonder that pensions have given way to 401(k) plans, which basically require the employee to set money aside for their own retirement.

In the end, 401(k) plans are good, even if they aren’t great. Saving always requires giving up spending today in the hope that you will be able to spend in the future. When you add in the investment component inherent to 401(k) plans, you bring in the additional hope that your savings will grow and allow you to spend far more than you save. Of course, investing also means there’s a risk that you make poor decisions and end up falling short of your hoped for financial outcome.

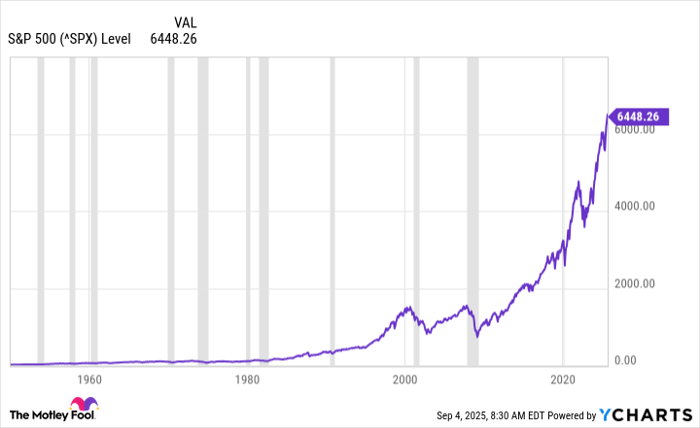

This risk is one of the reasons why 401(k) plans often have a limited selection of mutual fund or exchange-traded fund investments. The goal is to provide a path toward financial security, not a playground for aggressive investing. For most investors, a simple balanced fund with a mix of stocks and bonds is probably all that’s needed. History even suggests that buying a single S&P 500 index (SNPINDEX: ^GSPC) fund, if you hold it long enough, can be a good solution on the investment-selection front.

Focus on the saving part of the equation

The truth is, for most investors, the biggest impact will come from how much is saved. The investment aspect, while exciting, is less important. Think of it this way — if you double a $1,000 investment in one year, you’ve done pretty well. That’s a 100% return! But you only have $2,000 at the end of that year. That’s not enough to retire on. And it is hard to double your money on Wall Street, so that kind of return isn’t at all normal. In fact, the long-term return that most investors expect for the S&P 500 index is around 10% a year.

^SPX data by YCharts

At that return rate, it would take seven years to double your money. But there’s a 401(k) tool that can instantly double your money, up to a point. That tool is called the match. Essentially, as a way to entice employees to join the 401(k) plan, your employer may match your contribution up to a certain percentage. According to Vanguard, the average match is around 4%. Don’t miss out on the match!

Essentially, that first 4% or so of your contribution each paycheck instantly earns a 100% return. You put in 4% of your pay and your account gets an amount equal to 8%. And it happens instantly and automatically. You probably can’t achieve that kind of performance on Wall Street. And even if you did, it would be virtually impossible for you to achieve such returns consistently. But if you save enough in your 401(k) plan to get the match, you will automatically get that 100% return on your savings each pay check.

Save at least enough to get the match

If your company offers a 401(k) plan, you should probably join it. If there is a match, you should almost certainly take full advantage of it. In fact, even if you didn’t need the money (perhaps you are super lucky to be independently wealthy), you should probably still join and get the match. After all, 100% returns don’t come around often on Wall Street. The only place you can reliably get a 100% return, automatically and with each paycheck, is in your 401(k) with your company’s matching contribution.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Set #Forget #401k #Match #Grow #Nest #Egg #Automatically